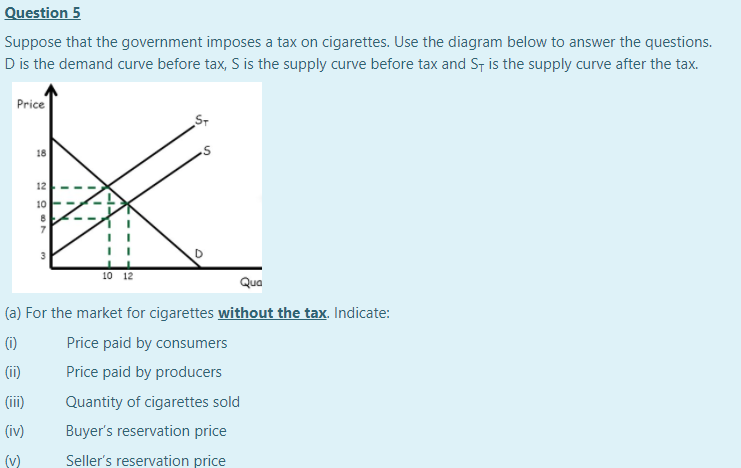

Question 5 Suppose that the government imposes a tax on cigarettes. Use the diagram below to answer the qu D is the demand curve before tax, S is the supply curve before tax and St is the supply curve after th Price 18 12 10 10 12 Qua (a) For the market for cigarettes without the tax, Indicate: (i) Price paid by consumers (ii) Price paid by producers (ii) Quantity of cigarettes sold

Question 5 Suppose that the government imposes a tax on cigarettes. Use the diagram below to answer the qu D is the demand curve before tax, S is the supply curve before tax and St is the supply curve after th Price 18 12 10 10 12 Qua (a) For the market for cigarettes without the tax, Indicate: (i) Price paid by consumers (ii) Price paid by producers (ii) Quantity of cigarettes sold

Principles of Microeconomics

7th Edition

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:N. Gregory Mankiw

Chapter6: Supply, Demand And Government Policies

Section: Chapter Questions

Problem 10PA

Related questions

Question

Transcribed Image Text:Question 5

Suppose that the government imposes a tax on cigarettes. Use the diagram below to answer the questions.

D is the demand curve before tax, S is the supply curve before tax and St is the supply curve after the tax.

Price

18

12

10

7

10 12

Qua

(a) For the market for cigarettes without the tax. Indicate:

(i)

Price paid by consumers

(ii)

Price paid by producers

(ii)

Quantity of cigarettes sold

(iv)

Buyer's reservation price

(v)

Seller's reservation price

Transcribed Image Text:(b) Calculate the consumer surplus before the tax.

Answer:

(c) Calculate the producer surplus before the tax.

Answer:

(d) For the market for cigarettes with the tax. Indicate:

(i)

the tax

(ii)

Price paid by consumers

(ii)

Price received by producers

(iv)

Quantity of cigarettes sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Recommended textbooks for you

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics

Economics

ISBN:

9781305156050

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Microeconomics (MindTap Course List)

Economics

ISBN:

9781305971493

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Principles of Macroeconomics (MindTap Course List)

Economics

ISBN:

9781285165912

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Essentials of Economics (MindTap Course List)

Economics

ISBN:

9781337091992

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning