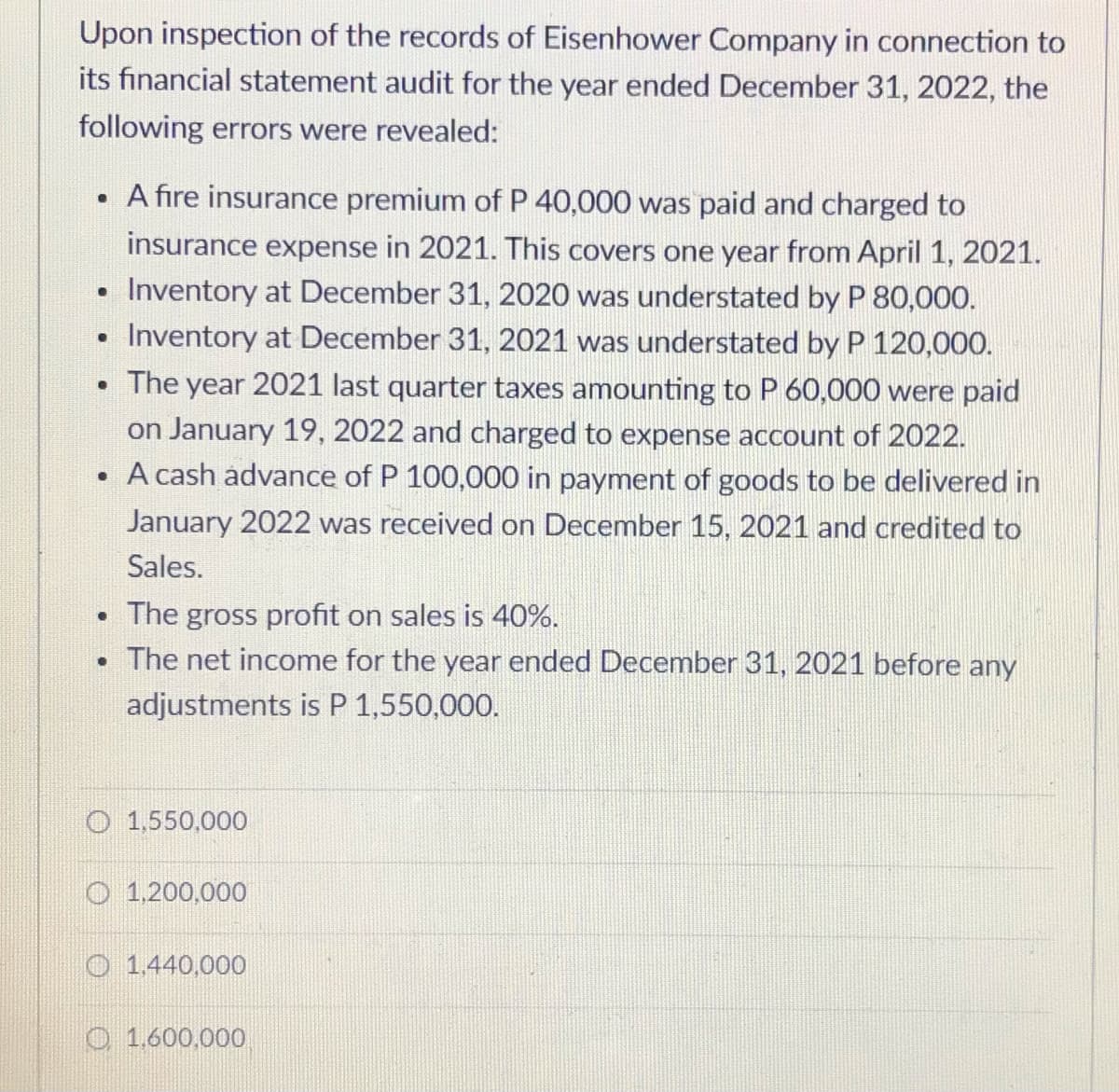

Upon inspection of the records of Eisenhower Company in connection to its financial statement audit for the year ended December 31, 2022, the following errors were revealed: A fire insurance premium of P 40,000 was paid and charged to insurance expense in 2021. This covers one year from April 1, 2021. Inventory at December 31, 2020 was understated by P 80,000. Inventory at December 31, 2021 was understated by P 120,000. • The year 2021 last quarter taxes amounting to P 60,000 were paid on January 19, 2022 and charged to expense account of 2022

Upon inspection of the records of Eisenhower Company in connection to its financial statement audit for the year ended December 31, 2022, the following errors were revealed: A fire insurance premium of P 40,000 was paid and charged to insurance expense in 2021. This covers one year from April 1, 2021. Inventory at December 31, 2020 was understated by P 80,000. Inventory at December 31, 2021 was understated by P 120,000. • The year 2021 last quarter taxes amounting to P 60,000 were paid on January 19, 2022 and charged to expense account of 2022

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter22: Accounting For Changes And Errors.

Section: Chapter Questions

Problem 10MC: Shannon Corporation began operations on January 1, 2019. Financial statements for the years ended...

Related questions

Question

Transcribed Image Text:Upon inspection of the records of Eisenhower Company in connection to

its financial statement audit for the year ended December 31, 2022, the

following errors were revealed:

A fire insurance premium of P 40,000 was paid and charged to

insurance expense in 2021. This covers one year from April 1, 2021.

Inventory at December 31, 2020 was understated by P 80,000.

Inventory at December 31, 2021 was understated by P 120,000.

• The year 2021 last quarter taxes amounting to P 60,000 were paid

on January 19, 2022 and charged to expense account of 2022.

A cash advance of P 100,000 in payment of goods to be delivered in

January 2022 was received on December 15, 2021 and credited to

Sales.

• The gross profit on sales is 40%.

The net income for the year ended December 31, 2021 before any

adjustments is P 1,550,000.

O 1,550,000

O 1,200,000

O 1.440,000

O 1.600,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L…

Accounting

ISBN:

9781337619455

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Auditing: A Risk Based-Approach to Conducting a Q…

Accounting

ISBN:

9781305080577

Author:

Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:

South-Western College Pub

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College