Consider an economy that lasts for two periods. A household receives nominal labour income Y1 = 100 in the first period and Y2 = 110 in the second period. The price level in the first period is P1 and in the second period it's P2 = 11. The nominal interest rate i is 15%. Household chooses real 10 consumption c1 and c2 (relative to price level in the first period) to maximise utility U(c1,c2) that exhibits the decreasing marginal rate of substitution property. 1. Calculate the inflation rate 7 and the real interest rate r. 2. Find the real consumption values for which the household neither saves, nor borrows. For all questions below assume that this is the optimal choice for the housheold. 3. Draw and describe analytically the set of feasible consumption choices. What is the

Consider an economy that lasts for two periods. A household receives nominal labour income Y1 = 100 in the first period and Y2 = 110 in the second period. The price level in the first period is P1 and in the second period it's P2 = 11. The nominal interest rate i is 15%. Household chooses real 10 consumption c1 and c2 (relative to price level in the first period) to maximise utility U(c1,c2) that exhibits the decreasing marginal rate of substitution property. 1. Calculate the inflation rate 7 and the real interest rate r. 2. Find the real consumption values for which the household neither saves, nor borrows. For all questions below assume that this is the optimal choice for the housheold. 3. Draw and describe analytically the set of feasible consumption choices. What is the

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter9: An Introduction To Basic Macroeconomic Markets

Section: Chapter Questions

Problem 9CQ

Related questions

Question

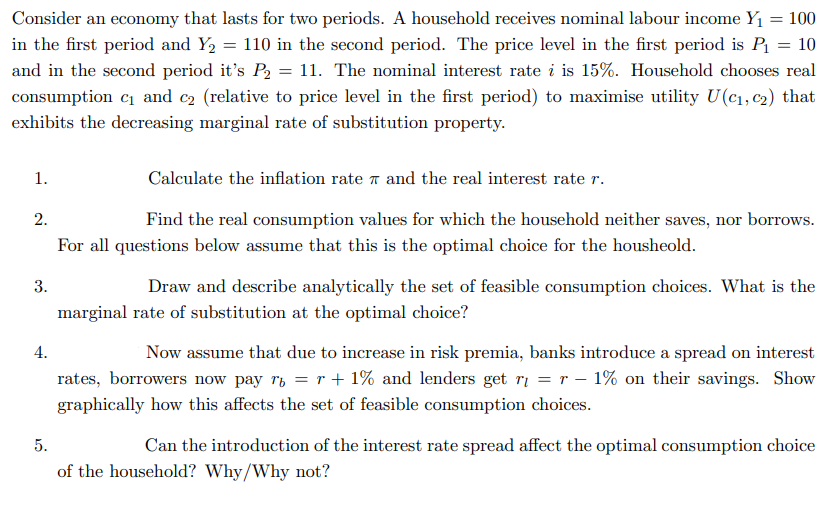

Transcribed Image Text:Consider an economy that lasts for two periods. A household receives nominal labour income Y1 = 100

in the first period and Y2 = 110 in the second period. The price level in the first period is P = 10

and in the second period it's P, = 11. The nominal interest rate i is 15%. Household chooses real

consumption c1 and c2 (relative to price level in the first period) to maximise utility U(c1, c2) that

exhibits the decreasing marginal rate of substitution property.

1.

Calculate the inflation rate 7 and the real interest rate r.

2.

Find the real consumption values for which the household neither saves, nor borrows.

For all questions below assume that this is the optimal choice for the housheold.

3.

Draw and describe analytically the set of feasible consumption choices. What is the

marginal rate of substitution at the optimal choice?

4.

Now assume that due to increase in risk premia, banks introduce a spread on interest

rates, borrowers now pay ry = r + 1% and lenders get ri = r – 1% on their savings. Show

graphically how this affects the set of feasible consumption choices.

5.

Can the introduction of the interest rate spread affect the optimal consumption choice

of the household? Why/Why not?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning