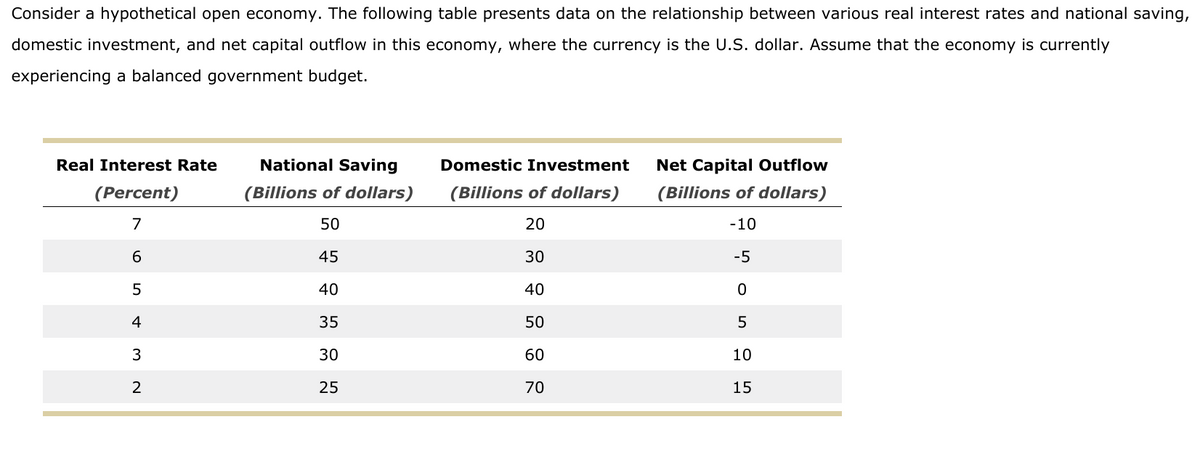

Consider a hypothetical open economy. The following table presents data on the relationship between various real interest rates and national saving, domestic investment, and net capital outflow in this economy, where the currency is the U.S. dollar. Assume that the economy is currently experiencing a balanced government budget. Real Interest Rate (Percent) 7 6 5 4 3 2 National Saving (Billions of dollars) 50 45 40 35 30 25 Domestic Investment (Billions of dollars) 20 30 40 50 60 70 Net Capital Outflow (Billions of dollars) -10 -5 0 5 10 15

Consider a hypothetical open economy. The following table presents data on the relationship between various real interest rates and national saving, domestic investment, and net capital outflow in this economy, where the currency is the U.S. dollar. Assume that the economy is currently experiencing a balanced government budget. Real Interest Rate (Percent) 7 6 5 4 3 2 National Saving (Billions of dollars) 50 45 40 35 30 25 Domestic Investment (Billions of dollars) 20 30 40 50 60 70 Net Capital Outflow (Billions of dollars) -10 -5 0 5 10 15

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter31: The Impacts Of Government Borrowing

Section: Chapter Questions

Problem 4SCQ: Imagine an economy in which Ricardian equivalence holds. This economy has a budget deficit of 50, a...

Related questions

Question

This is the second part to another question I asked about and I tried doing it on my own but I am not so sure if it is correct or not

Transcribed Image Text:Consider a hypothetical open economy. The following table presents data on the relationship between various real interest rates and national saving,

domestic investment, and net capital outflow in this economy, where the currency is the U.S. dollar. Assume that the economy is currently

experiencing a balanced government budget.

Real Interest Rate

National Saving

Domestic Investment

Net Capital Outflow

(Percent)

(Billions of dollars)

(Billions of dollars)

(Billions of dollars)

7

50

20

-10

6

45

30

-5

40

40

4

35

50

3

30

60

10

2

25

70

15

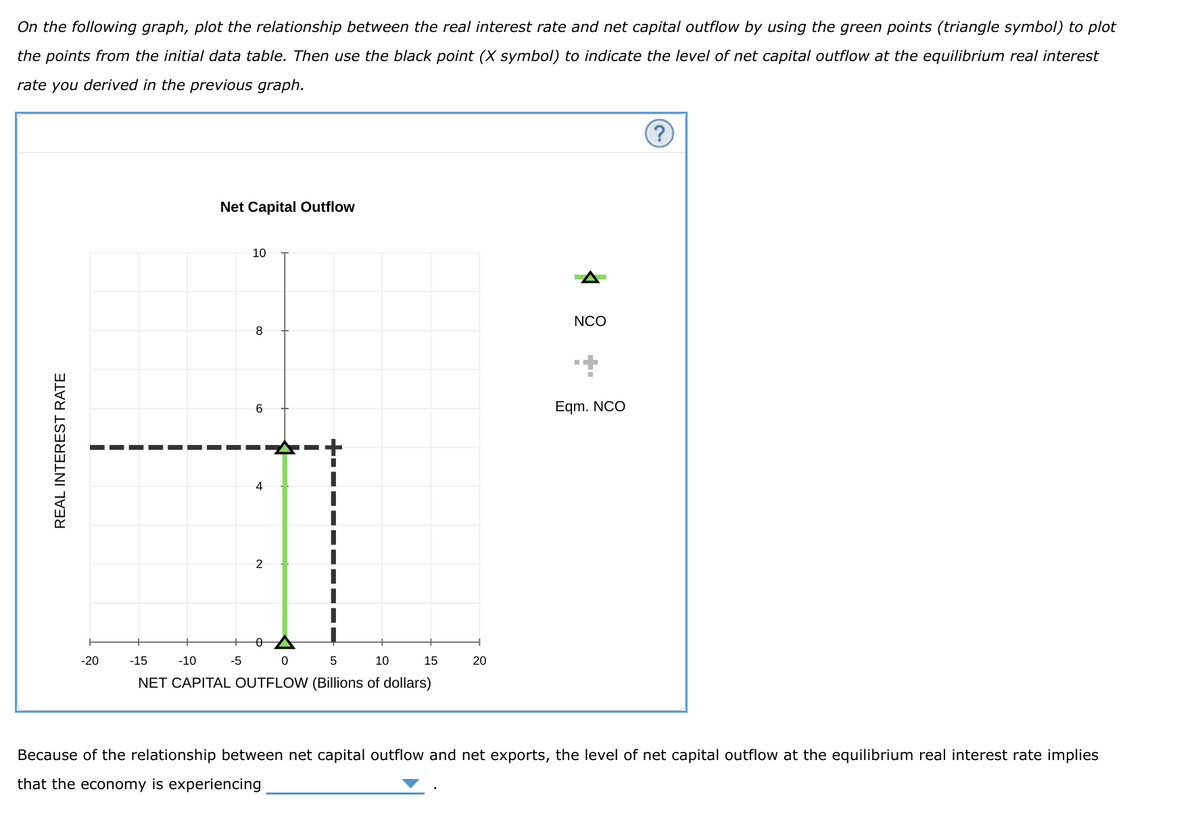

Transcribed Image Text:On the following graph, plot the relationship between the real interest rate and net capital outflow by using the green points (triangle symbol) to plot

the points from the initial data table. Then use the black point (X symbol) to indicate the level of net capital outflow at the equilibrium real interest

rate you derived in the previous graph.

Net Capital Outflow

10

NCO

8

Eqm. NCO

-20

-15

-10

-5

10

15

20

NET CAPITAL OUTFLOW (Billions of dollars)

Because of the relationship between net capital outflow and net exports, the level of net capital outflow at the equilibrium real interest rate implies

that the economy is experiencing

REAL INTEREST RATE

4-

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax