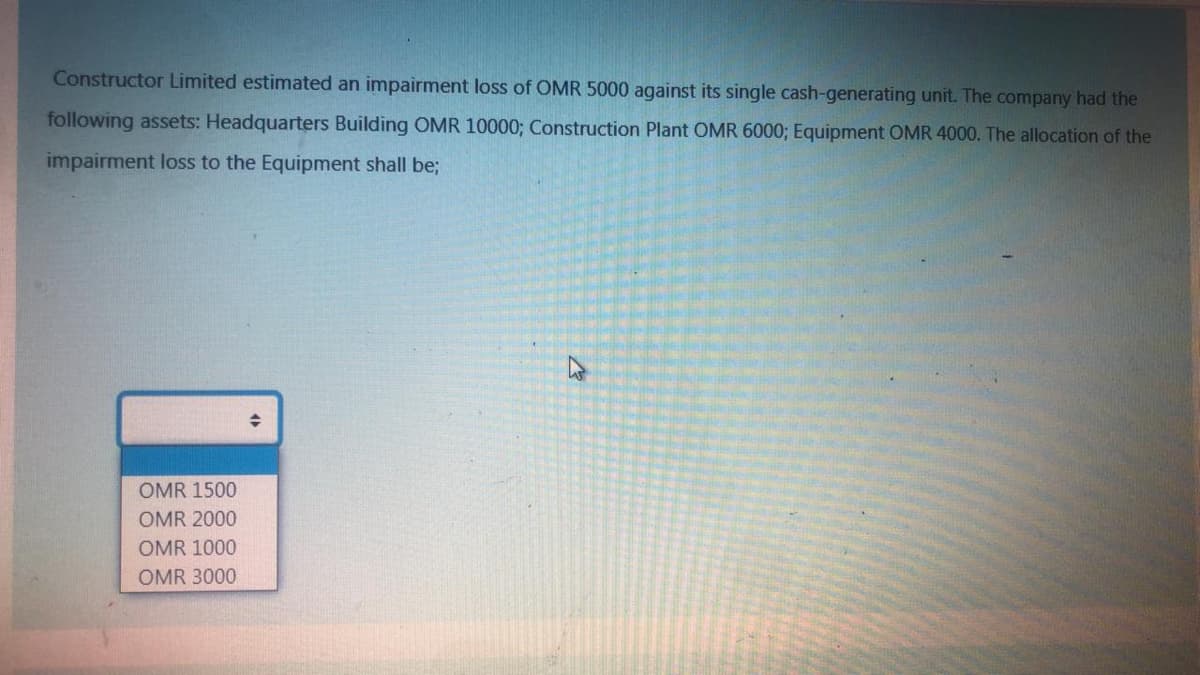

Constructor Limited estimated an impairment loss of OMR 5000 against its single cash-generating unit. The company had the following assets: Headquarters Building OMR 10000; Construction Plant OMR 6000; Equipment OMR 4000. The allocation of the impairment loss to the Equipment shall be; OMR 1500 OMR 2000 OMR 1000 OMR 3000

Q: An item of Plant and equipment is carried under the revaluation model and at the reporting date, the…

A: Given that, Cost = $653 million Fair value of asset = $498 million Accumulated depreciation = $178…

Q: Finsbury Co has a cash generating unit (CGU) that suffers a large drop in income due to reduced…

A: Answer- Step 1 - Calculation of Total impairment Loss - Carrying Cost of Assets…

Q: Jurassic Company owns equipment that cost $900,000 and has accumulated depreciation of $380,000. The…

A: Calculate the amount of impairment loss:

Q: An analyst is studying the impairment of the manufacturing equipment of WLP Corp.,a U.K.-based…

A: The impairment occurs for the assets due to change in legal condition, or change market value of the…

Q: Blanket Corporation sold equipment for cash of $41,000. Accumulated depreciation on the sale date…

A: Depreciation: It is a decrease in the value of the asset due to its normal usage over a specified…

Q: Celina Company incurred the following research and developments costs in the current year:…

A: Research and Development Expense: Direct expenditures pertaining to a company's efforts to create,…

Q: Silver Company operates a production line which is treated as a cash generating unit for impairment…

A: Impairment of assets is done for the purpose of ensuring that the value of assets should not be more…

Q: Garden Co has determined that its soil and peat moss CGU is impaired by $360,000 due to erosion.…

A: Impairment loss is the decrease in the recoverable amount from carrying amount. If the recoverable…

Q: Weird Co. uses straight-line depreciation for its property, plant, and equipment, which, stated at…

A: Depreciation means the loss in value of assets because of usage of assets , passage of time or…

Q: On January 1, 2021, Brandy Company owned a group of machines with the following aggregate cost and…

A: Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts…

Q: Leon Corporation incurred the following costs in 2021: Acquisition of R&D equipment with a useful…

A: Research and developement expenses are expenses related with making research and then developing new…

Q: Assume that Sohar Aluminium Company purchased a machinery for OMR 2000 and spent OMR200 for its…

A: Formula: Total cost of machinery = Machinery purchase price + Tax + Transportation cost +insurance…

Q: Bovine Ltd. has the following assets in a CGU: Carrying Value (thousands)Equipment $ 600 Building…

A: Introduction: Impairment loss: The amount by which the carrying amount of an asset or…

Q: Coronado Landscaping Limited has determined that its lawn maintenance division is a cash-generating…

A: Impairment of assets is the test done by the management to get assures that the assets do not…

Q: Factor Company’s cash generating unit has been assessed for impairment and it has been determined…

A: Impairment loss = 240,000 Carrying value: Building = 6,000,000 Land = 3,500,000 Equipment =…

Q: The t accounts for equipment and the related accumulated depreciation-equipment for Goldstone Co. at…

A: The cash flow statement shows the cash inflow and cash outflow due to the operating activities,…

Q: layna Ltd bought a machine on 1 January 20X2 for GHS 70,000. The useful life of this machine was…

A: Deprecation is the decrease in value of the asset due to wear, tear and obsolescence. An impaired…

Q: The company provided the data of PP&E in a cash-generating unit (CGU) as follows: Cost…

A: In accordance with IAS 36 " Impairment of Assets", if the Recoverable amount of an asset is lesser…

Q: Natraj Limited recognized an impairment loss of OMR 200 against a cash-generating containing the…

A: Impairment loss is the amount by which the carrying amount of an asset or cash - generating unit…

Q: Phoenix Co. acquired a large piece of specialized machinery used in its manufacturing process. The…

A: "Speeding ticket during transportation and cost incurred to repair a damaged door during…

Q: On 1 July 2019, it is discovered that the damage to the machine is worse than originally thought.…

A: The Impairment Loss = $1,085,000 – $950,000 = $135,000 is to be allocated: First, $35,000 will be…

Q: A machine with a cost of $164,000 and accumulated depreciation of $102,000 is sold for $53,600 cash.…

A: Lets understand the basics. Cashflow are divided into three parts which are, (1) Cashflow from…

Q: On December 31, 2022, Joshua Company had an equipment with cost of P9,000,000 and accumulated…

A: Lets understand the basics. As per IAS 36 "Impairment loss", impairment loss arise when recoverable…

Q: nge an old equipment for a new equipment.The cost and accumulated depreciation of the old equipment…

A: The adjusted net asset method is a business valuation strategy that modifies a company's reported…

Q: ABC has determined that one of its cash generating units (CGU) is impaired. The assets of the CGU at…

A: As per IAS -36 ( Impairment of assets ) cash-generating units are the smallest identifiable assets…

Q: Factor Company’s cash generating unit has been assessed for impairment and it has been determined…

A: As per IAS 36 The impairment of cgu to be first write of to Goodwill and then to other applicable…

Q: Jurassic Company owns machinery that cost $900,000 and has accumulated depreciation of $380,000. The…

A:

Q: The Cello Co. is considering whether according to IAS 36 - 'Impairment of Assets', any impairment…

A: Impairment loss = Carrying value of the assets - Recoverable value of the assets where, Recoverable…

Q: oronado Landscaping Limited has determined that its lawn maintenance division is a cash-generating…

A: Impairment loss: It is the loss that happen when the carrying amount of the asset exceeds its…

Q: Ermon Company determined that its electronics division is a cash generating unit. The entity…

A: Impairment loss is the loss in the value of asset Impairment loss = Book Value - Fair market Value…

Q: On January 1, 20x1, DEVIOUS CROOKED Co. purchased the following assets and decided to depreciate…

A: Introduction: Under composite depreciation method, different assets with different life are…

Q: INSTIGATE PROVOKE Co. determined that one of its cash-generating units is impaired. Information on…

A: IAS 36 "Impairment of asset" deals with the concept of cash generating unit and impairment loss.…

Q: On 1/1/X2, Hudson Enterprises decided to sell equipment it had been using in its business for…

A: The depreciation is charged on asset so at to reduce the book value of fixed asset with passage of…

Q: Sunnyskies Ltd is an Australian business that manufactures solar panels for domestic use.

A: Impairement loss is the reduction in the market value of assets…

Q: In December 2005, SHOWEE Company exchanged an old machine, with a cost P6,000,000 and 50%…

A: Here discuss about the details of exchange of machinery which can be incurred the exchange price…

Q: Factor Company’s cash generating unit has been assessed for impairment and it has been determined…

A: Asset impairment emerges when there is an abrupt drop in the fair value of an asset underneath its…

Q: Synthia, Inc., a clothing manufacturer, purchased a sewing machine for P10,000 on July 1, 20x1. The…

A: Impairment loss is incorrect because it is calculated when the fair value of any asset (or…

Q: Factor Company’s cash generating unit has been assessed for impairment and it has been determined…

A: The question is multiple choice question Required Choose the Correct Option.

Q: An entity acquired a machine and incurred the following costs: Cash paid for machine, including VAT…

A: Assets: Assets are the resources of an organization used in the business operations to generate…

Q: Factor Company's cash generating unit has been assessed for impairment and it has been determined…

A: The impairment loss is allocated to assets based on the proportion of their carrying amount. The…

Q: On January 1, 2014, Elite Company purchased equipment with a cost of P11,000,000, useful life of 10…

A: Fixed assets are those assets which are held by the business for longer period of time. For example,…

Q: An asset group is being evaluated for an impairment loss. The following financial information is…

A: In accounting terms impairment loss deals with assets impairment where impaired value was duly…

Q: The net assets of Fyngle, a cash generating unit (CGU) are: $ Property, plant and equipment…

A: We have the following information: Fyngle has a recoverable amount of only $200,000

Q: Toro Co. has equipment with a carrying amount of $700,000. The value-in-use of the equipment is…

A: Generally Accepted Accounting Principles (GAAP): These are the guidelines necessary to create…

Step by step

Solved in 2 steps

- Shine Ltd estimated an impairment loss of $10,000 against its single cash-generating unit. The company had the following assets: headquarters building $129573; plant $81501; goodwill $14190. The net carrying amount of the plant after allocation of the impairment loss is: A. 81501 B. 3618 C. 3861 D. None of theseFactor Company’s cash generating unit has been assessed for impairment and it has been determined that the unit has incurred an impairment loss of P240,000. The carrying amounts of the assets were as follows: Building P6,000,000; Land P3,500,000; Equipment P2,000,000; Vehicles P2,500,000. The cash generating unit has not recorded goodwill. If the fair value less cost to sell of the building is P5,960,000, what amount of impairment should be allocated to the equipment? * P34,286 P50,000 P62,500 P87,500Natraj Limited recognized an impairment loss of OMR 200 against a cash-generating containing the following assets: Mine buildings OMR 500; Roads OMR 300; Crushing equipment OMR 700. The net carrying amount of the Roads after allocation of the impairment loss is: a- OMR 300 b- None of them c- OMR 100 d- OMR 260

- The company provided the data of PP&E in a cash-generating unit (CGU) as follows: Cost Accumulated Depreciation Equipment A $ 15,000 $ 8,000 Equipment B 30,000 19,000 Equipment C 45,000 23,000 The unit’s fair value less costs to sell was $25,000. The unit’s future cash flows was $32,000, and its present value was $28,000. The company adopted IFRS. Prepare journal entries to record impairment. If the recoverable amount of Equipment C is $19,000, prepare journal entries to record impairment. If the recoverable amount of Equipment C is $24,000, prepare journal entries to record impairment.Factor Company’s cash generating unit has been assessed for impairment and it has been determined that the unit has incurred an impairment loss of P240,000. The carrying amounts of the assets were as follows: Building P6,000,000; Land P3,500,000; Equipment P2,000,000; Vehicles P2,500,000. The cash generating unit has not recorded goodwill. How much of impairment loss should be allocated to the building? * P50,000 P62,500 P87,500 P102,857In 2009, Cilla Company acquired production machinery at a cost of $420,000, which now has accumulated depreciation of $230,000. The sum of undiscounted future cash flows from use of the machinery is $150,000 and its fair value is $164,000. What amount should Cilla recognize as a loss on impairment? Group of answer choices $0 $66,000 $40,000 $26,000

- Jurassic Company owns equipment that cost $900,000 and has accumulated depreciation of $380,000. The expected future net cash flows from the use of the asset are expected to be $500,000. The fair value of the equipment is $400,000. Prepare the journal entry, if any, to record the impairment loss.ABC has determined that one of its cash generating units (CGU) is impaired. The assets of the CGU at their book value are: Land – 4,000,000; Factory – 1,200,000; Machinery and Equipment – 1,800,000. The value in use of the cash generating unit is P5,500,000. The impairment loss allocated to Machinery and Equipment is? (do not round off the percentage, round off your final answer to the nearest peso)Diva Ltd has an item of equipment with a carrying amount of $110000 (cost $150000 less accumulated depreciation $40000). the following data has been obtained by Diva in relation to the asset; estimated fair value of the asset less costs of disposal - $90,000 present value of future cash flows expected to be derived from the asset $70000 To account for the impairment loss, the accountant for Diva is considering a number of accounting entries. In accordance with IAS 16 Property, Plant and Equipment and IAS 36 impairment of assets, which one of the following entries is made to recognise the impairment loss?

- The following information is available relating to a cash generating unit belonging to Bliss plc: £m Building 60 Plant and Equipment 12 Goodwill 20 Current Assets 40 132 Following an industrial accident, it has been determined that the recoverable amount of the cash generating unit to be £100m. The current assets are already at their recoverable amount. Determine the impairment loss relating to this Cash Generating Unit. Allocate the impairment loss to the cash generating unit, and show the value of each of the assets listed above once the impairment loss has been allocated.Cake Company determined as a result of a plant re-arrangement that there had been a significant change in the manner in which a machinery was going to be used in manufacturing process. Estimated cash inflows from the use of the machinery-P1,750,000 Estimated cash outflows from the use of the machinery-P375,000 Estimated residual value of the machinery at the end of its useful life-P250,000 Estimated income tax payments-P100,000 What total amount should be included as future cash flows in determining the machinery's value in use?Presented below is information related to Wolfie Corp.’s equipment on 12/31/2022: Description Amount Capitalized cost $900,000 Accumulated depreciation to date 750,000 Estimated residual value 40,000 Expected future cash flows 125,000 Estimated Fair value 100,000 The amount of the impairment loss, if any, that Wolfie Corp. should record on 12/31/22 is: $45,000 $50,000 $10,000 $20,000 $25,000 There is no impairment.