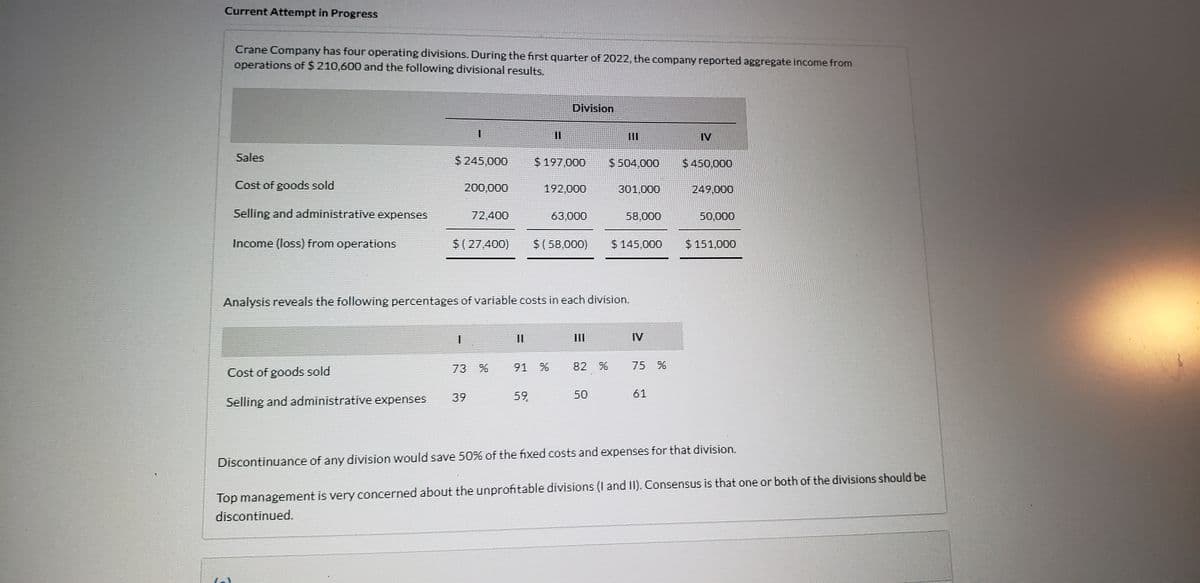

Crane Company has four operating divisions. During the first quarter of 2022, the company reported aggregate income from operations of $ 210,600 and the following divisional results. Division 3. II IV Sales $ 245,000 $ 197,000 $ 504,000 $ 450,000 Cost of goods sold 200,000 192,000 301,000 249,000 Selling and administrative expenses 72,400 63,000 58,000 50,000 Income (loss) from operations $(27,400) $(58,000) $145,000 $ 151,000 Analysis reveals the following percentages of variable costs in each division. III IV 73 % 91 % 82 % 75 % Cost of goods sold 39 59, 50 61 Selling and administrative expenses Discontinuance of any division would save 50% of the fixed costs and expenses for that division. Top management is very concerned about the unprofitable divisions (I and II). Consensus is that one or both of the divisions should be discontinued.

Crane Company has four operating divisions. During the first quarter of 2022, the company reported aggregate income from operations of $ 210,600 and the following divisional results. Division 3. II IV Sales $ 245,000 $ 197,000 $ 504,000 $ 450,000 Cost of goods sold 200,000 192,000 301,000 249,000 Selling and administrative expenses 72,400 63,000 58,000 50,000 Income (loss) from operations $(27,400) $(58,000) $145,000 $ 151,000 Analysis reveals the following percentages of variable costs in each division. III IV 73 % 91 % 82 % 75 % Cost of goods sold 39 59, 50 61 Selling and administrative expenses Discontinuance of any division would save 50% of the fixed costs and expenses for that division. Top management is very concerned about the unprofitable divisions (I and II). Consensus is that one or both of the divisions should be discontinued.

Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Chapter8: Inventories: Special Valuation Issues

Section: Chapter Questions

Problem 3RE: Blue Corporation uses the FIFO cost flow assumption. Presented below is information related to Blues...

Related questions

Question

Transcribed Image Text:Current Attempt in Progress

Crane Company has four operating divisions. During the first quarter of 2022, the company reported aggregate income from

operations of $ 210,600 and the following divisional results.

Division

IV

Sales

$ 245,000

$ 197,000

$ 504.000

$450,000

Cost of goods sold

200,000

192,000

301.000

249,000

Selling and administrative expenses

72,400

63,000

58,000

50,000

Income (loss) from operations

$( 27,400)

$( 58,000)

$ 145,000

$ 151,000

Analysis reveals the following percentages of variable costs in each division.

一

II

II

IV

73 %

91 %

82 %

75 %

Cost of goods sold

39

59.

50

61

Selling and administrative expenses

Discontinuance of any division would save 50% of the fixed costs and expenses for that division.

Top management is very concerned about the unprofitable divisions (I and II). Consensus is that one or both of the divisions should be

discontinued.

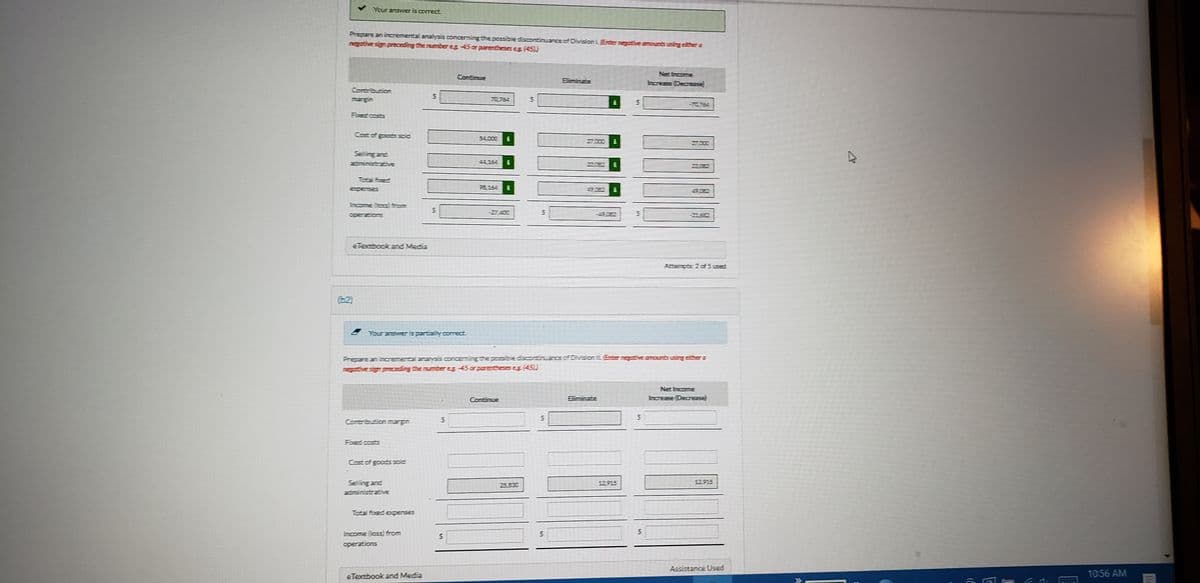

Transcribed Image Text:Your answer is correct.

Prepare an incamental analysis concerning thepossibie discontinuance of Division LEnter negot

negative sign preceding the numbereg 45 or parentheses es (45))

susing either a

Net Income

Continue

Eliminate

hcrease Decease

Woonquouco

margin

5-ס2

-70754

Foed costs

Cost of goods soic

54,000

27000

27000

Selling and

adininistrativE

44,254

120E2

Total foed

98,154

Expenses

50E2

Income (css iom

in

-27,400

operations

-21682

eTexbook and Media

Attenpts 2 c5used

(2)

Frepare an incremental analysis concerning the possible discontinuance.of DrvSonL

ntive sign preczding the number e 45 ar parentheseseg (45)

Net Income

Continue

Eliminate

hcease (Decesa

in

Contributionmargin

Fored costs

Cast of goods soic

Selling and

25,830

12.915

12.915

adiministrative

Total fued expenses

Income (loss) firom

aperations

Assistance Used

eTextbook and Media

10:56 AM

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning