CPP 3-1 (#1) Calculate and Document Federal & State Income Tax Withholding Calculate federal and state income tax withholding for a number of employees of TCLH Industries, a manufacturer of cleaning products. Use the wage-bracket method when it is possible to do so, and use the percentage method in all other instances. Assume the state income tax withholding rate to be 5% of taxable pay (which is the same for federal and state income tax withholding). 1. Zachary Fox does not make any voluntary deductions that impact earnings subject to federal income tax withholding. He is married, files his tax return as married filing jointly, and his weekly gross pay was $1,162. When completing form W-4 Zachary checked box 2c, entered $2,000 in step 3 of the form, and left step 4 blank. 2. Calvin Bell makes a 401(k) retirement plan contribution of 6% of gross pay. He is single, claims two federal withholding allowances and one state withholding allowance, and his weekly gross pay was $417.93. 3. David Alexander makes a 401(k) retirement plan contribution of 12% of gross pay. He is single, claims one withholding allowance for both federal and state taxes, and his weekly gross pay was $4,050. 4. Michael Sierra contributes $50 to a flexible spending account each period. He is married, claims four federal withholding allowances and three state withholding allowances, and his weekly gross pay was $2,450. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. Publication 15-T (2020) 1: Zachary Fox Federal income tax withholding = $ State income tax withholding = $ 2: Calvin Bell Federal income tax withholding = $ State income tax withholding = $_ 3: David Alexander Federal income tax withholding = $ State income tax withholding = $ 4: Michael Sierra Federal income tax withholding = $ State income tax withholding = $

CPP 3-1 (#1) Calculate and Document Federal & State Income Tax Withholding Calculate federal and state income tax withholding for a number of employees of TCLH Industries, a manufacturer of cleaning products. Use the wage-bracket method when it is possible to do so, and use the percentage method in all other instances. Assume the state income tax withholding rate to be 5% of taxable pay (which is the same for federal and state income tax withholding). 1. Zachary Fox does not make any voluntary deductions that impact earnings subject to federal income tax withholding. He is married, files his tax return as married filing jointly, and his weekly gross pay was $1,162. When completing form W-4 Zachary checked box 2c, entered $2,000 in step 3 of the form, and left step 4 blank. 2. Calvin Bell makes a 401(k) retirement plan contribution of 6% of gross pay. He is single, claims two federal withholding allowances and one state withholding allowance, and his weekly gross pay was $417.93. 3. David Alexander makes a 401(k) retirement plan contribution of 12% of gross pay. He is single, claims one withholding allowance for both federal and state taxes, and his weekly gross pay was $4,050. 4. Michael Sierra contributes $50 to a flexible spending account each period. He is married, claims four federal withholding allowances and three state withholding allowances, and his weekly gross pay was $2,450. NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation. Publication 15-T (2020) 1: Zachary Fox Federal income tax withholding = $ State income tax withholding = $ 2: Calvin Bell Federal income tax withholding = $ State income tax withholding = $_ 3: David Alexander Federal income tax withholding = $ State income tax withholding = $ 4: Michael Sierra Federal income tax withholding = $ State income tax withholding = $

Chapter18: Accounting Periods And Methods

Section: Chapter Questions

Problem 9DQ: LO.2 Osprey Corporation, an accrual basis taxpayer, had taxable income for 2019 and paid 40,000 on...

Related questions

Question

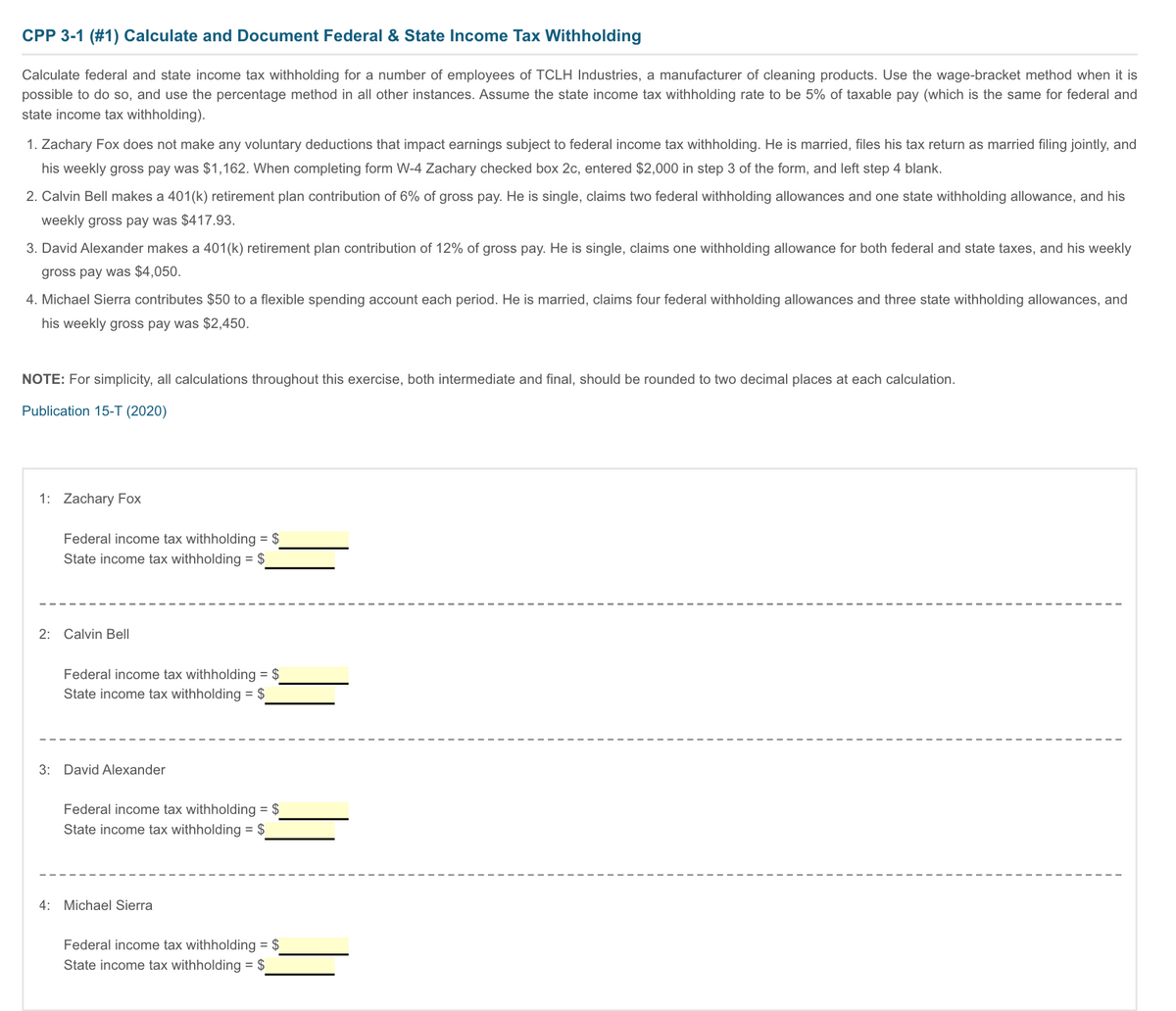

Transcribed Image Text:CPP 3-1 (#1) Calculate and Document Federal & State Income Tax Withholding

Calculate federal and state income tax withholding for a number of employees of TCLH Industries, a manufacturer of cleaning products. Use the wage-bracket method when it is

possible to do so, and use the percentage method in all other instances. Assume the state income tax withholding rate to be 5% of taxable pay (which is the same for federal and

state income tax withholding).

1. Zachary Fox does not make any voluntary deductions that impact earnings subject to federal income tax withholding. He is married, files his tax return as married filing jointly, and

his weekly gross pay was $1,162. When completing form W-4 Zachary checked box 2c, entered $2,000 in step 3 of the form, and left step 4 blank.

2. Calvin Bell makes a 401(k) retirement plan contribution of 6% of gross pay. He is single, claims two federal withholding allowances and one state withholding allowance, and his

weekly gross pay was $417.93.

3. David Alexander makes a 401(k) retirement plan contribution of 12% of gross pay. He is single, claims one withholding allowance for both federal and state taxes, and his weekly

gross pay was $4,050.

4. Michael Sierra contributes $50 to a flexible spending account each period. He is married, claims four federal withholding allowances and three state withhol

allowances, and

his weekly gross pay was $2,450.

NOTE: For simplicity, all calculations throughout this exercise, both intermediate and final, should be rounded to two decimal places at each calculation.

Publication 15-T (2020)

1: Zachary Fox

Federal income tax withholding = $

State income tax withholding = $

2: Calvin Bell

Federal income tax withholding = $

State income tax withholding = $

3: David Alexander

Federal income tax withholding = $

State income tax withholding = $

4: Michael Sierra

Federal income tax withholding = $

State income tax withholding = $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Individual Income Taxes

Accounting

ISBN:

9780357109731

Author:

Hoffman

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning