Consider a hypothetical economy where there are no taxes and no international trade. Households spend $0.60 of each additional dollar they earn and save the remaining $0.40. If there are no taxes and no international trade, the oversimplified multiplier for this economy is 2.5. I need help with the part in bold. Suppose investment spending in this economy increases by $250 billion. The increase in investment will lead to an increase in income, generating an increase in consumption that increases income yet again, and so on. Fill in the following table to show the impact of the change in investment spending on the first two rounds of consumption spending and, eventually, on total output and income. Now consider a more realistic case. Specifically, assume that the government in our hypothetical economy collects income taxes. In this case, the multiplier will be ______ (options: the same as, smaller than, larger than) the oversimplified multiplier you found earlier. Suppose that the price level in our economy remains the same and that there is still no international trade. Now, however, the government decides to implement an income tax of 5% on each dollar of income. The MPC and MPS, however, remain the same as before. In this case, after accounting for the impact of taxes, the multiplier in this economy is __________(1.0526, 2.3256, 2.5, 1.0309) , and a $250 billion increase in investment spending will lead to a _________ ($581.4, $257.73, $625, $263.16) billion _______ (decrease, increase) in output

Consider a hypothetical economy where there are no taxes and no international trade. Households spend $0.60 of each additional dollar they earn and save the remaining $0.40. If there are no taxes and no international trade, the oversimplified multiplier for this economy is 2.5. I need help with the part in bold. Suppose investment spending in this economy increases by $250 billion. The increase in investment will lead to an increase in income, generating an increase in consumption that increases income yet again, and so on. Fill in the following table to show the impact of the change in investment spending on the first two rounds of consumption spending and, eventually, on total output and income. Now consider a more realistic case. Specifically, assume that the government in our hypothetical economy collects income taxes. In this case, the multiplier will be ______ (options: the same as, smaller than, larger than) the oversimplified multiplier you found earlier. Suppose that the price level in our economy remains the same and that there is still no international trade. Now, however, the government decides to implement an income tax of 5% on each dollar of income. The MPC and MPS, however, remain the same as before. In this case, after accounting for the impact of taxes, the multiplier in this economy is __________(1.0526, 2.3256, 2.5, 1.0309) , and a $250 billion increase in investment spending will lead to a _________ ($581.4, $257.73, $625, $263.16) billion _______ (decrease, increase) in output

Chapter9: Aggregate Demand

Section: Chapter Questions

Problem 1.1P

Related questions

Question

100%

Consider a hypothetical economy where there are no taxes and no international trade. Households spend $0.60 of each additional dollar they earn and save the remaining $0.40. If there are no taxes and no international trade, the oversimplified multiplier for this economy is 2.5.

I need help with the part in bold.

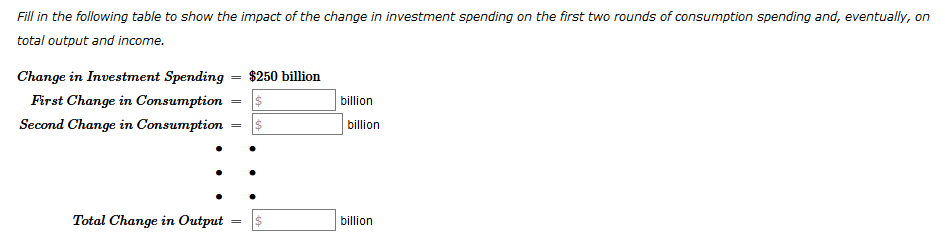

Suppose investment spending in this economy increases by $250 billion. The increase in investment will lead to an increase in income, generating an increase in consumption that increases income yet again, and so on.

Fill in the following table to show the impact of the change in investment spending on the first two rounds of consumption spending and, eventually, on total output and income.

Now consider a more realistic case. Specifically, assume that the government in our hypothetical economy collects income taxes. In this case, the multiplier will be ______ (options: the same as, smaller than, larger than) the oversimplified multiplier you found earlier.

Suppose that the price level in our economy remains the same and that there is still no international trade. Now, however, the government decides to implement an income tax of 5% on each dollar of income. The MPC and MPS, however, remain the same as before. In this case, after accounting for the impact of taxes, the multiplier in this economy is __________(1.0526, 2.3256, 2.5, 1.0309) , and a $250 billion increase in investment spending will lead to a _________ ($581.4, $257.73, $625, $263.16) billion _______ (decrease, increase) in output.

Transcribed Image Text:Fill in the following table to show the impact of the change in investment spending on the first two rounds of consumption spending and, eventually, on

total output and income.

Change in Investment Spending

$250 billion

First Change in Consumption

$

billion

Second Change in Consumption

billion

Total Change in Output

2$

billion

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning