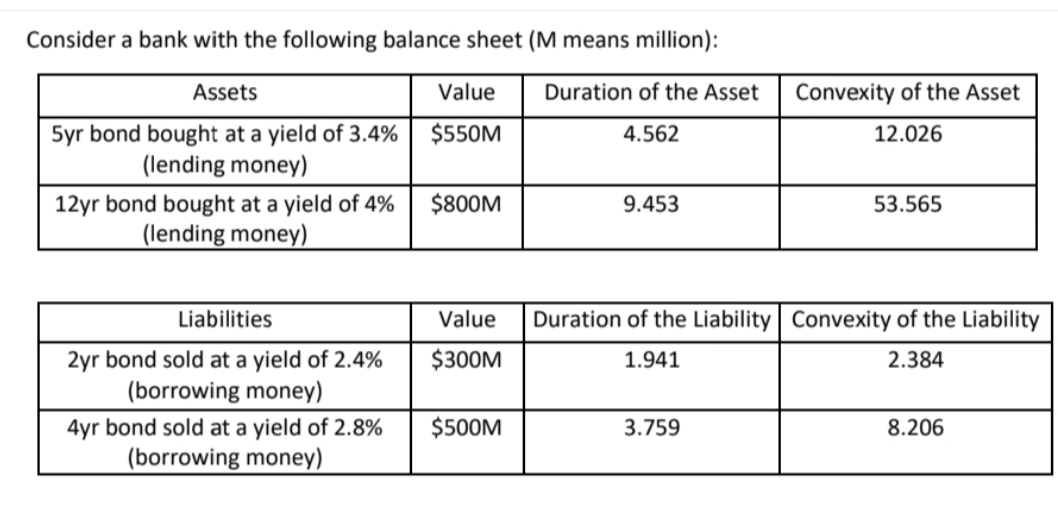

Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset $550M 5yr bond bought at a yield of 3.4% (lending money) 4.562 12.026 $800M 12yr bond bought at a yield of 4% (lending money) 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability $300M 2yr bond sold at a yield of 2.4% (borrowing money) 1.941 2.384 4yr bond sold at a yield of 2.8% $500M 3.759 8.206 (borrowing money)

Q: Use the information presented in Northeastern Mutual Bank's balance sheet to answer the following…

A: Additional investment always increases the balance of assets and also the balance of owners equity.

Q: Can you please provide clear answers for B,C,D. Question 3. Bond Consider a bank with the…

A: b. The computation of durability and convexity is shown below: The formula snip used for computing…

Q: Njenge Bank has the following balance sheet (in millions) with the risk weights in parentheses.…

A: Liabilities and Equity- The liabilities symbolize their obligations. Both liabilities and…

Q: USAir has $54 million of current assets and $58 million of noncurrent assets. It forecasts an EBIT…

A: (Note: We’ll answer Part D as it has been specifically asked.) Given : Current assets = $54mCurrent…

Q: Suppose the Fed conducts an open market purchase by buying $10 million in Treasury bonds from Acme…

A: Purchase by buying $10 million in Treasury bonds from Acme Bank Value of bonds = 50-10 =40 Value of…

Q: Consider a bank with the following balance sheet (M means million): Assets Value Duration of the…

A:

Q: The following information is about a hypothetical government security dealer named M.P. Jorgan.…

A: Repricing gap is the difference in asset dollar value liability dollar value. To calculate the net…

Q: East Bank securitises a $50 million pool of its business loans. The asset backed securities (ABS)…

A: Securitization is the financial practice in structured finance which involves pooling various types…

Q: Consider a bank with the following balance sheet (M means million): Assets Value Duration of the…

A: c) Computation of the net worth of the bank and equity to asset ratio using the duration and…

Q: Consider a bank with the following balance sheet (M means million): Assets Value Duration of the…

A: Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for you. If…

Q: Consider a bank with the following balance sheet (M means million): Assets Value Duration of the…

A: Excel Spreadsheet: Excel Workings:

Q: Consider the Following balance sheet Expected Balance Sheet for XYZ Bank Assets Yield Liabilities…

A: Net revenue income is a monetary execution measure that means the contrast between the income…

Q: Bank 1 has assets composed solely of a 10-year, 12 percent coupon, $1 million loan with a 12 percent…

A: Here, Details of Bank 1: Asset- 10-year, 12 percent coupon, $1 million loan with a 12 percent yield…

Q: Consider a bank with the following balance sheet (M means million): Assets Value Duration of the…

A: a) The computation of new equity: Hence, the assets to equity value is 1.01.

Q: Suppose the Fed conducts an open market purchase by buying $10 million in Treasury bonds from Acme…

A: An open-market transaction seems to be essentially an order issued by an insider to purchase or sell…

Q: a. What percentage of the firm's assets does the firm finance using debt (liabilities)? b. If…

A: To run the business, companies arrange the funds from external sources and purchase various required…

Q: Nienge Bank has the following balance sheet (in millions) with the risk weights in parentheses.

A:

Q: Njenge Bank has the following balance sheet (in millions) with the risk weights in parentheses.…

A: Comment- Since we only answer up to 3 sub-parts, we’ll answer the first 3. Please resubmit the…

Q: D) In c)’s scenario, to maintain the equity to asset ratio at 40% which is required by the…

A: Calculation of cash to be raised is shown below: Hence, Cash needed to be raised is $41 million.…

Q: Kaiju Bank has $6 million CET1 capital, $1 million additional Tier 1 capital and $2 million Tier 2…

A: CET 1: Common Equity Tier 1 Capital is a part of Tier 1 capital, made of Common Equity Capital of…

Q: Consider a bank with the following balance sheet (M means million): Assets Value Duration of the…

A: Solution: To have a solution for D we must compute C for an Equity value By raising the interest…

Q: BBB company has $54 million of current assets and $58 million of noncurrent assets. It forecasts an…

A: Answer a:- * Total assets = Current assets + non current assets = 54 + 58 = $112m * Debt ratio =…

Q: XYZ Bank has the following T account: Assets Liabilities Reserves 400,000 Deposits 1,600,000 Loans…

A: The leverage ratio is a statistic that compares a bank's main capital to its total assets. The ratio…

Q: Consider a bank with the following balance sheet (M means million): Assets Value…

A: The equity to assets ratio is a ratio that tells that how much company is financed with equity…

Q: Question One Njenge Bank has the following balance sheet (in millions) with the risk weights in…

A: As per Bartleby policy, only the first three interlinked parts are answered of the first question.…

Q: Assume you have the following asset and liability in your Balance Sheet: Asset - Bond A Modified…

A: Duration of asset (DA) = 2.6 years Duration of liability (DL) = 3.1 years Value of asset (VA) = RM…

Q: Consider a bank with the following balance sheet (M means million): Assets Value Duration of the…

A: C. By raising the interest rates by 1% percent The new bond Price BPn Other notations as per the…

Q: Consider a bank with the following balance sheet (M means million): Assets Value Duration of the…

A: The total equity is

Q: Consider a bank with the following balance sheet (M means million): Assets Value Duration of the…

A: Part (a): Calculation of equity to asset ratio of the bank: Answer: Equity to asset ratio is 0.4074…

Q: Consider a bank with the following balance sheet (M means million): Assets Value Duration of the…

A: In the current situation Let’s Equity to Asset ratio

Q: Use the information presented in Southwestern Mutul Bank's balance sheet to anthe fngte Bank's…

A: The question provides us with bank's balance sheet. Any transaction has dual effect in the books of…

Q: Sun Rise Bank holds assets and liabilities whose average durations and pounds amounts are shown in…

A: To determine the weighted average duration of Sunrise Bank's Assets and liabilities portfolios, we…

Q: Njenge Bank has the following balance sheet (in millions) with the risk weights in parentheses.…

A: Basel Accords: The Basel Accords are a sequence of three chronological banking guideline agreements…

Q: Consider a bank with the following balance sheet (M means million): Assets Value Duration of the…

A: Since you have posted a question with multiple sub-parts, we will solve first three subparts for…

Q: U Morgan Bank has bank capital equal to 10% of total assets. Most s deposits are short-term and…

A: Bank capital is the difference between the assets and liabilities of a bank. It shows the equity of…

Q: Consider a bank with the following balance sheet (M means million): Assets Value Duration of the…

A: When the interest rate increases by 1%, then the percentage change in price can be calculated using…

Q: Assume Bismuth Electronics has a book value of $6 billion of equity and a face value of $19.7…

A: The cost of capital which is determined using the proportionate weight of each category of capital…

Q: Question One Njenge Bank has the following balance sheet (in millions) with the risk weights in…

A: Basel I was established in 1988. It used to create the growth of international banks as well as an…

Q: ge Bank has the following balance sheet (in millions) with the risk weights in parentheses.…

A: Financial assets that do not display on a entity's statment of financial position are refer as…

Q: Bond Consider a bank with the following balance sheet (M means million): Assets Value Duration of…

A: a) The computation of total equity: The computation of asset to equity ratio:

Q: 5yr bond bought at a yield of 3.4% (lending money) 12yr bond bought at a yield of 4% (lending…

A: Solution: “Since you have posted a question with multiple sub-parts, we will solve the first three…

Q: Consider a bank with the following balance sheet (M means million): Assets 5yr bond bought at a…

A: Calculation of Net worth of the bank and Equity to asset ratio is shown below: Hence, Net worth of…

Calculate the equity (total asset – total liability) to asset ratio of the bank

Step by step

Solved in 2 steps

- Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset5yr bond bought at a yield of 3.4% (lending money) $550M 4.56212.02612yr bond bought at a yield of 4% (lending money) $800M 9.45353.565 Liabilities Value Duration of the Liability Convexity of the Liability2yr bond sold at a yield of 2.4% (borrowing money) $300M 1.941 2.3844yr bond sold at a yield of 2.8% (borrowing money) $500M 3.759 8.206 If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio In c)’s scenario, to maintain the equity to asset ratio at 40% which is required by the regulation, the bank decides to raise cash (zero duration and zero convexity) from the equity holders. How much cash does the bank need to raise?Consider a bank with the following balance sheet (M means million):Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4% (lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4% (lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability2yr bond sold at a yield of 2.4%(borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8%(borrowing money) $500M 3.759 8.206 If the interest rates go up by 1%, using the duration and convexity rule to determine the networth of the bank and the equity to asset ratioConsider a bank with the following balance sheet (M means million):Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4% (lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4% (lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability2yr bond sold at a yield of 2.4%(borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8%(borrowing money) $500M 3.759 8.206 Calculate the duration and convexity of the both asset and liability sides;

- Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4% (lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4% (lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4% (borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8% (borrowing money) $500M 3.759 8.206 Calculate the equity (total asset – total liability) to asset ratio of the bank Calculate the duration and convexity of the both asset and liability sides; If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio; In c)’s scenario, to maintain the equity to asset ratio at 40% which is required by the regulation, the bank decides to raise cash (zero…Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4% (lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4% (lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4% (borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8% (borrowing money) $500M 3.759 8.206 In the scenario "If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio", to maintain the equity to asset ratio at 40% which is required by the regulation, the bank decides to raise cash (zero duration and zero convexity) from the equity holders. How much cash does the bank need to raise?Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4%(lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4%(lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4%(borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8%(borrowing money) $500M 3.759 8.206 Calculate the equity (total asset – total liability) to asset ratio of the bank

- Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4% (lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4% (lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4% (borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8% (borrowing money) $500M 3.759 8.206 Required a) Calculate the equity (total asset – total liability) to asset ratio of the bank (Hint: equity to asset ratio = total equity/total asset) b) Calculate the duration and convexity of the both asset and liability sides; c) If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio; d) In c)’s scenario, to maintain the equity to asset ratio at 40% which is…Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4% (lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4% (lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4% (borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8% (borrowing money) $500M 3.759 8.206 Required Please answer the Subparts D and E only. a) Calculate the equity (total asset – total liability) to asset ratio of the bank b) Calculate the duration and convexity of the both asset and liability sides; c) If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio; D) In c)’s scenario, to maintain the…Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4%(lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4%(lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4%(borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8%(borrowing money) $500M 3.759 8.206 a) Calculate the equity (total asset – total liability) to asset ratio of the bank (Hint: equity to asset ratio = total equity/total asset) b) Calculate the duration and convexity of the both asset and liability sides; c) If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio; d) In c)’s scenario, to maintain the equity to asset ratio at 40% which is required by the regulation, the bank decides to raise cash (zero duration and zero…

- Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4% (lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4% (lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4% (borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8% (borrowing money) $500M 3.759 8.206 A) If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio B) In A)’s scenario, to maintain the equity to asset ratio at 40% which is required by the regulation, the bank decides to raise cash (zero duration and zero convexity) from the equity holders. How much cash does the bank need to raise? I would like for B to be solved, thank you.Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4% (lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4% (lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4% (borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8% (borrowing money) $500M 3.759 8.206 Required ONLY ANSWER SUBSECTION D a) Calculate the equity (total asset – total liability) to asset ratio of the bank b) Calculate the duration and convexity of the both asset and liability sides; c) If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio; D) In c)’s scenario, to maintain the equity to asset ratio at 40% which is required by the regulation, the…Consider a bank with the following balance sheet (M means million): Assets Value Duration of the Asset Convexity of the Asset 5yr bond bought at a yield of 3.4% (lending money) $550M 4.562 12.026 12yr bond bought at a yield of 4% (lending money) $800M 9.453 53.565 Liabilities Value Duration of the Liability Convexity of the Liability 2yr bond sold at a yield of 2.4% (borrowing money) $300M 1.941 2.384 4yr bond sold at a yield of 2.8% (borrowing money) $500M 3.759 8.206 Calculate the equity (total asset – total liability) to asset ratio of the bank (Hint: equity to asset ratio = total equity/total asset) Calculate the duration and convexity of the both asset and liability sides If the interest rates go up by 1%, using the duration and convexity rule to determine the net worth of the bank and the equity to asset ratio In c)’s scenario, to maintain the equity to asset ratio at 40% which is required by the…