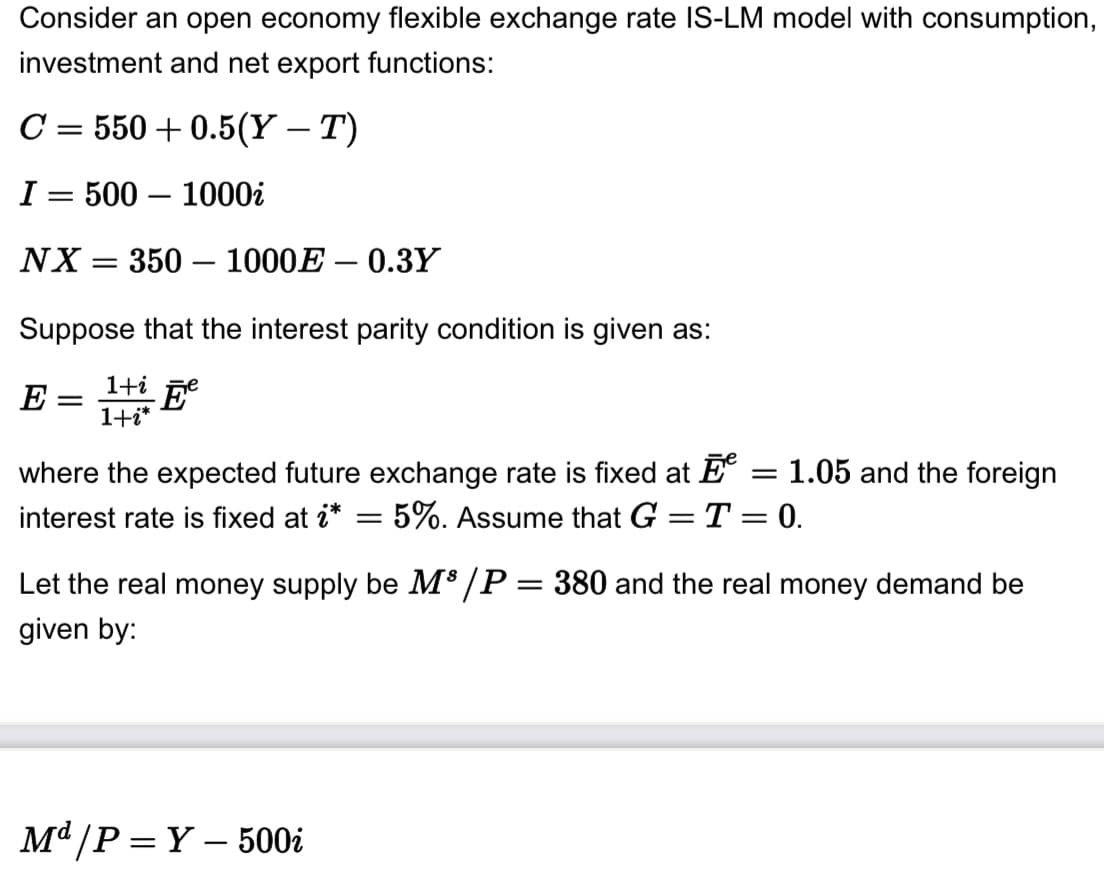

Consider an open economy flexible exchange rate IS-LM model with consumption, investment and net export functions: C = 550 +0.5(Y – T) I 500-1000i = NX = 350 1000E-0.3Y - Suppose that the interest parity condition is given as: E = 1+1 Ee 1+i* where the expected future exchange rate is fixed at = 1.05 and the foreign interest rate is fixed at i* = 5%. Assume that G = T = 0. Let the real money supply be M³/P = 380 and the real money demand be given by: Md/P=Y-500i

Consider an open economy flexible exchange rate IS-LM model with consumption, investment and net export functions: C = 550 +0.5(Y – T) I 500-1000i = NX = 350 1000E-0.3Y - Suppose that the interest parity condition is given as: E = 1+1 Ee 1+i* where the expected future exchange rate is fixed at = 1.05 and the foreign interest rate is fixed at i* = 5%. Assume that G = T = 0. Let the real money supply be M³/P = 380 and the real money demand be given by: Md/P=Y-500i

Managerial Economics: Applications, Strategies and Tactics (MindTap Course List)

14th Edition

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Chapter6: Managing In The Global Economy

Section: Chapter Questions

Problem 12E

Related questions

Question

Assume that the expected future exchange rate is unchanged and that the central bank holds the real money supply fixed.

Solve for the new equilibrium output Y, equilibrium interest rate i and equilibrium exchange rate E.

Transcribed Image Text:Consider an open economy flexible exchange rate IS-LM model with consumption,

investment and net export functions:

C = 550 +0.5(Y – T)

I= 500-1000i

NX = 350 - 1000E-0.3Y

Suppose that the interest parity condition is given as:

E = 1+ Ee

1+i*

where the expected future exchange rate is fixed at = 1.05 and the foreign

interest rate is fixed at i* = 5%. Assume that G = T = 0.

Let the real money supply be M³/P = 380 and the real money demand be

given by:

Md/P=Y-500i

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning

Managerial Economics: Applications, Strategies an…

Economics

ISBN:

9781305506381

Author:

James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:

Cengage Learning