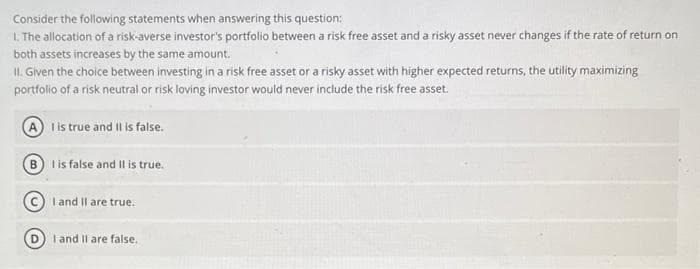

Consider the following statements when answering this question: 1. The allocation of a risk-averse investor's portfolio between a risk free asset and a risky asset never changes if the rate of return on both assets increases by the same amount. II. Given the choice between investing in a risk free asset or a risky asset with higher expected returns, the utility maximizing portfolio of a risk neutral or risk loving investor would never include the risk free asset. I is true and II is false. BI is false and II is true. I and II are true. I and II are false.

Consider the following statements when answering this question: 1. The allocation of a risk-averse investor's portfolio between a risk free asset and a risky asset never changes if the rate of return on both assets increases by the same amount. II. Given the choice between investing in a risk free asset or a risky asset with higher expected returns, the utility maximizing portfolio of a risk neutral or risk loving investor would never include the risk free asset. I is true and II is false. BI is false and II is true. I and II are true. I and II are false.

Chapter7: Uncertainty

Section: Chapter Questions

Problem 7.13P

Related questions

Question

Transcribed Image Text:Consider the following statements when answering this question:

1. The allocation of a risk-averse investor's portfolio between a risk free asset and a risky asset never changes if the rate of return on

both assets increases by the same amount.

II. Given the choice between investing in a risk free asset or a risky asset with higher expected returns, the utility maximizing

portfolio of a risk neutral or risk loving investor would never include the risk free asset.

I is true and II is false.

BI is false and II is true.

I and II are true.

I and II are false.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning