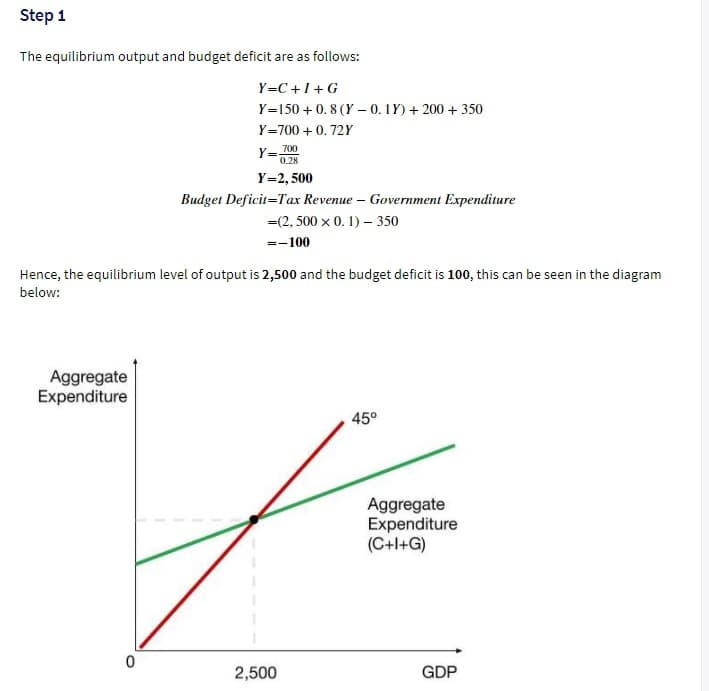

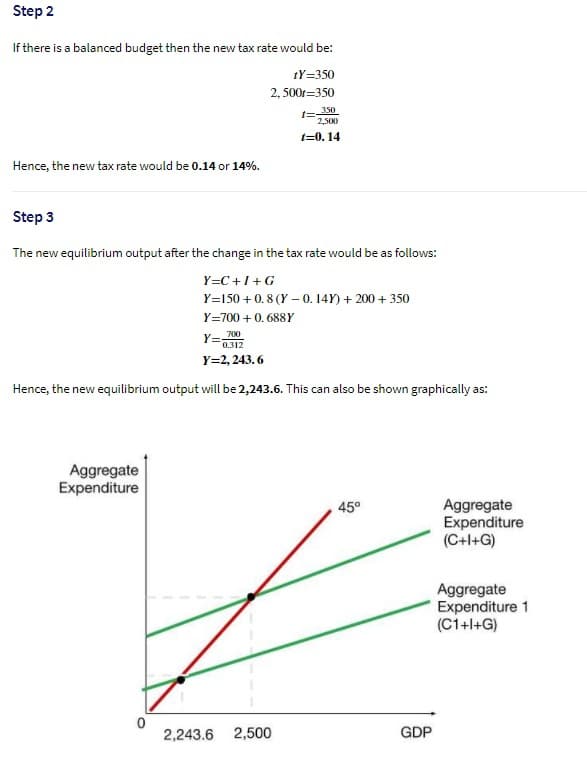

Consider a closed economy with fixed prices and wages. Suppose consumption function takes the form C = 150+0,8Yd, Investments are I = 200, government purchases are G = 350, tax rate t= 0,1. There are no lump-sum taxes. (some calculations are added in the images) 1)Compute the government spending multiplier before and after changes in tax rate. Explain why multiplier is changed? 2) If the potential output is 3000 and economy is in initial equilibrium (a) what changes in government purchases the Government need to implement in order to achieve potential output? Show how changes in government purchases affect the planned aggregate spending line and new equilibrium output.

Consider a closed economy with fixed prices and wages. Suppose consumption function takes the form C = 150+0,8Yd, Investments are I = 200, government purchases are G = 350, tax rate t= 0,1. There are no lump-sum taxes. (some calculations are added in the images)

1)Compute the government spending multiplier before and after changes in tax rate. Explain why multiplier is changed?

2) If the potential output is 3000 and economy is in initial equilibrium (a) what changes in government purchases the Government need to implement in order to achieve potential output? Show how changes in government purchases affect the planned aggregate spending line and new equilibrium output.

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images