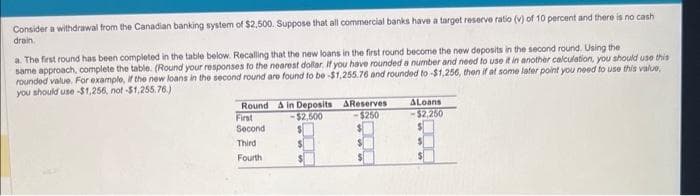

Consider a withdrawal from the Canadian banking system of $2,500. Suppose that all commercial banks have a target reserve ratio (v) of 10 percent and there is no cash drain. a. The first round has been completed in the table below. Recalling that the new loans in the first round become the new deposits in the second round. Using the same approach, complete the table. (Round your responses to the nearest dollar. If you have rounded a number and need to use it in another calculation, you should use this rounded value. For example, if the new loans in the second round are found to be -$1,255.76 and rounded to -$1,256, then if at some later point you need to use this value, you should use -$1,256, not-$1,255.76.) Round & in Deposits -$2,500 First Second Third Fourth AReserves $250 ALoans -$2,250

Consider a withdrawal from the Canadian banking system of $2,500. Suppose that all commercial banks have a target reserve ratio (v) of 10 percent and there is no cash drain. a. The first round has been completed in the table below. Recalling that the new loans in the first round become the new deposits in the second round. Using the same approach, complete the table. (Round your responses to the nearest dollar. If you have rounded a number and need to use it in another calculation, you should use this rounded value. For example, if the new loans in the second round are found to be -$1,255.76 and rounded to -$1,256, then if at some later point you need to use this value, you should use -$1,256, not-$1,255.76.) Round & in Deposits -$2,500 First Second Third Fourth AReserves $250 ALoans -$2,250

Principles of Economics 2e

2nd Edition

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:Steven A. Greenlaw; David Shapiro

Chapter28: Monetary Policy And Bank Regulation

Section: Chapter Questions

Problem 39P: Suppose the Fed conducts an open market sale by selling $10 million in Treasury bonds to Acme Bank....

Related questions

Question

100%

Transcribed Image Text:Consider a withdrawal from the Canadian banking system of $2,500. Suppose that all commercial banks have a target reserve ratio (v) of 10 percent and there is no cash

drain.

a. The first round has been completed in the table below. Recalling that the new loans in the first round become the new deposits in the second round. Using the

same approach, complete the table. (Round your responses to the nearest dollar. If you have rounded a number and need to use it in another calculation, you should use this

rounded value. For example, if the new loans in the second round are found to be -$1,255.76 and rounded to -$1,256, then if at some later point you need to use this value,

you should use -$1,256, not-$1,255.76.)

Round & in Deposits

-$2,500

First

Second

Third

Fourth

AReserves

$250

ALoans

-$2,250

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Principles of Economics 2e

Economics

ISBN:

9781947172364

Author:

Steven A. Greenlaw; David Shapiro

Publisher:

OpenStax

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc