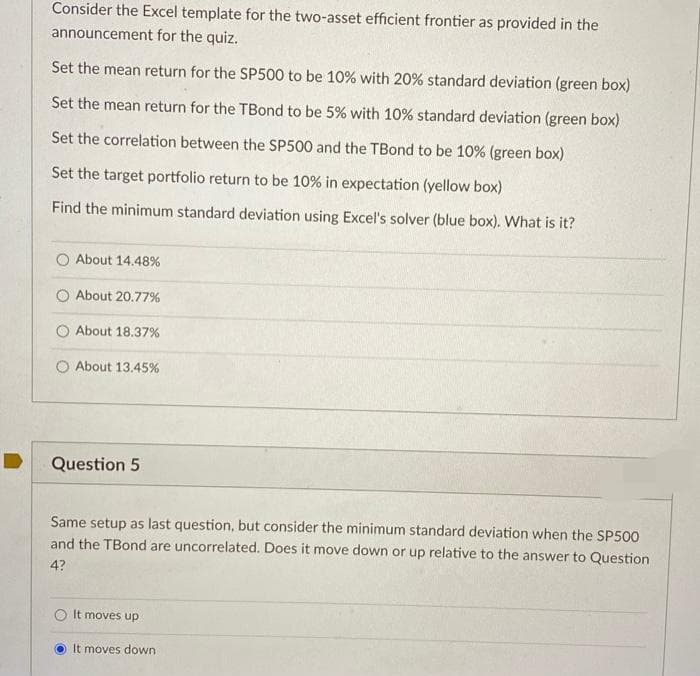

Consider the Excel template for the two-asset efficient frontier as provided in the announcement for the quiz. Set the mean return for the SP500 to be 10% with 20% standard deviation (green box) Set the mean return for the TBond to be 5% with 10% standard deviation (green box) Set the correlation between the SP500 and the TBond to be 10% (green box) Set the target portfolio return to be 10% in expectation (yellow box) Find the minimum standard deviation using Excel's solver (blue box). What is it? O About 14.48% O About 20.77% O About 18.37% O About 13.45%

Consider the Excel template for the two-asset efficient frontier as provided in the announcement for the quiz. Set the mean return for the SP500 to be 10% with 20% standard deviation (green box) Set the mean return for the TBond to be 5% with 10% standard deviation (green box) Set the correlation between the SP500 and the TBond to be 10% (green box) Set the target portfolio return to be 10% in expectation (yellow box) Find the minimum standard deviation using Excel's solver (blue box). What is it? O About 14.48% O About 20.77% O About 18.37% O About 13.45%

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 18P

Related questions

Question

100%

2

Transcribed Image Text:Consider the Excel template for the two-asset efficient frontier as provided in the

announcement for the quiz.

Set the mean return for the SP500 to be 10% with 20% standard deviation (green box)

Set the mean return for the TBond to be 5% with 10% standard deviation (green box)

Set the correlation between the SP500 and the TBond to be 10% (green box)

Set the target portfolio return to be 10% in expectation (yellow box)

Find the minimum standard deviation using Excel's solver (blue box). What is it?

O About 14.48%

About 20.77%

O About 18.37%

O About 13.45%

Question 5

Same setup as last question, but consider the minimum standard deviation when the SP500

and the TBond are uncorrelated. Does it move down or up relative to the answer to Question

4?

It moves up

It moves down

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 4 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning