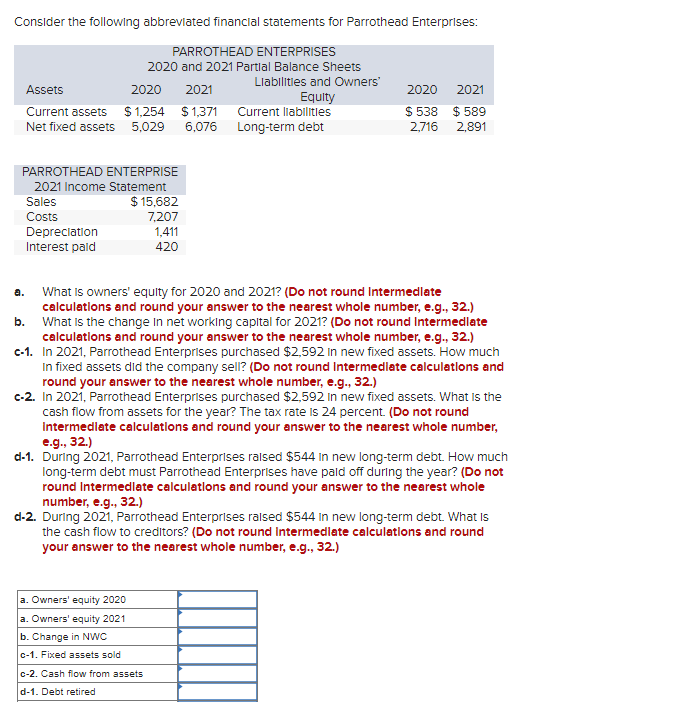

Consider the following abbreviated financial statements for Parrothead Enterprises: PARROTHEAD ENTERPRISES 2020 and 2021 Partial Balance Sheets Liabilities and Owners' Assets 2020 2021 2020 2021 Equity Current assets $1,254 $1,371 Current liabilities $ 538 $589 Net fixed assets 5,029 6,076 Long-term debt 2,716 2,891 PARROTHEAD ENTERPRISE 2021 Income Statement Sales $ 15,682 Costs 7,207 Depreciation 1,411 Interest pald 420 a. What is owners' equity for 2020 and 2021? (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What is the change in net working capital for 2021? (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c-1. In 2021, Parrothead Enterprises purchased $2,592 in new fixed assets. How much In fixed assets did the company sell? (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c-2. In 2021, Parrothead Enterprises purchased $2,592 in new fixed assets. What is the cash flow from assets for the year? The tax rate is 24 percent. (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d-1. During 2021, Parrothead Enterprises raised $544 in new long-term debt. How much long-term debt must Parrothead Enterprises have paid off during the year? (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d-2. During 2021, Parrothead Enterprises raised $544 in new long-term debt. What is the cash flow to creditors? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) a. Owners' equity 2020 a. Owners' equity 2021 b. Change in NWC c-1. Fixed assets sold c-2. Cash flow from assets d-1. Debt retired

Consider the following abbreviated financial statements for Parrothead Enterprises: PARROTHEAD ENTERPRISES 2020 and 2021 Partial Balance Sheets Liabilities and Owners' Assets 2020 2021 2020 2021 Equity Current assets $1,254 $1,371 Current liabilities $ 538 $589 Net fixed assets 5,029 6,076 Long-term debt 2,716 2,891 PARROTHEAD ENTERPRISE 2021 Income Statement Sales $ 15,682 Costs 7,207 Depreciation 1,411 Interest pald 420 a. What is owners' equity for 2020 and 2021? (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What is the change in net working capital for 2021? (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c-1. In 2021, Parrothead Enterprises purchased $2,592 in new fixed assets. How much In fixed assets did the company sell? (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c-2. In 2021, Parrothead Enterprises purchased $2,592 in new fixed assets. What is the cash flow from assets for the year? The tax rate is 24 percent. (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d-1. During 2021, Parrothead Enterprises raised $544 in new long-term debt. How much long-term debt must Parrothead Enterprises have paid off during the year? (Do not round Intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d-2. During 2021, Parrothead Enterprises raised $544 in new long-term debt. What is the cash flow to creditors? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) a. Owners' equity 2020 a. Owners' equity 2021 b. Change in NWC c-1. Fixed assets sold c-2. Cash flow from assets d-1. Debt retired

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter9: Long-term Liabilities

Section: Chapter Questions

Problem 103.4C

Related questions

Question

Transcribed Image Text:Consider the following abbreviated financial statements for Parrothead Enterprises:

PARROTHEAD ENTERPRISES

2020 and 2021 Partial Balance Sheets

Liabilities and Owners'

Assets

2020

2021

2020 2021

Equity

Current assets

$1,254

$1,371

Current liabilities

$ 538 $589

Net fixed assets 5,029

6,076

Long-term debt

2,716 2,891

PARROTHEAD ENTERPRISE

2021 Income Statement

Sales

$ 15,682

Costs

7,207

Depreciation

1,411

Interest pald

420

a.

What is owners' equity for 2020 and 2021? (Do not round Intermediate

calculations and round your answer to the nearest whole number, e.g., 32.)

b. What is the change in net working capital for 2021? (Do not round Intermediate

calculations and round your answer to the nearest whole number, e.g., 32.)

c-1. In 2021, Parrothead Enterprises purchased $2,592 in new fixed assets. How much

In fixed assets did the company sell? (Do not round Intermediate calculations and

round your answer to the nearest whole number, e.g., 32.)

c-2. In 2021, Parrothead Enterprises purchased $2,592 in new fixed assets. What is the

cash flow from assets for the year? The tax rate is 24 percent. (Do not round

Intermediate calculations and round your answer to the nearest whole number,

e.g., 32.)

d-1. During 2021, Parrothead Enterprises raised $544 in new long-term debt. How much

long-term debt must Parrothead Enterprises have paid off during the year? (Do not

round Intermediate calculations and round your answer to the nearest whole

number, e.g., 32.)

d-2. During 2021, Parrothead Enterprises raised $544 in new long-term debt. What is

the cash flow to creditors? (Do not round intermediate calculations and round

your answer to the nearest whole number, e.g., 32.)

a. Owners' equity 2020

a. Owners' equity 2021

b. Change in NWC

c-1. Fixed assets sold

c-2. Cash flow from assets

d-1. Debt retired

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning