Consolidated Industries is a diversified manufacturer with business units organized as divisions, including the Reigis Steel Division. Consolidated monitors its divisions on the basis of both unit contribution and return on investment (ROI), with investment defined as average operating assets employed. All investments in operating assets are expected to earn a minimum return of 12% before income taxes. Reigis's cost of goods sold is considered to be entirely variable; however, its administrative expenses do not depend on volume. Selling expenses are a mixed cost with one-third attributed to sales volume. The 2022 operating statement for Reigis follows. The division's operating assets employed were $348,750,000 at November 30, 2022, unchanged from the year before. REIGIS STEEL DIVISION Operating Statement For the Year Ended November 30, 2022 (000s omitted) Sales revenue $ 196,000 Less expenses: Cost of goods sold Administrative expenses Selling expenses $ 101,950 20,000 17,100 139,050 Income from operations, before tax $ 56,950 Required: 1. Calculate Reigis Steel Division's unit contribution if it produced and sold 3,100,000 units during the year ended November 30, 2022. (Round your answer to 2 decimal places.) 2. Calculate the following performance measures for 2022 for Reigis: a. Pretax ROI, based on average operating assets employed. (Round your answer to 2 decimal places.) b. Residual income (RI), calculated on the basis of average operating assets employed. (Enter your answer in whole dollars, not in thousands.) 1. Contribution margin per unit 2a. Return on investment % 2b. Residual income

Consolidated Industries is a diversified manufacturer with business units organized as divisions, including the Reigis Steel Division. Consolidated monitors its divisions on the basis of both unit contribution and return on investment (ROI), with investment defined as average operating assets employed. All investments in operating assets are expected to earn a minimum return of 12% before income taxes. Reigis's cost of goods sold is considered to be entirely variable; however, its administrative expenses do not depend on volume. Selling expenses are a mixed cost with one-third attributed to sales volume. The 2022 operating statement for Reigis follows. The division's operating assets employed were $348,750,000 at November 30, 2022, unchanged from the year before. REIGIS STEEL DIVISION Operating Statement For the Year Ended November 30, 2022 (000s omitted) Sales revenue $ 196,000 Less expenses: Cost of goods sold Administrative expenses Selling expenses $ 101,950 20,000 17,100 139,050 Income from operations, before tax $ 56,950 Required: 1. Calculate Reigis Steel Division's unit contribution if it produced and sold 3,100,000 units during the year ended November 30, 2022. (Round your answer to 2 decimal places.) 2. Calculate the following performance measures for 2022 for Reigis: a. Pretax ROI, based on average operating assets employed. (Round your answer to 2 decimal places.) b. Residual income (RI), calculated on the basis of average operating assets employed. (Enter your answer in whole dollars, not in thousands.) 1. Contribution margin per unit 2a. Return on investment % 2b. Residual income

Financial And Managerial Accounting

15th Edition

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:WARREN, Carl S.

Chapter24: Evaluating Decentralized Operations

Section: Chapter Questions

Problem 8E: Rocky Mountain Airlines Inc. has two divisions organized as profit centers, the Passenger Division...

Related questions

Question

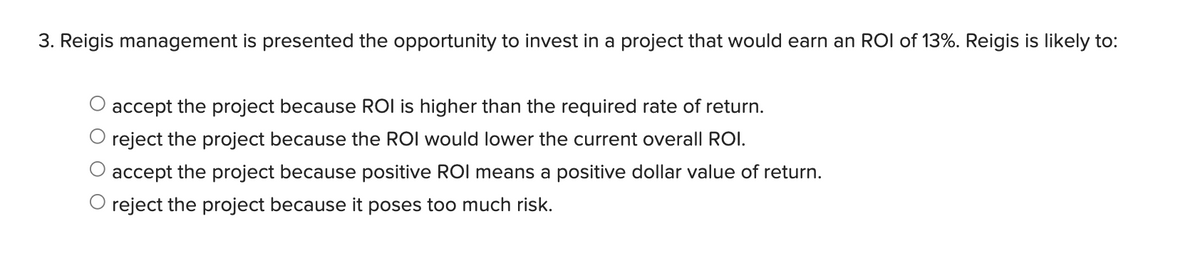

Transcribed Image Text:3. Reigis management is presented the opportunity to invest in a project that would earn an ROI of 13%. Reigis is likely to:

accept the project because ROI is higher than the required rate of return.

O reject the project because the ROI would lower the current overall ROI.

O accept the project because positive ROl means a positive dollar value of return.

O reject the project because it poses too much risk.

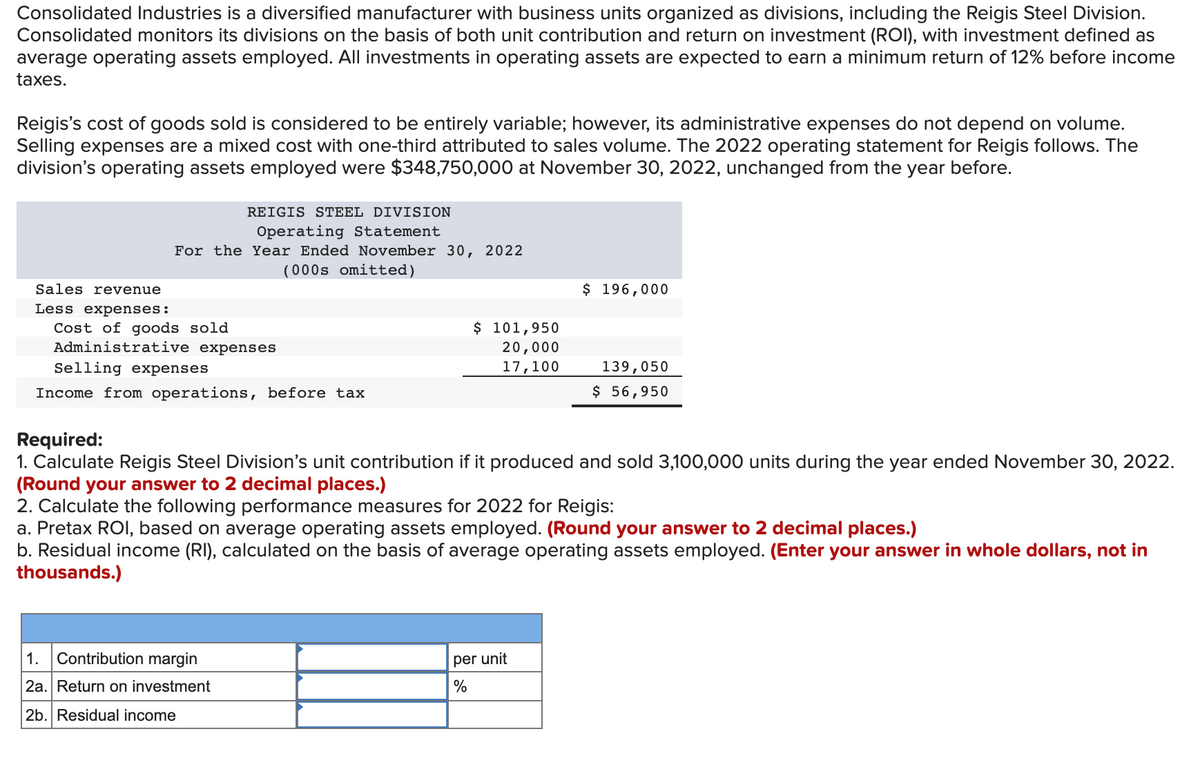

Transcribed Image Text:Consolidated Industries is a diversified manufacturer with business units organized as divisions, including the Reigis Steel Division.

Consolidated monitors its divisions on the basis of both unit contribution and return on investment (ROI), with investment defined as

average operating assets employed. All investments in operating assets are expected to earn a minimum return of 12% before income

taxes.

Reigis's cost of goods sold is considered to be entirely variable; however, its administrative expenses do not depend on volume.

Selling expenses are a mixed cost with one-third attributed to sales volume. The 2022 operating statement for Reigis follows. The

division's operating assets employed were $348,750,000 at November 30, 2022, unchanged from the year before.

REIGIS STEEL DIVISION

Operating Statement

For the Year Ended November 30, 2022

(000s omitted)

Sales revenue

$ 196,000

Less expenses:

$ 101,950

Cost of goods sold

Administrative expenses

20,000

Selling expenses

139,050

$ 56,950

17,100

Income from operations, before tax

Required:

1. Calculate Reigis Steel Division's unit contribution if it produced and sold 3,100,000 units during the year ended November 30, 2022.

(Round your answer to 2 decimal places.)

2. Calculate the following performance measures for 2022 for Reigis:

a. Pretax ROI, based on average operating assets employed. (Round your answer to 2 decimal places.)

b. Residual income (RI), calculated on the basis of average operating assets employed. (Enter your answer in whole dollars, not in

thousands.)

1. Contribution margin

per unit

2a. Return on investment

%

2b. Residual income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning