Consider the following model for a small open economy. Using this model, and rounding to 3 decimal places, please answer all questions to this CML Y = 750 – s – 1000i + 5e (1) IS Equation %3D i = 0.5 (1+ s) + 0.001Y – 0.0054 (2) LM Equation %3D i = ij = 0.05 (3) BP=0 locus Let foreign prices be fixed at P = 1 and the nominal exchange rate e be flexible. Question 1: Assuming that this is a classical economy with full flexible domestic prices and output is fixed at the full employment level Y=Yp= 2000. Also assume that there is no COVID (s-o) and the benchmark for nominal money supply is M-- s0. Solve for P

Consider the following model for a small open economy. Using this model, and rounding to 3 decimal places, please answer all questions to this CML Y = 750 – s – 1000i + 5e (1) IS Equation %3D i = 0.5 (1+ s) + 0.001Y – 0.0054 (2) LM Equation %3D i = ij = 0.05 (3) BP=0 locus Let foreign prices be fixed at P = 1 and the nominal exchange rate e be flexible. Question 1: Assuming that this is a classical economy with full flexible domestic prices and output is fixed at the full employment level Y=Yp= 2000. Also assume that there is no COVID (s-o) and the benchmark for nominal money supply is M-- s0. Solve for P

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter19: International Finance And The Foreign Exchange Market

Section: Chapter Questions

Problem 1CQ

Related questions

Question

Explain it correctly I upvote

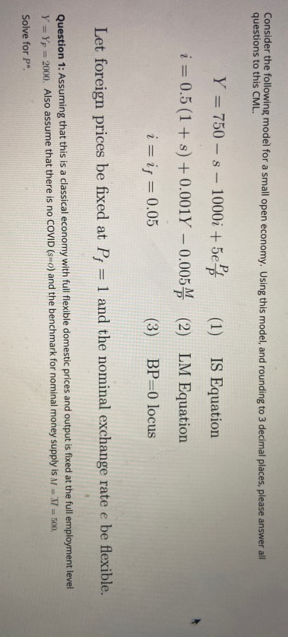

Transcribed Image Text:Consider the following model for a small open economy. Using this model, and rounding to 3 decimal places, please answer all

questions to this CML

Y = 750 – s – 1000i + 5e

(1)

IS Equation

%3D

i = 0.5 (1+ s) + 0.001Y – 0.0054 (2)

LM Equation

%3D

i = ij = 0.05

(3)

BP=0 locus

Let foreign prices be fixed at P = 1 and the nominal exchange rate e be flexible.

Question 1: Assuming that this is a classical economy with full flexible domestic prices and output is fixed at the full employment level

Y=Yp= 2000. Also assume that there is no COVID (s-o) and the benchmark for nominal money supply is M-- s0.

Solve for P

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning