Use the data in the following table to calculate the refinancing rate (1) using the Taylor rule, and fill in the last cell in table. Variable Value Equilibrium real refinancing rate (;*) 2% Four-quarter average inflation (x) 2% Inflation target (T) 1% Output (Y) Potential output (Y*) 11.5 12 Weight on the output gap (w1) Weight on the inflation gap (w2) 0.5 0.5 Refinancing rate (i) Suppose that the equilibrium real refinancing rate (r*) is 1% instead of 2%. Based on the Taylor rule and assuming everything else remains the same, how would this change the refinancing rate (i) you calculated in the previous question? The central bank should set the refinancing rate at 1.42%. The central bank should set the refinancing rate at -0.58%. For every percentage point lower the equilibrium real refinancing rate goes, the nominal refinancing rate should be 1 percentage point higher. Suppose the inflation rate over the last four quarters has been 3% instead of 2%. Assuming everything else is the same, what policy would the Taylor rule recommend? O Conservative policy O Tighter policy O Easier policy

Use the data in the following table to calculate the refinancing rate (1) using the Taylor rule, and fill in the last cell in table. Variable Value Equilibrium real refinancing rate (;*) 2% Four-quarter average inflation (x) 2% Inflation target (T) 1% Output (Y) Potential output (Y*) 11.5 12 Weight on the output gap (w1) Weight on the inflation gap (w2) 0.5 0.5 Refinancing rate (i) Suppose that the equilibrium real refinancing rate (r*) is 1% instead of 2%. Based on the Taylor rule and assuming everything else remains the same, how would this change the refinancing rate (i) you calculated in the previous question? The central bank should set the refinancing rate at 1.42%. The central bank should set the refinancing rate at -0.58%. For every percentage point lower the equilibrium real refinancing rate goes, the nominal refinancing rate should be 1 percentage point higher. Suppose the inflation rate over the last four quarters has been 3% instead of 2%. Assuming everything else is the same, what policy would the Taylor rule recommend? O Conservative policy O Tighter policy O Easier policy

Chapter1: Making Economics Decisions

Section: Chapter Questions

Problem 1QTC

Related questions

Question

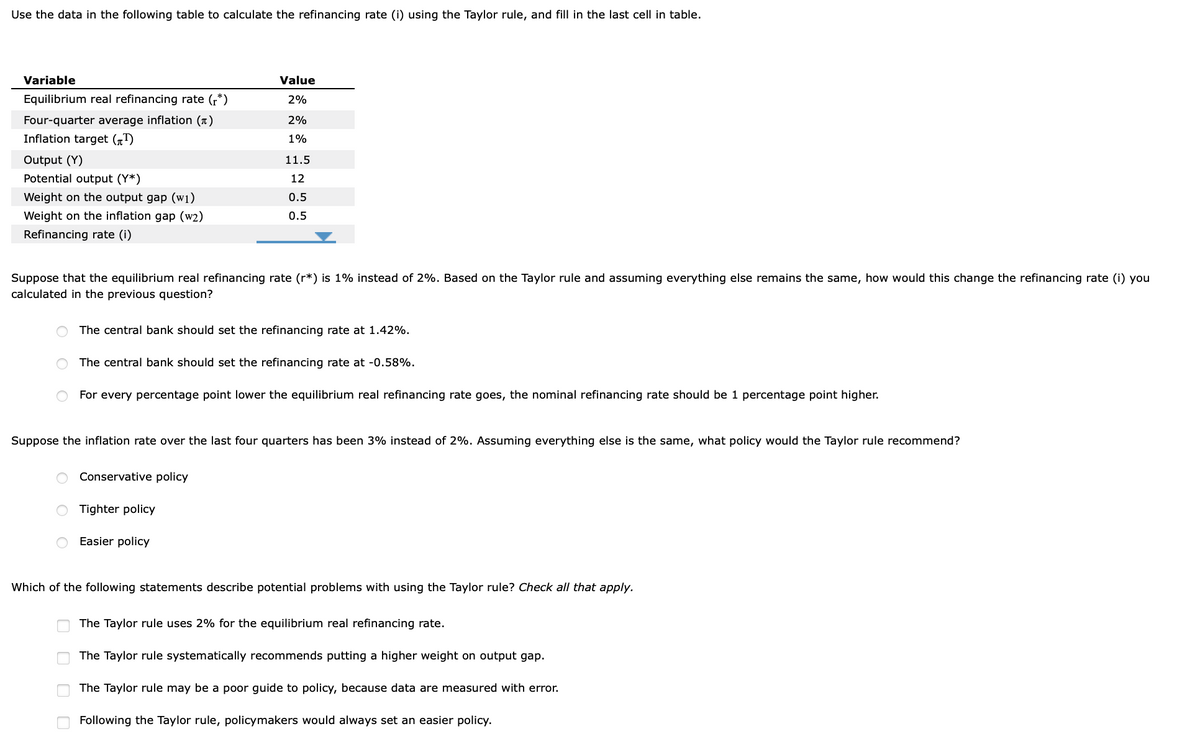

Transcribed Image Text:Use the data in the following table to calculate the refinancing rate (i) using the Taylor rule, and fill in the last cell in table.

Variable

Value

Equilibrium real refinancing rate (r*)

2%

Four-quarter average inflation (1)

Inflation target („T)

2%

1%

Output (Y)

11.5

Potential output (Y*)

12

Weight on the output gap (w1)

0.5

Weight on the inflation gap (w2)

0.5

Refinancing rate (i)

Suppose that the equilibrium real refinancing rate (r*) is 1% instead of 2%. Based on the Taylor rule and assuming everything else remains the same, how would this change the refinancing rate (i) you

calculated in the previous question?

The central bank should set the refinancing rate at 1.42%.

The central bank should set the refinancing rate at -0.58%.

For every percentage point lower the equilibrium real refinancing rate goes, the nominal refinancing rate should be 1 percentage point higher.

Suppose the inflation rate over the last four quarters has been 3% instead of 2%. Assuming everything else is the same, what policy would the Taylor rule recommend?

Conservative policy

Tighter policy

O Easier policy

Which of the following statements describe potential problems with using the Taylor rule? Check all that apply.

The Taylor rule uses 2% for the equilibrium real refinancing rate.

The Taylor rule systematically recommends putting a higher weight on output gap.

The Taylor rule may be a poor guide to policy, because data are measured with error.

Following the Taylor rule, policymakers would always set an easier policy.

O O

O O

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (12th Edition)

Economics

ISBN:

9780134078779

Author:

Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:

PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:

9780134870069

Author:

William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:

PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:

9781305585126

Author:

N. Gregory Mankiw

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-…

Economics

ISBN:

9781259290619

Author:

Michael Baye, Jeff Prince

Publisher:

McGraw-Hill Education