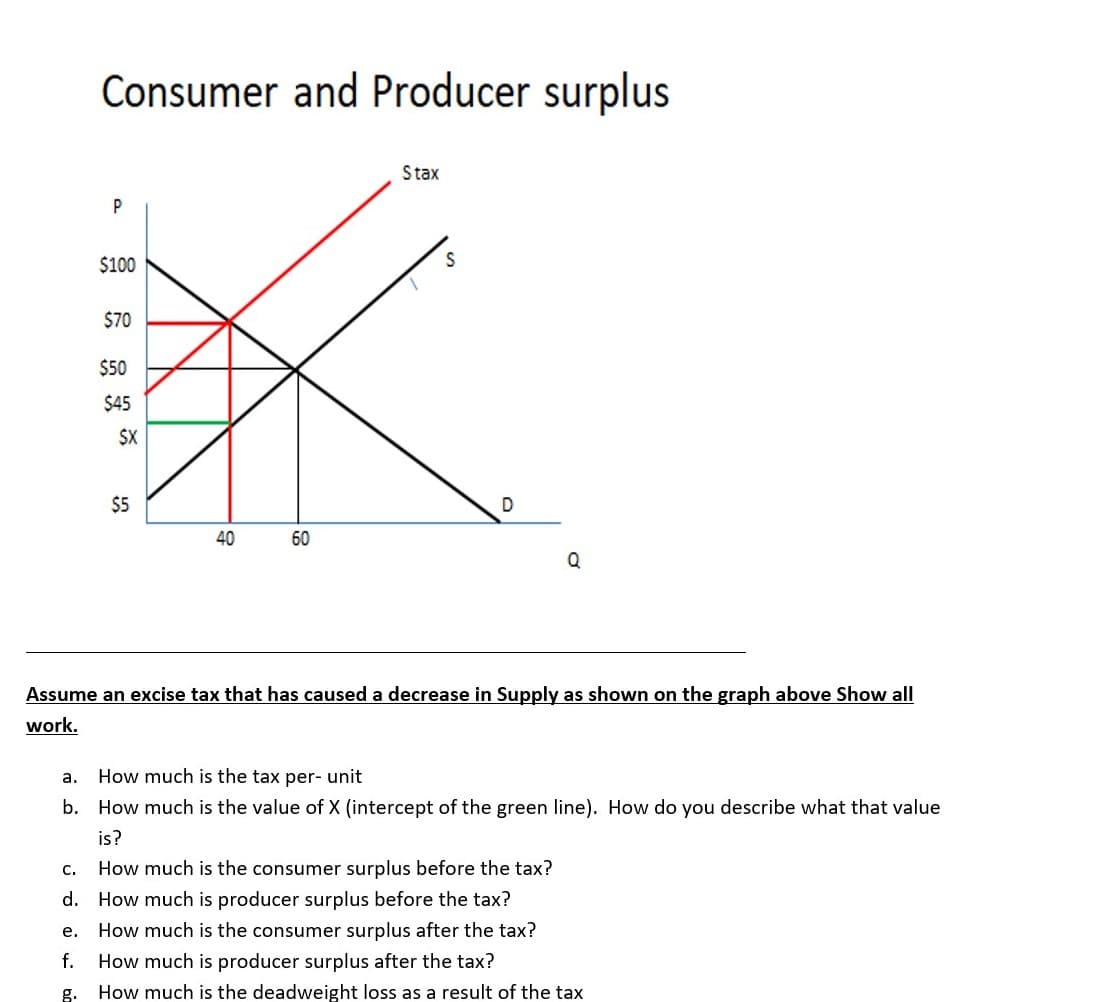

Consumer and Producer surplus Stax P $100 $70 $50 $45 $X $5 40 60 Q Assume an excise tax that has caused a decrease in Supply as shown on the graph above Sho work. a. How much is the tax per- unit b. How much is the value of X (intercept of the green line). How do you describe what th is? c. How much is the consumer surplus before the tax?

Consumer and Producer surplus Stax P $100 $70 $50 $45 $X $5 40 60 Q Assume an excise tax that has caused a decrease in Supply as shown on the graph above Sho work. a. How much is the tax per- unit b. How much is the value of X (intercept of the green line). How do you describe what th is? c. How much is the consumer surplus before the tax?

Principles of Macroeconomics (MindTap Course List)

8th Edition

ISBN:9781305971509

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter7: Consumers, Producers, And The Efficiency Of Markets

Section: Chapter Questions

Problem 6PA

Related questions

Question

All questions need answering for the second question (the picture without the graph) . Old Equilibrium is on the page with graph

Transcribed Image Text:Consumer and Producer surplus

Stax

P

$100

$70

$50

$45

$X

$5

D

40

60

Assume an excise tax that has caused a decrease in Supply as shown on the graph above Show all

work.

а.

How much is the tax per- unit

b. How much is the value of X (intercept of the green line). How do you describe what that value

is?

C.

How much is the consumer surplus before the tax?

d. How much is producer surplus before the tax?

е.

How much is the consumer surplus after the tax?

f.

How much is producer surplus after the tax?

g.

How much is the deadweight loss as a result of the tax

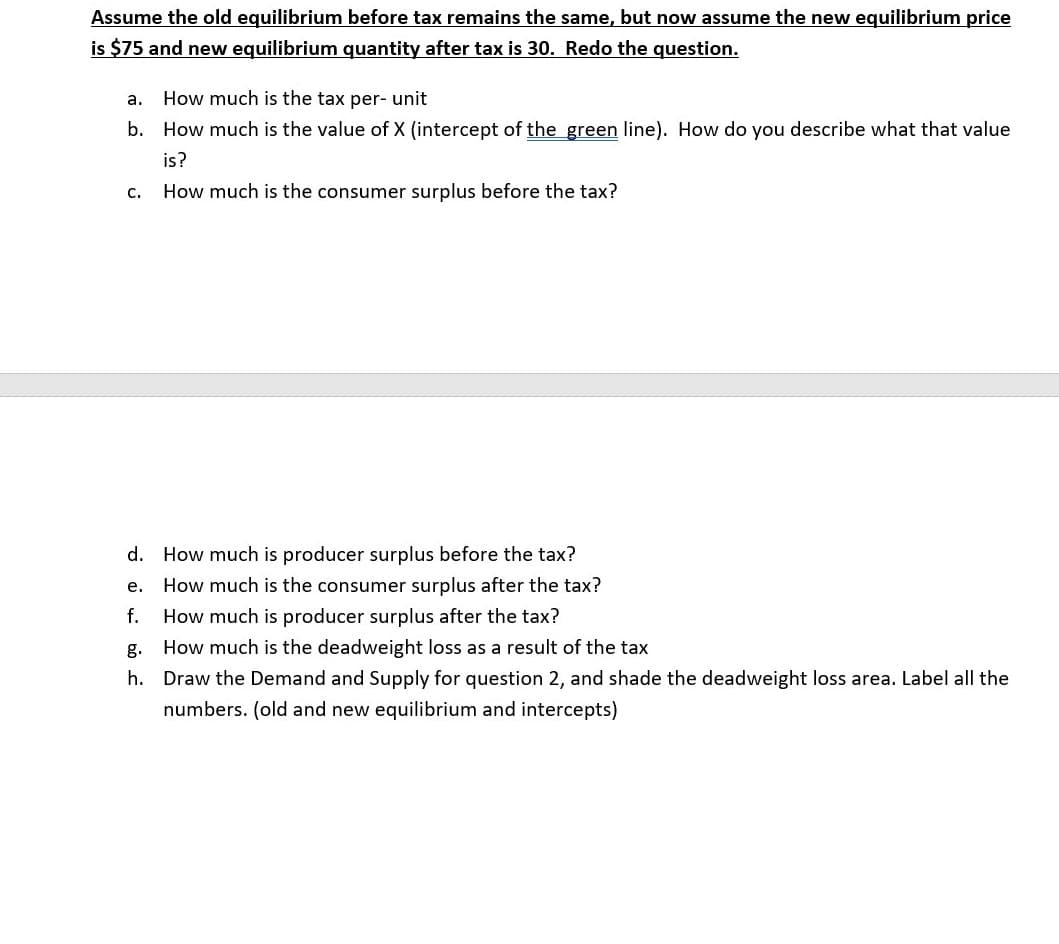

Transcribed Image Text:Assume the old equilibrium before tax remains the same, but now assume the new equilibrium price

is $75 and new equilibrium quantity after tax is 30. Redo the question.

a. How much is the tax per- unit

b. How much is the value of X (intercept of the green line). How do you describe what that value

is?

c.

How much is the consumer surplus before the tax?

d. How much is producer surplus before the tax?

e. How much is the consumer surplus after the tax?

f.

How much is producer surplus after the tax?

g.

How much is the deadweight loss as a result of the tax

h. Draw the Demand and Supply for question 2, and shade the deadweight loss area. Label all the

numbers. (old and new equilibrium and intercepts)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781305971509

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning