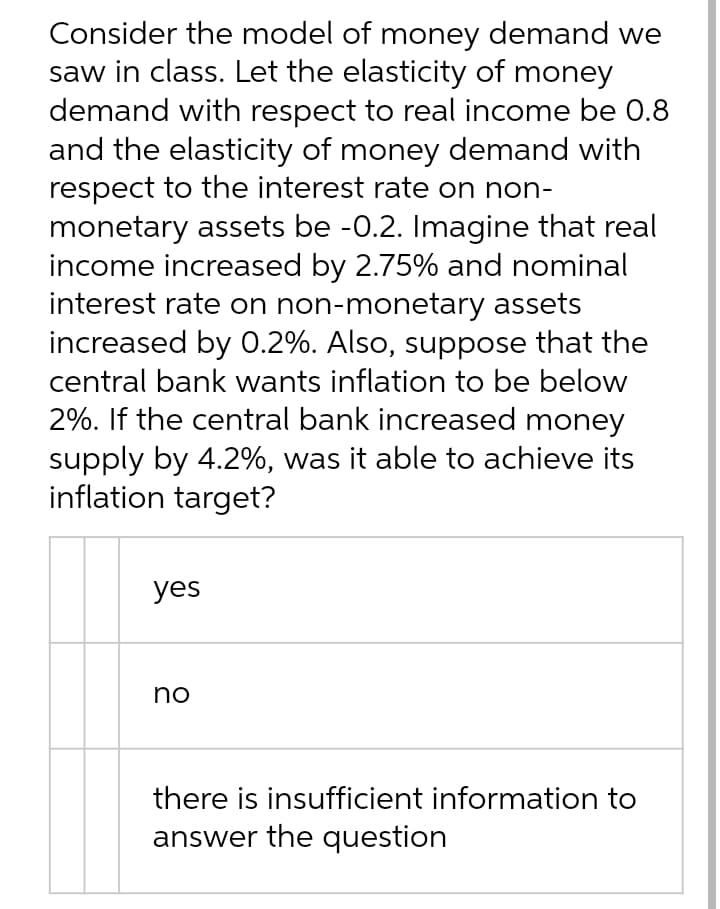

Consider the model of money demand we saw in class. Let the elasticity of money demand with respect to real income be 0.8 and the elasticity of money demand with respect to the interest rate on non- monetary assets be -0.2. Imagine that real income increased by 2.75% and nominal interest rate on non-monetary assets increased by 0.2%. Also, suppose that the central bank wants inflation to be below 2%. If the central bank increased money supply by 4.2%, was it able to achieve its inflation target?

Consider the model of money demand we saw in class. Let the elasticity of money demand with respect to real income be 0.8 and the elasticity of money demand with respect to the interest rate on non- monetary assets be -0.2. Imagine that real income increased by 2.75% and nominal interest rate on non-monetary assets increased by 0.2%. Also, suppose that the central bank wants inflation to be below 2%. If the central bank increased money supply by 4.2%, was it able to achieve its inflation target?

Macroeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506756

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter14: Modern Macroeconomics And Monetary Policy

Section: Chapter Questions

Problem 15CQ

Related questions

Question

7

Transcribed Image Text:Consider the model of money demand we

saw in class. Let the elasticity of money

demand with respect to real income be 0.8

and the elasticity of money demand with

respect to the interest rate on non-

monetary assets be -0.2. Imagine that real

income increased by 2.75% and nominal

interest rate on non-monetary assets

increased by 0.2%. Also, suppose that the

central bank wants inflation to be below

2%. If the central bank increased money

supply by 4.2%, was it able to achieve its

inflation target?

yes

no

there is insufficient information to

answer the question

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Brief Principles of Macroeconomics (MindTap Cours…

Economics

ISBN:

9781337091985

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning