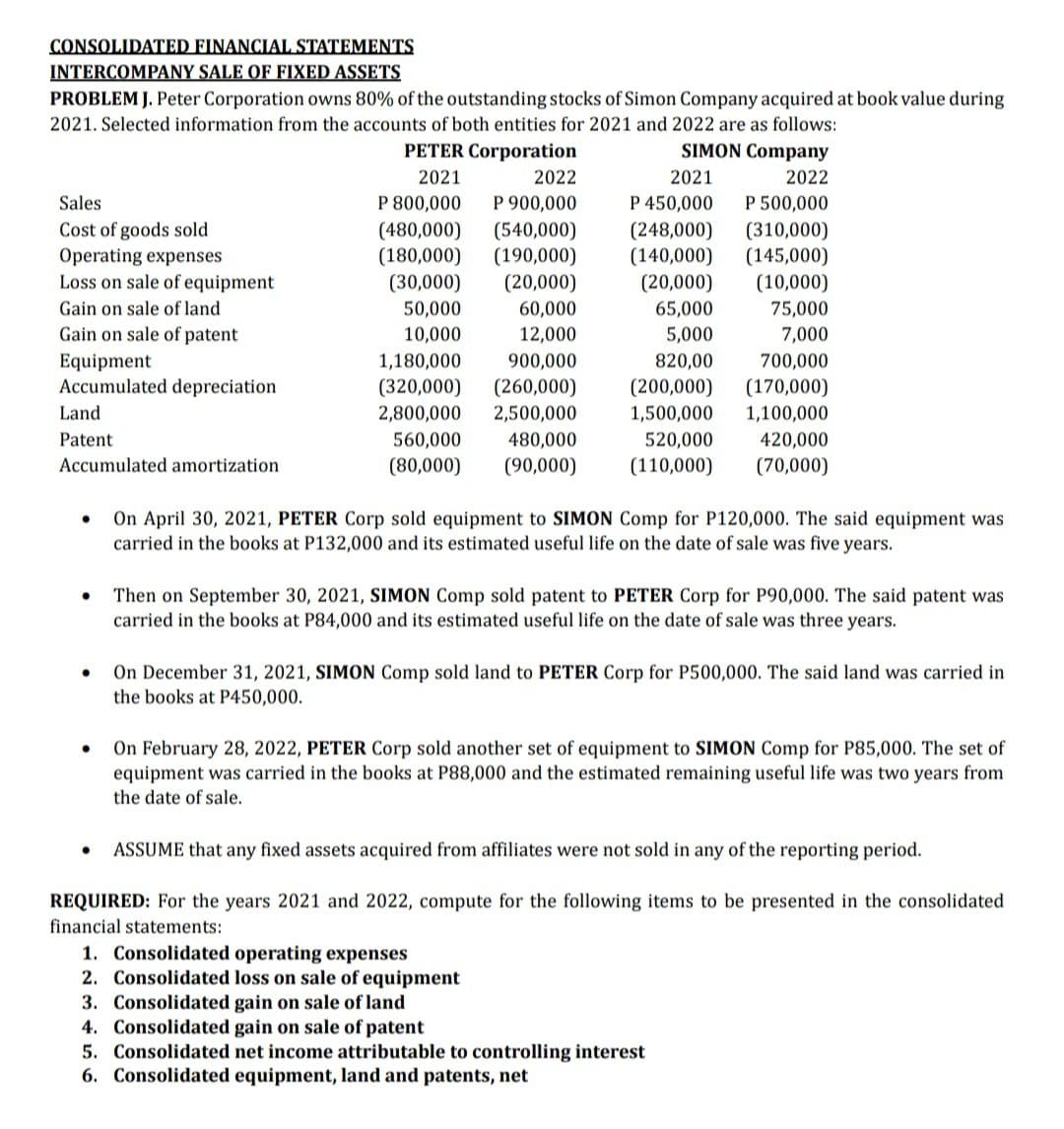

CONSOLIDATED FINANCIAL STATEMENTS INTERCOMPANY SALE OF FIXED ASSETS PROBLEM J. Peter Corporation owns 80% of the outstanding stocks of Simon Company acquired at book value during 2021. Selected information from the accounts of both entities for 2021 and 2022 are as follows: PETER Corporation SIMON Company 2021 2022 2021 2022 P 900,000 (540,000) (190,000) (20,000) P 500,000 (310,000) (145,000) (10,000) Sales P 800,000 P 450,000 Cost of goods sold Operating expenses Loss on sale of equipment (480,000) (180,000) (30,000) (248,000) (140,000) (20,000) Gain on sale of land 50,000 60,000 65,000 75,000 Gain on sale of patent 10,000 12,000 5,000 7,000 Equipment Accumulated depreciation 1,180,000 900,000 820,00 700,000 (320,000) (260,000) (200,000) (170,000) Land 2,800,000 2,500,000 1,500,000 1,100,000 560,000 480,000 (90,000) Patent 520,000 420,000 Accumulated amortization (80,000) (110,000) (70,000) On April 30, 2021, PETER Corp sold equipment to SIMON Comp for P120,000. The said equipment was carried in the books at P132,000 and its estimated useful life on the date of sale was five years. Then on September 30, 2021, SIMON Comp sold patent to PETER Corp for P90,000. The said patent was carried in the books at P84,000 and its estimated useful life on the date of sale was three years. On December 31, 2021, SIMON Comp sold land to PETER Corp for P500,000. The said land was carried in the books at P450,000. On February 28, 2022, PETER Corp sold another set of equipment to SIMON Comp for P85,000. The set of equipment was carried in the books at P88,000 and the estimated remaining useful life was two years from the date of sale. ASSUME that any fixed assets acquired from affiliates were not sold in any of the reporting period. REQUIRED: For the years 2021 and 2022, compute for the following items to be presented in the consolidated financial statements: 1. Consolidated operating expenses 2. Consolidated loss on sale of equipment 3. Consolidated gain on sale of land

CONSOLIDATED FINANCIAL STATEMENTS INTERCOMPANY SALE OF FIXED ASSETS PROBLEM J. Peter Corporation owns 80% of the outstanding stocks of Simon Company acquired at book value during 2021. Selected information from the accounts of both entities for 2021 and 2022 are as follows: PETER Corporation SIMON Company 2021 2022 2021 2022 P 900,000 (540,000) (190,000) (20,000) P 500,000 (310,000) (145,000) (10,000) Sales P 800,000 P 450,000 Cost of goods sold Operating expenses Loss on sale of equipment (480,000) (180,000) (30,000) (248,000) (140,000) (20,000) Gain on sale of land 50,000 60,000 65,000 75,000 Gain on sale of patent 10,000 12,000 5,000 7,000 Equipment Accumulated depreciation 1,180,000 900,000 820,00 700,000 (320,000) (260,000) (200,000) (170,000) Land 2,800,000 2,500,000 1,500,000 1,100,000 560,000 480,000 (90,000) Patent 520,000 420,000 Accumulated amortization (80,000) (110,000) (70,000) On April 30, 2021, PETER Corp sold equipment to SIMON Comp for P120,000. The said equipment was carried in the books at P132,000 and its estimated useful life on the date of sale was five years. Then on September 30, 2021, SIMON Comp sold patent to PETER Corp for P90,000. The said patent was carried in the books at P84,000 and its estimated useful life on the date of sale was three years. On December 31, 2021, SIMON Comp sold land to PETER Corp for P500,000. The said land was carried in the books at P450,000. On February 28, 2022, PETER Corp sold another set of equipment to SIMON Comp for P85,000. The set of equipment was carried in the books at P88,000 and the estimated remaining useful life was two years from the date of sale. ASSUME that any fixed assets acquired from affiliates were not sold in any of the reporting period. REQUIRED: For the years 2021 and 2022, compute for the following items to be presented in the consolidated financial statements: 1. Consolidated operating expenses 2. Consolidated loss on sale of equipment 3. Consolidated gain on sale of land

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

ChapterA2: Investments

Section: Chapter Questions

Problem 29E

Related questions

Question

Transcribed Image Text:CONSOLIDATED FINANCIAL STATEMENTS

INTERCOMPANY SALE OF FIXED ASSETS

PROBLEM J. Peter Corporation owns 80% of the outstanding stocks of Simon Company acquired at book value during

2021. Selected information from the accounts of both entities for 2021 and 2022 are as follows:

PETER Corporation

SIMON Company

2021

2022

2021

2022

P 900,000

P 450,000

(248,000)

(140,000)

(20,000)

Sales

P 800,000

P 500,000

Cost of goods sold

Operating expenses

Loss on sale of equipment

(480,000)

(180,000)

(30,000)

50,000

(540,000)

(190,000)

(20,000)

60,000

(310,000)

(145,000)

(10,000)

Gain on sale of land

65,000

75,000

Gain on sale of patent

10,000

12,000

5,000

7,000

Equipment

Accumulated depreciation

1,180,000

(320,000)

900,000

820,00

700,000

(260,000)

2,500,000

(200,000)

1,500,000

(170,000)

1,100,000

Land

2,800,000

520,000

(110,000)

Patent

560,000

480,000

420,000

Accumulated amortization

(80,000)

(90,000)

(70,000)

On April 30, 2021, PETER Corp sold equipment to SIMON Comp for P120,000. The said equipment was

carried in the books at P132,000 and its estimated useful life on the date of sale was five years.

Then on September 30, 2021, SIMON Comp sold patent to PETER Corp for P90,000. The said patent was

carried in the books at P84,000 and its estimated useful life on the date of sale was three years.

On December 31, 2021, SIMON Comp sold land to PETER Corp for P500,000. The said land was carried in

the books at P450,000.

On February 28, 2022, PETER Corp sold another set of equipment to SIMON Comp for P85,000. The set of

equipment was carried in the books at P88,000 and the estimated remaining useful life was two years from

the date of sale.

ASSUME that any fixed assets acquired from affiliates were not sold in any of the reporting period.

REQUIRED: For the years 2021 and 2022, compute for the following items to be presented in the consolidated

financial statements:

1. Consolidated operating expenses

2. Consolidated loss on sale of equipment

3. Consolidated gain on sale of land

4. Consolidated gain on sale of patent

5. Consolidated net income attributable to controlling interest

6. Consolidated equipment, land and patents, net

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning