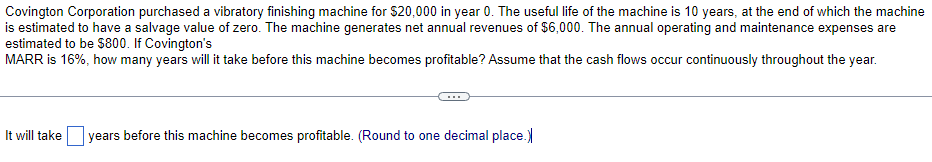

Covington Corporation purchased a vibratory finishing machine for $20,000 in year 0. The useful life of the machine is 10 years, at the end of which the machine is estimated to have a salvage value of zero. The machine generates net annual revenues of $6,000. The annual operating and maintenance expenses are estimated to be $800. If Covington's MARR is 16%, how many years will it take before this machine becomes profitable? Assume that the cash flows occur continuously throughout the year. It will take years before this machine becomes profitable. (Round to one decimal place.

Covington Corporation purchased a vibratory finishing machine for $20,000 in year 0. The useful life of the machine is 10 years, at the end of which the machine is estimated to have a salvage value of zero. The machine generates net annual revenues of $6,000. The annual operating and maintenance expenses are estimated to be $800. If Covington's MARR is 16%, how many years will it take before this machine becomes profitable? Assume that the cash flows occur continuously throughout the year. It will take years before this machine becomes profitable. (Round to one decimal place.

Managerial Economics: A Problem Solving Approach

5th Edition

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Chapter5: Investment Decisions: Look Ahead And Reason Back

Section: Chapter Questions

Problem 5.4IP

Related questions

Question

Transcribed Image Text:Covington Corporation purchased a vibratory finishing machine for $20,000 in year 0. The useful life of the machine is 10 years, at the end of which the machine

is estimated to have a salvage value of zero. The machine generates net annual revenues of $6,000. The annual operating and maintenance expenses are

estimated to be $800. If Covington's

MARR is 16%, how many years will it take before this machine becomes profitable? Assume that the cash flows occur continuously throughout the year.

It will take years before this machine becomes profitable. (Round to one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 3 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:

9781337106665

Author:

Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:

Cengage Learning