Cost indeXes are as 2021 Cost Retail Cost $105,400 $170,000 430,000 2,900 6,200 inning inventory chases 622,000 4,000 $630,C 2,6 6,0 chase returns ight-in markups markdowns 5,150 4,150 500,000 14,400 1,900 sales to customers es to employees (net of 20% discount) mal spoilage ce Index: anuary 1, 2021 1.00

Cost indeXes are as 2021 Cost Retail Cost $105,400 $170,000 430,000 2,900 6,200 inning inventory chases 622,000 4,000 $630,C 2,6 6,0 chase returns ight-in markups markdowns 5,150 4,150 500,000 14,400 1,900 sales to customers es to employees (net of 20% discount) mal spoilage ce Index: anuary 1, 2021 1.00

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter7: Inventories: Cost Measurement And Flow Assumptions

Section: Chapter Questions

Problem 5MC: The moving average inventory cost flow assumption is applicable to which of the following inventory...

Related questions

Question

Transcribed Image Text:and cost indexes for 2021 and 2022 are as follows:

2021

2022

Cost

Retail

Cost

Retail

$105,400 $170,000

430,000

2,900

6,200

Beginning inventory

622,000

4,000

$630,000 $792,000

2,600

6,000

Purchases

Purchase returns

2,450

Freight-in

Net markups

Net markdowns

5,150

4,150

500,000

14,400

1,900

8,600

6,400

690,000

14,400

5,300

Net sales to customers

Sales to employees (net of 20% discount)

Normal spoilage

Price Index:

January 1, 2021

December 31, 2021

December 31, 2022

1.00

1.04

1.20

Problem 9-13 (Algo) Part 1

Required:

1. Estimate the 2021 and 2022 ending inventory and cost of goods sold using the dollar-value LIFO retail method.

Answer is complete but not entirely correct.

2021

2022

Estimated ending inventory at retail

24

351,800 X $

483,400 X

Estimated ending inventory at cost

24

342,650 X $

645,590 X

Estimated cost of goods sold

24

502,983 X $

143,500 X

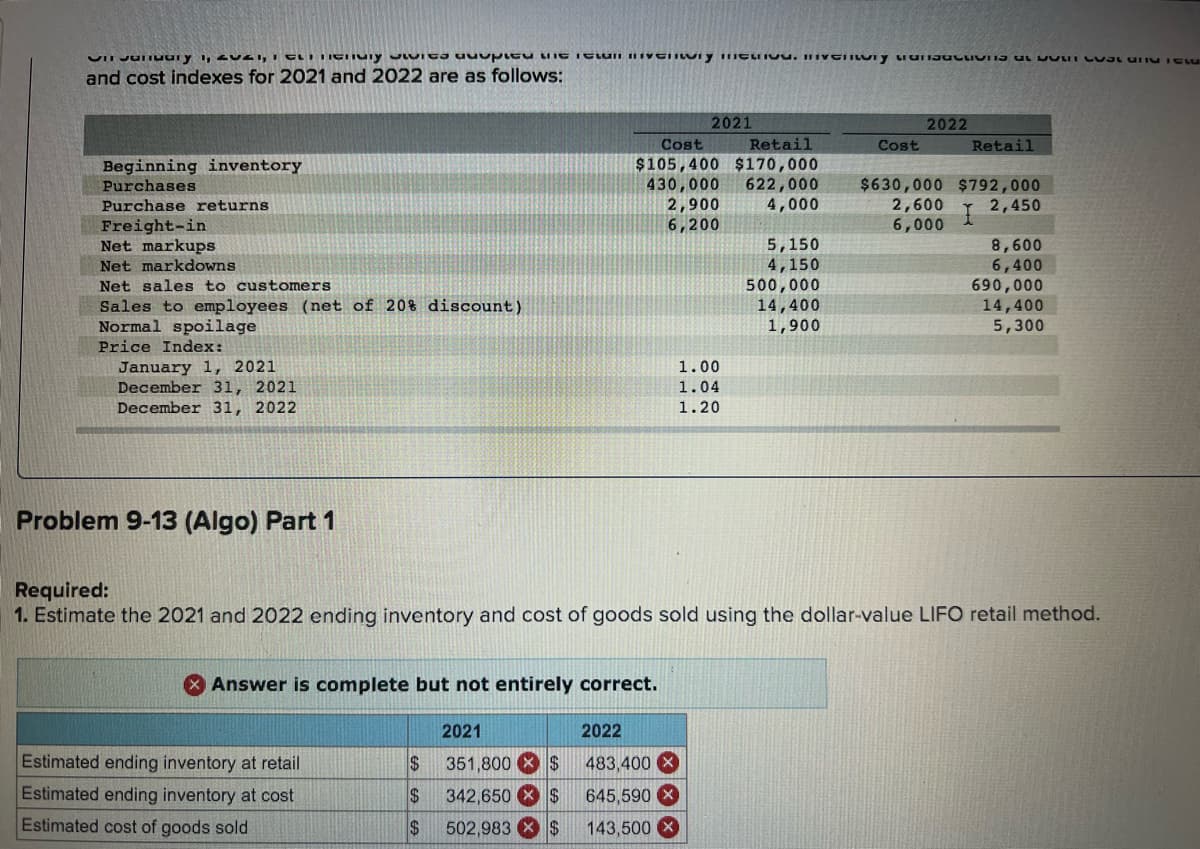

![Problem 9-13 (Algo) Retail inventory method; various applications [LO9-3, 9-4, 9-5]

[The following information applies to the questions displayed below.]

On January 1, 2021, Pet Friendly Stores adopted the retail inventory method. Inventory transactions at both cost and retail,

and cost indexes for 2021 and 2022 are as follows:

2022

Retail

2021

Cost

Retail

Cost

Beginning inventory

Purchases

$105,400 $170,000

430,000

2,900

6,200

$630,000 $792,000

2,600

6,000

622,000

4,000

Purchase returns

2,450

Freight-in

Net markups

Net markdowns

8,600

6,400

690,000

14,400

5,300

5,150

4,150

500,000

14,400

1,900

Net sales to customers

Sales to employees (net of 20% discount)

Normal spoilage

Price Index:

January 1, 2021

December 31, 2021

December 31, 2022

1.00

1.04

1.20

Problem 9-13 (Algo) Part 1

Required:

1. Estimate the 2021 and 2022 ending inventory and cost of goods sold using the dollar-value LIFO retail method.

X Answer is complete but not entirely correct.

2021

2022

Estimatedending inventory at retail

351.800 xS

483 400 X](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F3e1bfd6a-3cb6-4031-858f-4ba8da8545b1%2Fa3bc40fe-949b-4576-9ce1-7516624aa571%2F5875zl5_processed.jpeg&w=3840&q=75)

Transcribed Image Text:Problem 9-13 (Algo) Retail inventory method; various applications [LO9-3, 9-4, 9-5]

[The following information applies to the questions displayed below.]

On January 1, 2021, Pet Friendly Stores adopted the retail inventory method. Inventory transactions at both cost and retail,

and cost indexes for 2021 and 2022 are as follows:

2022

Retail

2021

Cost

Retail

Cost

Beginning inventory

Purchases

$105,400 $170,000

430,000

2,900

6,200

$630,000 $792,000

2,600

6,000

622,000

4,000

Purchase returns

2,450

Freight-in

Net markups

Net markdowns

8,600

6,400

690,000

14,400

5,300

5,150

4,150

500,000

14,400

1,900

Net sales to customers

Sales to employees (net of 20% discount)

Normal spoilage

Price Index:

January 1, 2021

December 31, 2021

December 31, 2022

1.00

1.04

1.20

Problem 9-13 (Algo) Part 1

Required:

1. Estimate the 2021 and 2022 ending inventory and cost of goods sold using the dollar-value LIFO retail method.

X Answer is complete but not entirely correct.

2021

2022

Estimatedending inventory at retail

351.800 xS

483 400 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning