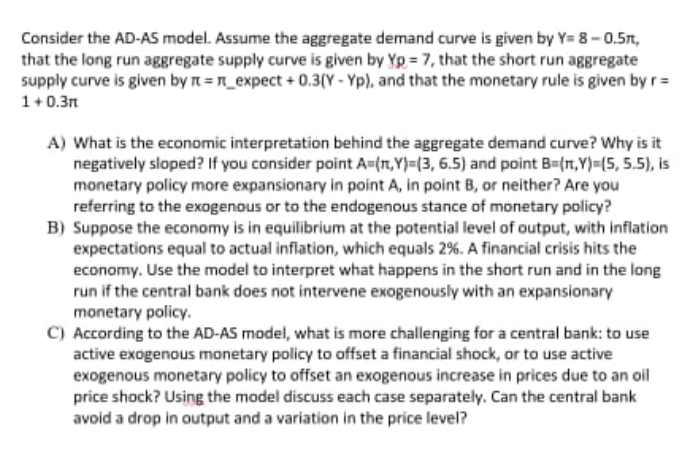

Consider the AD-AS model. Assume the aggregate demand curve is given by Y= 8-0.5n, that the long run aggregate supply curve is given by Yp = 7, that the short run aggregate supply curve is given by n =n_expect + 0.3(Y - Yp), and that the monetary rule is given by r= 1+0.3n A) What is the economic interpretation behind the aggregate demand curve? Why is it negatively sloped? If you consider point A=(n,Y}=(3, 6.5) and point B={n,Y)=(5, 5.5), is monetary policy more expansionary in point A, in point B, or neither? Are you referring to the exogenous or to the endogenous stance of monetary policy? B) Suppose the economy is in equilibrium at the potential level of output, with inflation expectations equal to actual inflation, which equals 2%. A financial crisis hits the economy. Use the model to interpret what happens in the short run and in the long run if the central bank does not intervene exogenously with an expansionary monetary policy.

Consider the AD-AS model. Assume the aggregate demand curve is given by Y= 8-0.5n, that the long run aggregate supply curve is given by Yp = 7, that the short run aggregate supply curve is given by n =n_expect + 0.3(Y - Yp), and that the monetary rule is given by r= 1+0.3n A) What is the economic interpretation behind the aggregate demand curve? Why is it negatively sloped? If you consider point A=(n,Y}=(3, 6.5) and point B={n,Y)=(5, 5.5), is monetary policy more expansionary in point A, in point B, or neither? Are you referring to the exogenous or to the endogenous stance of monetary policy? B) Suppose the economy is in equilibrium at the potential level of output, with inflation expectations equal to actual inflation, which equals 2%. A financial crisis hits the economy. Use the model to interpret what happens in the short run and in the long run if the central bank does not intervene exogenously with an expansionary monetary policy.

Chapter26: Monetary Policy

Section26.A: Policy Disputes Using The Self Correcting Aggregate Demand And Supply Model

Problem 9SQ

Related questions

Question

Transcribed Image Text:Consider the AD-AS model. Assume the aggregate demand curve is given by Y= 8-0.5n,

that the long run aggregate supply curve is given by Yp = 7, that the short run aggregate

supply curve is given by n =n_expect + 0.3(Y - Yp), and that the monetary rule is given by r=

1+0.3n

A) What is the economic interpretation behind the aggregate demand curve? Why is it

negatively sloped? If you consider point A=(n,Y}=(3, 6.5) and point B={n,Y)=(5, 5.5), is

monetary policy more expansionary in point A, in point B, or neither? Are you

referring to the exogenous or to the endogenous stance of monetary policy?

B) Suppose the economy is in equilibrium at the potential level of output, with inflation

expectations equal to actual inflation, which equals 2%. A financial crisis hits the

economy. Use the model to interpret what happens in the short run and in the long

run if the central bank does not intervene exogenously with an expansionary

monetary policy.

C) According to the AD-AS model, what is more challenging for a central bank: to use

active exogenous monetary policy to offset a financial shock, or to use active

exogenous monetary policy to offset an exogenous increase in prices due to an oil

price shock? Using the model discuss each case separately. Can the central bank

avoid a drop in output and a variation in the price level?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Exploring Economics

Economics

ISBN:

9781544336329

Author:

Robert L. Sexton

Publisher:

SAGE Publications, Inc