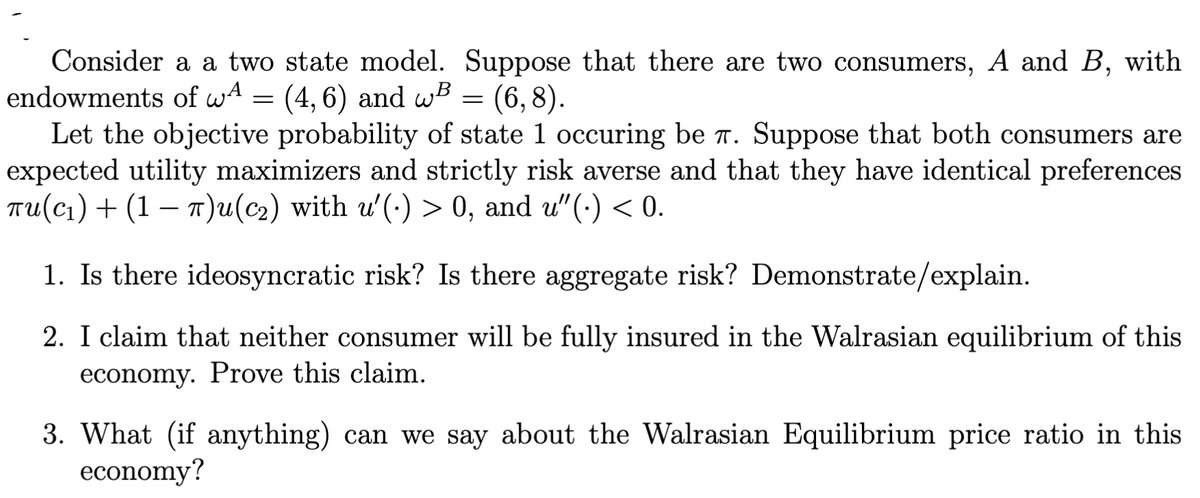

Consider a a two state model. Suppose that there are two consumers, A and B, with endowments of wA = (4, 6) and wB = (6,8). Let the objective probability of state 1 occuring be T. Suppose that both consumers are expected utility maximizers and strictly risk averse and that they have identical preferences TU(C1)+ (1 – 7)u(c2) with u'(-) > 0, and u"(·) < 0. | 1. Is there ideosyncratic risk? Is there aggregate risk? Demonstrate/explain. 2. I claim that neither consumer will be fully insured in the Walrasian equilibrium of this economy. Prove this claim. 3. What (if anything) can we say about the Walrasian Equilibrium price ratio in this economy?

Consider a a two state model. Suppose that there are two consumers, A and B, with endowments of wA = (4, 6) and wB = (6,8). Let the objective probability of state 1 occuring be T. Suppose that both consumers are expected utility maximizers and strictly risk averse and that they have identical preferences TU(C1)+ (1 – 7)u(c2) with u'(-) > 0, and u"(·) < 0. | 1. Is there ideosyncratic risk? Is there aggregate risk? Demonstrate/explain. 2. I claim that neither consumer will be fully insured in the Walrasian equilibrium of this economy. Prove this claim. 3. What (if anything) can we say about the Walrasian Equilibrium price ratio in this economy?

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.6P

Related questions

Question

do not only give definitions, answer questions properly

And plzz give the answer of all questions.

Transcribed Image Text:Consider a a two state model. Suppose that there are two consumers, A and B, with

endowments of wA = (4, 6) and wB = (6,8).

Let the objective probability of state 1 occuring be r. Suppose that both consumers are

expected utility maximizers and strictly risk averse and that they have identical preferences

TU(C1)+ (1 – 1)u(c2) with u'(-) > 0, and u"(·) < 0.

1. Is there ideosyncratic risk? Is there aggregate risk? Demonstrate/explain.

2. I claim that neither consumer will be fully insured in the Walrasian equilibrium of this

economy. Prove this claim.

3. What (if anything) can we say about the Walrasian Equilibrium price ratio in this

economy?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you