You are evaluating various investment opportunities currently available and you have calculated expected returns and standard deviation for five different well-diversified portfolios of risky assets. Portfolio Expected return (%) Standard deviation (%) Q 7.8 10.5 R 10 14 S 4.6 5 11.7 18.5 6.2 7.5 a. For each portfolio, determine the Sharpe ratio. Assume that the risk free rate is 3%. b. Using your analysis in part (a), explain which of these five portfolios is most likely to be the market portfolio. Draw up the Capital Market Line Equation. c. If you are willing to make an investment with a standard deviation of 7%, is it possible for you to earn 7%? d. What is the minimum risk level that would be necessary for an investment to earn 7%. What is the composition of the portfolio along the CML that will generate the 7% return. e. Suppose you are now willing t f. Devise how would you apply portfolio performance evaluation and attribution analysis in practice. Illustrate with suitable example. make an investment with a standard deviation of 18.2%. Determine what would be the investment proportions in the risk free asset and market portfolio? Determine the expected return for this portfolio.

You are evaluating various investment opportunities currently available and you have calculated expected returns and standard deviation for five different well-diversified portfolios of risky assets. Portfolio Expected return (%) Standard deviation (%) Q 7.8 10.5 R 10 14 S 4.6 5 11.7 18.5 6.2 7.5 a. For each portfolio, determine the Sharpe ratio. Assume that the risk free rate is 3%. b. Using your analysis in part (a), explain which of these five portfolios is most likely to be the market portfolio. Draw up the Capital Market Line Equation. c. If you are willing to make an investment with a standard deviation of 7%, is it possible for you to earn 7%? d. What is the minimum risk level that would be necessary for an investment to earn 7%. What is the composition of the portfolio along the CML that will generate the 7% return. e. Suppose you are now willing t f. Devise how would you apply portfolio performance evaluation and attribution analysis in practice. Illustrate with suitable example. make an investment with a standard deviation of 18.2%. Determine what would be the investment proportions in the risk free asset and market portfolio? Determine the expected return for this portfolio.

Chapter8: Analysis Of Risk And Return

Section: Chapter Questions

Problem 5P

Related questions

Question

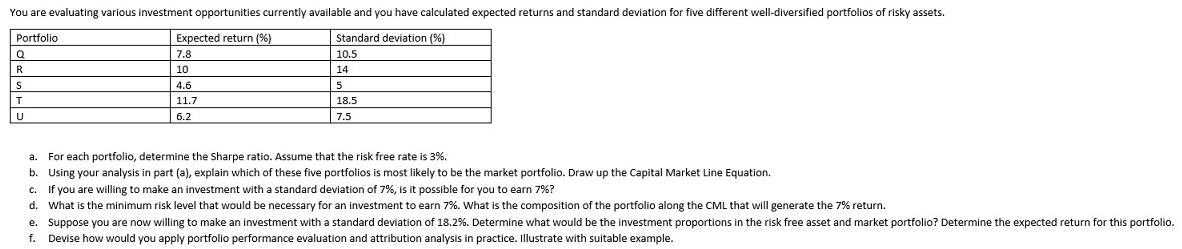

Transcribed Image Text:You are evaluating various investment opportunities currently available and you have calculated expected returns and standard deviation for five different well-diversified portfolios of risky assets.

Portfolio

Expected return (%)

Standard deviation (%)

Q

7.8

10.5

R

10

14

S

4.6

5

11.7

18.5

6.2

7.5

a. For each portfolio, determine the Sharpe ratio. Assume that the risk free rate is 3%.

b. Using your analysis in part (a), explain which of these five portfolios is most likely to be the market portfolio. Draw up the Capital Market Line Equation.

c. If you are willing to make an investment with a standard deviation of 7%, is it possible for you to earn 7%?

d. What is the minimum risk level that would be necessary for an investment to earn 7%. What is the composition of the portfolio along the CML that will generate the 7% return.

e. Suppose you are now willing t

f. Devise how would you apply portfolio performance evaluation and attribution analysis in practice. Illustrate with suitable example.

make an investment with a standard deviation of 18.2%. Determine what would be the investment proportions in the risk free asset and market portfolio? Determine the expected return for this portfolio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning