Consider an economy with two goods, consumption c and leisure I, and a representative consumer. The consumer is endowed with 24 hours of time in a day. A consumer's daily leisure hours are equal to 1 = 24-h where h is the number of hours a day the consumer chooses to work. The price of consumption p is equal to 1 and the consumer's hourly wage is w. The consumer faces an ad valorem tax on their earnings of τ percent. The consumer also receives some exogenous income Y that does not depend on how many hours she works (e.g. an inheritance). The consumer's preferences over consumption and hours of work can be represented by the utility function: n'+p 1+ P U(C,h) = c-B where ß> 0 and p > 0 are parameters. a) What is this consumer's budget constraint? b) Solve for the consumer's utility maximizing hours of work h*(w, 1-T) and ( 1

Consider an economy with two goods, consumption c and leisure I, and a representative consumer. The consumer is endowed with 24 hours of time in a day. A consumer's daily leisure hours are equal to 1 = 24-h where h is the number of hours a day the consumer chooses to work. The price of consumption p is equal to 1 and the consumer's hourly wage is w. The consumer faces an ad valorem tax on their earnings of τ percent. The consumer also receives some exogenous income Y that does not depend on how many hours she works (e.g. an inheritance). The consumer's preferences over consumption and hours of work can be represented by the utility function: n'+p 1+ P U(C,h) = c-B where ß> 0 and p > 0 are parameters. a) What is this consumer's budget constraint? b) Solve for the consumer's utility maximizing hours of work h*(w, 1-T) and ( 1

Chapter17: Capital And Time

Section: Chapter Questions

Problem 17.1P

Related questions

Question

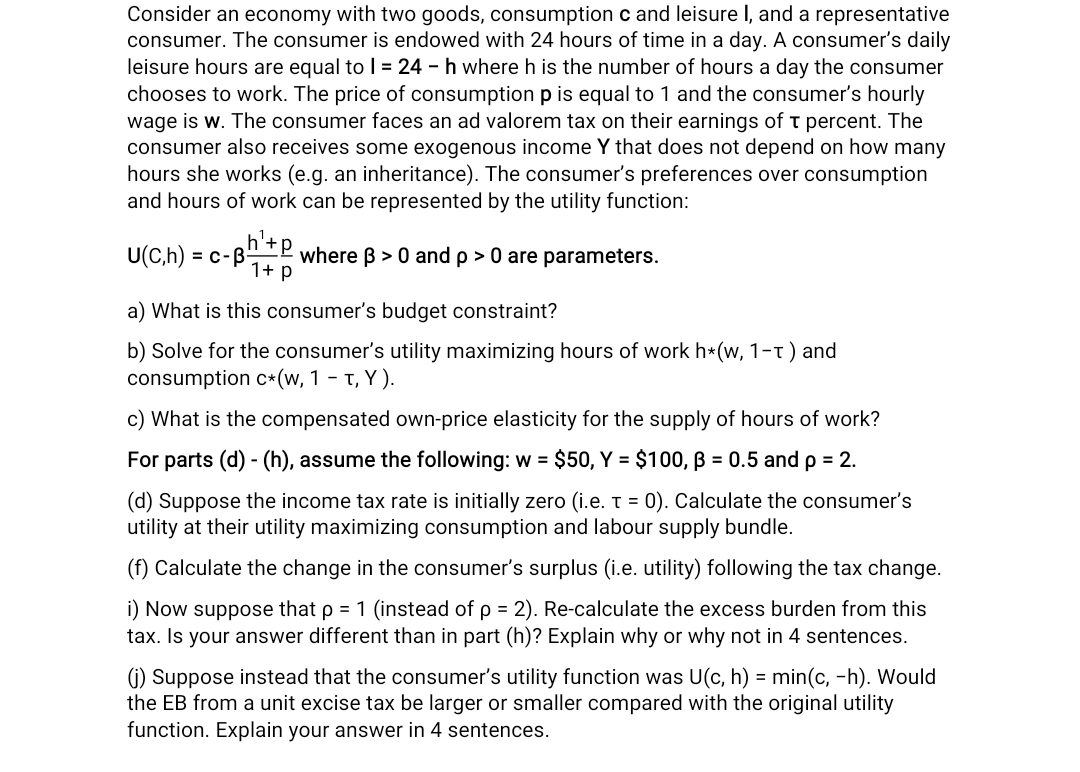

Transcribed Image Text:Consider an economy with two goods, consumption c and leisure I, and a representative

consumer. The consumer is endowed with 24 hours of time in a day. A consumer's daily

leisure hours are equal to 1 = 24 - h where h is the number of hours a day the consumer

chooses to work. The price of consumption p is equal to 1 and the consumer's hourly

wage is w. The consumer faces an ad valorem tax on their earnings of T percent. The

consumer also receives some exogenous income Y that does not depend on how many

hours she works (e.g. an inheritance). The consumer's preferences over consumption

and hours of work can be represented by the utility function:

U(C,h) = c-B- where ß> 0 and p > 0 are parameters.

‚h¹- P

1+ p

a) What is this consumer's budget constraint?

b) Solve for the consumer's utility maximizing hours of work h*(w, 1-T) and

consumption c* (w, 1 - T, Y).

c) What is the compensated own-price elasticity for the supply of hours of work?

For parts (d) - (h), assume the following: w = $50, Y = $100, ß = 0.5 and p = 2.

(d) Suppose the income tax rate is initially zero (i.e. t = 0). Calculate the consumer's

utility at their utility maximizing consumption and labour supply bundle.

(f) Calculate the change in the consumer's surplus (i.e. utility) following the tax change.

i) Now suppose that p = 1 (instead of p = 2). Re-calculate the excess burden from this

tax. Is your answer different than in part (h)? Explain why or why not in 4 sentences.

(j) Suppose instead that the consumer's utility function was U(c, h) = min(c, -h). Would

the EB from a unit excise tax be larger or smaller compared with the original utility

function. Explain your answer in 4 sentences.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you