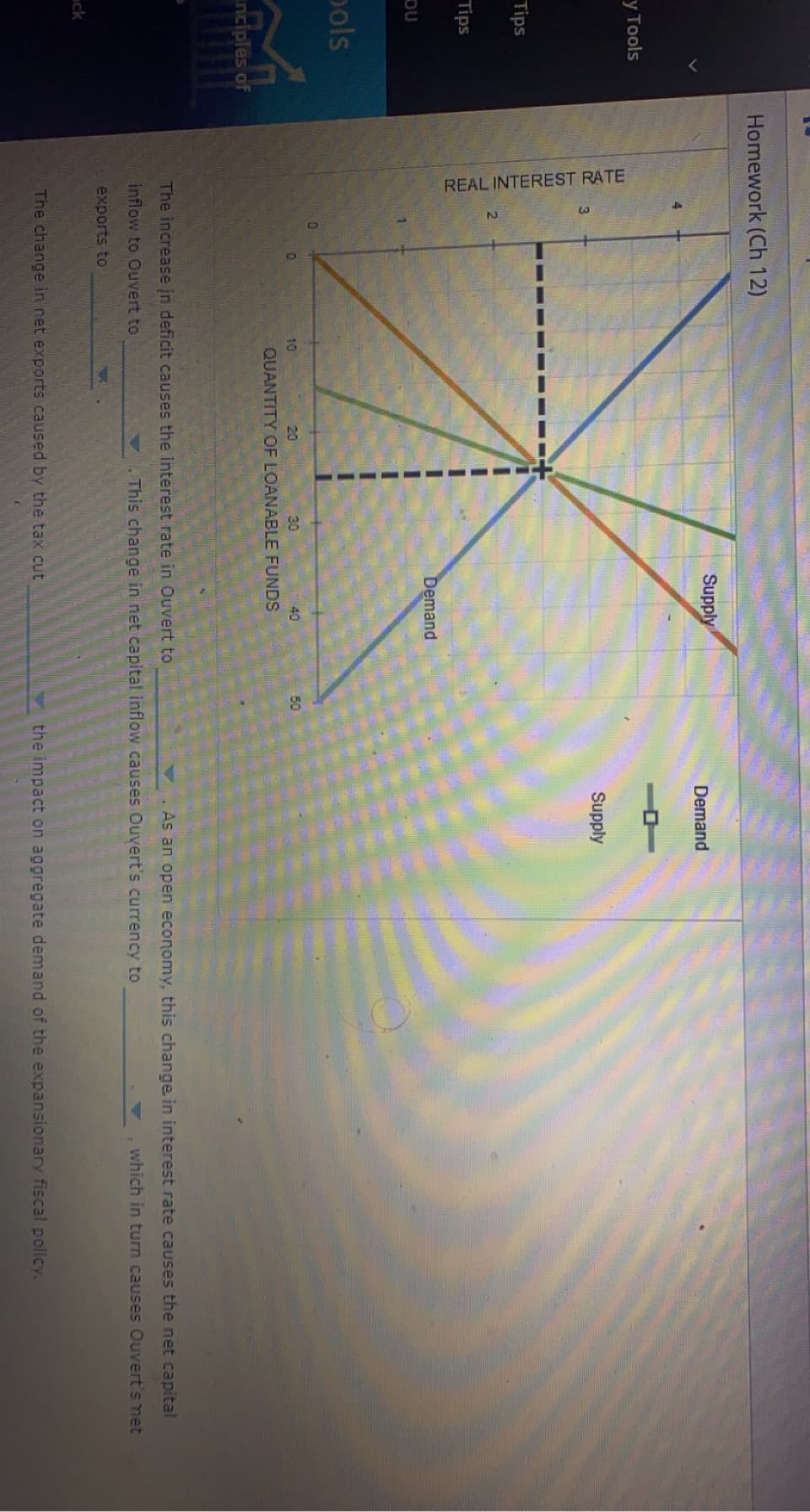

REAL INTEREST RATE Supply Demand Supply Demand 10 20 30 40 50 QUANTITY OF LOANABLE FUNDS The increase in deficit causes the interest rate in Ouvert to . As an open economy, this change in interest rate causes the net capital inflow to Ouvert to .This change in net capital inflow causes Ouvert's currency to which in turn causes Ouvert's net exports to The change in net exports caused by the tax cut the impact on aggregate demand of the expansionary fiscal policy.

REAL INTEREST RATE Supply Demand Supply Demand 10 20 30 40 50 QUANTITY OF LOANABLE FUNDS The increase in deficit causes the interest rate in Ouvert to . As an open economy, this change in interest rate causes the net capital inflow to Ouvert to .This change in net capital inflow causes Ouvert's currency to which in turn causes Ouvert's net exports to The change in net exports caused by the tax cut the impact on aggregate demand of the expansionary fiscal policy.

Chapter24: Fiscal Policy

Section: Chapter Questions

Problem 3P

Related questions

Question

Transcribed Image Text:REAL INTEREST RATE

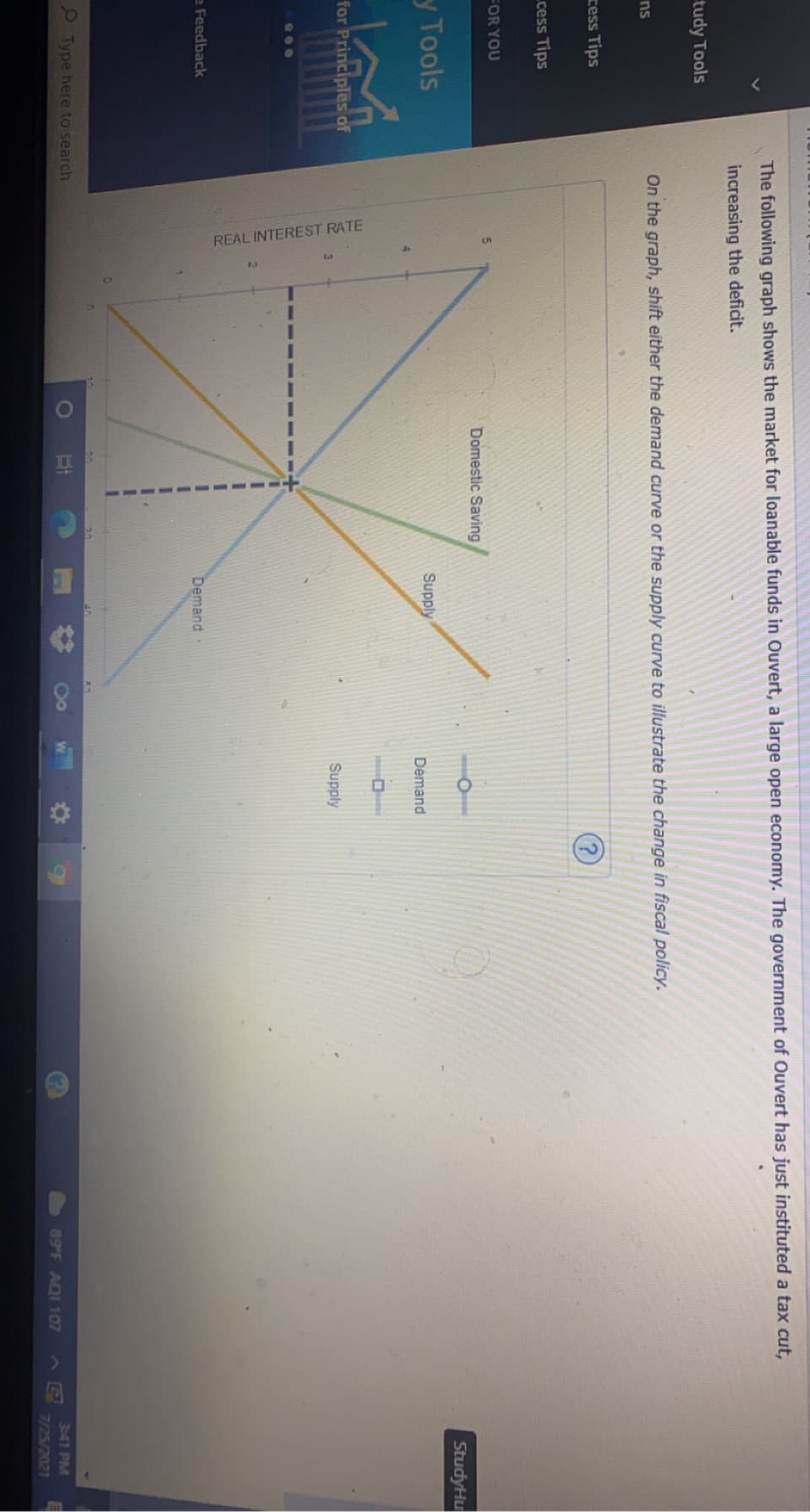

The following graph shows the market for loanable funds in Ouvert, a large open economy. The government of Ouvert has just instituted a tax cut,

increasing the deficit.

tudy Tools

On the graph, shift either the demand curve or the supply curve to illustrate the change in fiscal policy.

ns

ress Tips

cess Tips

FOR YOU

Domestic Saving

StudyHu

y Tools

Supply

Demand

for Principles of

Supply

··.

e Feedback

Demand

O Type here to search

341 PM

89 F AQI 107

7/25/2021

Transcribed Image Text:REAL INTEREST RATE

10

Homework (Ch 12)

Supply

Demand

У Тools

Supply

Tips

Tips

Demand

OU

pols

10

20

30

40

50

QUANTITY OF LOANABLE FUNDS

inciples of

The increase in deficit causes the interest rate in Ouvert to

As an open economy, this change in interest rate causes the net capital

inflow to Ouvert to

.This change in net capital inflow causes Ouvert's currency to

which in turn causes Ouvert's net

exports to

ack

The change in net exports caused by the tax cut

the impact on aggregate demand of the expansionary fiscal policy,

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning