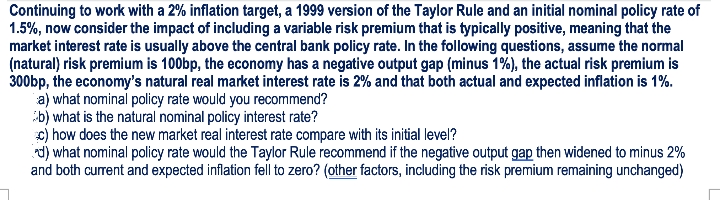

Continuing to work with a 2% inflation target, a 1999 version of the Taylor Rule and an initial nominal policy rate of 1.5%, now consider the impact of including a variable risk premium that is typically positive, meaning that the market interest rate is usually above the central bank policy rate. In the following questions, assume the normal (natural) risk premium is 100bp, the economy has a negative output gap (minus 1%), the actual risk premium is 300bp, the economy's natural real market interest rate is 2% and that both actual and expected inflation is 1%.

Continuing to work with a 2% inflation target, a 1999 version of the Taylor Rule and an initial nominal policy rate of 1.5%, now consider the impact of including a variable risk premium that is typically positive, meaning that the market interest rate is usually above the central bank policy rate. In the following questions, assume the normal (natural) risk premium is 100bp, the economy has a negative output gap (minus 1%), the actual risk premium is 300bp, the economy's natural real market interest rate is 2% and that both actual and expected inflation is 1%.

Economics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter15: Macroeconomic Policy, Economic Stability, And The Federal Debt

Section: Chapter Questions

Problem 6CQ

Related questions

Question

Transcribed Image Text:Continuing to work with a 2% inflation target, a 1999 version of the Taylor Rule and an initial nominal policy rate of

1.5%, now consider the impact of including a variable risk premium that is typically positive, meaning that the

market interest rate is usually above the central bank policy rate. In the following questions, assume the normal

(natural) risk premium is 100bp, the economy has a negative output gap (minus 1%), the actual risk premium is

300bp, the economy's natural real market interest rate is 2% and that both actual and expected inflation is 1%.

a) what nominal policy rate would you recommend?

b) what is the natural nominal policy interest rate?

c) how does the new market real interest rate compare with its initial level?

t) what nominal policy rate would the Taylor Rule recommend if the negative output gap then widened to minus 2%

and both current and expected inflation fell to zero? (other factors, including the risk premium remaining unchanged)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Macroeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506756

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning