Consider the market for ice cream cones. Suppose that supply in this market is given by PS = Q$ and demand is given by PD = 30 – 4 × QD. Answer the following questions. a.) Suppose that the government is considering imposing a $4.00 price control as either a price ceiling or a price floor. Would this be a binding price control as a price floor or as a price ceiling? Will this cause a shortage or a surplus? Compute the size of the shortage or surplus that would result. b.) Suppose that instead of a price control, the government is considering imposing a $1.00 per ice cream cone tax in the market on producers. Compute the tax equilibrium quantity Qf, the consumer effective price with the tax PD, the producer effective price with the tax ps, tax incidence and producer tax incidence. c.) Notice that the competitive equilibrium (Qº,Pe) and the point (Qf,Pº) are both on the demand curve. Use them to compute the price elasticity of demand. d.) Notice that the competitive equilibrium (Qº, Pª) and the point (Qf, P5) are both on the supply curve. Use them to compute the price elasticity of supply. Does the side of the market with a larger elasticity have a higher tax incidence? e.) Compute consumer surplus, producer surplus, and government surplus in the market for ice cream cones with and without the $1.00 per ice cream cone tax. Compute the deadweight loss , consumer created by the tax

Consider the market for ice cream cones. Suppose that supply in this market is given by PS = Q$ and demand is given by PD = 30 – 4 × QD. Answer the following questions. a.) Suppose that the government is considering imposing a $4.00 price control as either a price ceiling or a price floor. Would this be a binding price control as a price floor or as a price ceiling? Will this cause a shortage or a surplus? Compute the size of the shortage or surplus that would result. b.) Suppose that instead of a price control, the government is considering imposing a $1.00 per ice cream cone tax in the market on producers. Compute the tax equilibrium quantity Qf, the consumer effective price with the tax PD, the producer effective price with the tax ps, tax incidence and producer tax incidence. c.) Notice that the competitive equilibrium (Qº,Pe) and the point (Qf,Pº) are both on the demand curve. Use them to compute the price elasticity of demand. d.) Notice that the competitive equilibrium (Qº, Pª) and the point (Qf, P5) are both on the supply curve. Use them to compute the price elasticity of supply. Does the side of the market with a larger elasticity have a higher tax incidence? e.) Compute consumer surplus, producer surplus, and government surplus in the market for ice cream cones with and without the $1.00 per ice cream cone tax. Compute the deadweight loss , consumer created by the tax

Microeconomics A Contemporary Intro

10th Edition

ISBN:9781285635101

Author:MCEACHERN

Publisher:MCEACHERN

Chapter16: Public Goods And Public Choice

Section: Chapter Questions

Problem 14PAE

Related questions

Question

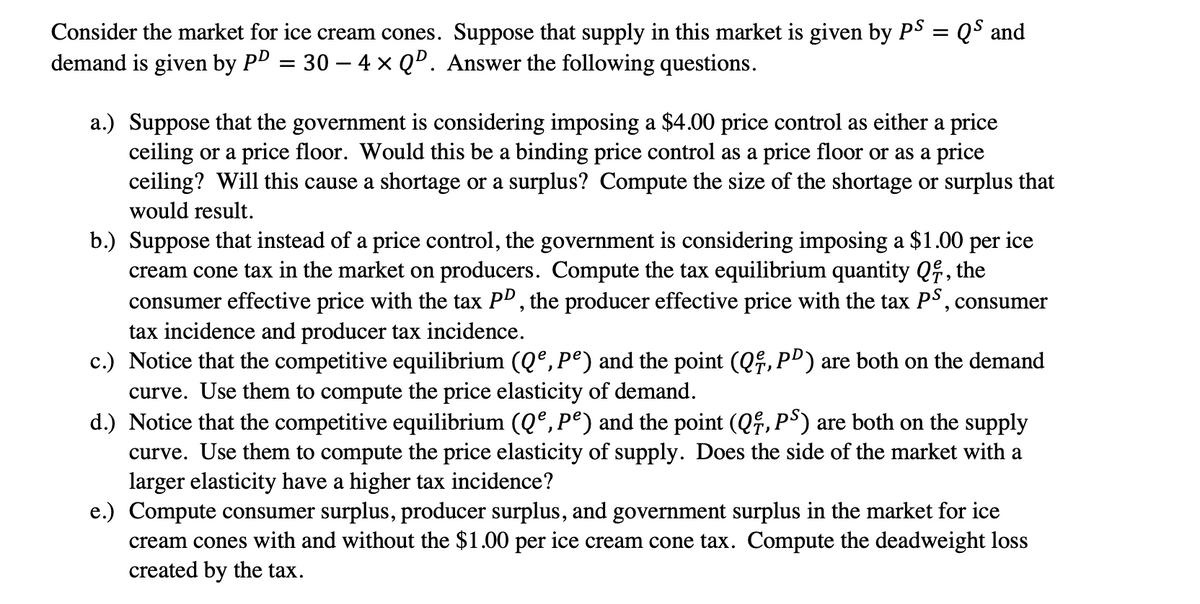

Transcribed Image Text:Consider the market for ice cream cones.

Suppose that supply in this market is given by PS = QS and

demand is given by PD = 30 – 4 x QD. Answer the following questions.

a.) Suppose that the government is considering imposing a $4.00 price control as either a price

ceiling or a price floor. Would this be a binding price control as a price floor or as a price

ceiling? Will this cause a shortage or a surplus? Compute the size of the shortage or surplus that

would result.

b.) Suppose that instead of a price control, the government is considering imposing a $1.00 per ice

cream cone tax in the market on producers. Compute the tax equilibrium quantity Q, the

consumer effective price with the tax PP, the producer effective price with the tax PS, consumer

tax incidence and producer tax incidence.

c.) Notice that the competitive equilibrium (Q°, Pº) and the point (Q,P") are both on the demand

curve. Use them to compute the price elasticity of demand.

d.) Notice that the competitive equilibrium (Qº,Pº) and the point (Qf,P³) are both on the supply

curve. Use them to compute the price elasticity of supply. Does the side of the market with a

larger elasticity have a higher tax incidence?

e.) Compute consumer surplus, producer surplus, and government surplus in the market for ice

cream cones with and without the $1.00 per ice cream cone tax. Compute the deadweight loss

created by the tax.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Answer questions D and E ONLY

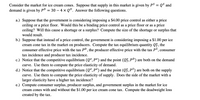

Transcribed Image Text:Consider the market for ice cream cones. Suppose that supply in this market is given by PS = QS and

demand is given by PD

30 – 4 x QD. Answer the following questions.

a.) Suppose that the government is considering imposing a $4.00 price control as either a price

ceiling or a price floor. Would this be a binding price control as a price floor or as a price

ceiling? Will this cause a shortage or a surplus? Compute the size of the shortage or surplus that

would result.

b.) Suppose that instead of a price control, the government is considering imposing a $1.00 per ice

cream cone tax in the market on producers. Compute the tax equilibrium quantity Q, the

consumer effective price with the tax PD, the producer effective price with the tax PS,

tax incidence and producer tax incidence.

c.) Notice that the competitive equilibrium (Q°, pº) and the point (Qf,P") are both on the demand

curve. Use them to compute the price elasticity of demand.

d.) Notice that the competitive equilibrium (Qº,Pº) and the point (Qf,P³) are both on the supply

curve. Use them to compute the price elasticity of supply. Does the side of the market with a

larger elasticity have a higher tax incidence?

e.) Compute consumer surplus, producer surplus, and government surplus in the market for ice

cream cones with and without the $1.00 per ice cream cone tax. Compute the deadweight loss

created by the tax.

consumer

Solution

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning