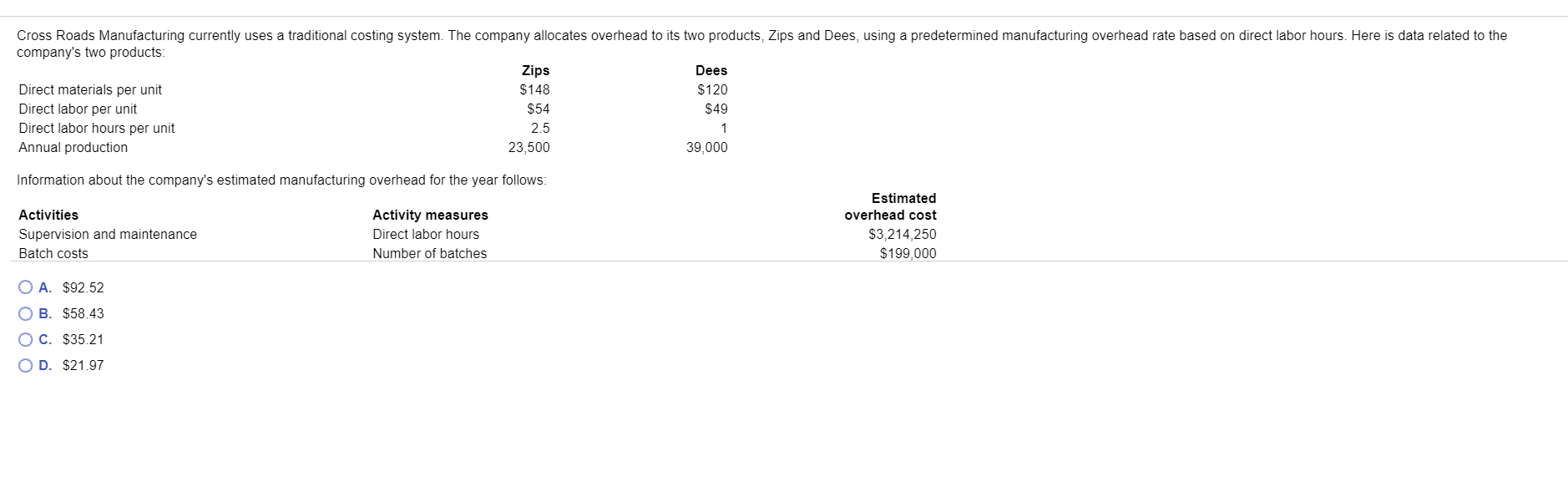

Cross Roads Manufacturing currently uses a traditional costing system. The company allocates overhead to its two products, Zips and Dees, using a predetermined manufacturing overhead rate based on direct labor hours. Here is data related to the company's two products: Zips Dees Direct materials per unit Direct labor per unit $148 $120 $54 $49 Direct labor hours per unit 2.5 1 Annual production 23,500 39,000 Information about the company's estimated manufacturing overhead for the year follows: Estimated Activities Activity measures Direct labor hours overhead cost $3,214,250 $199,000 Supervision and maintenance Number of batches Batch costs O A. $92.52 O B. $58.43 O C. $35.21 D. $21.97 Direct labor hours $3,214,250 Supervision and maintenance Batch costs $199,000 Number of batches Number of engineering hours $194,950 Engineering changes $3,608,200 Total estimated manufacturing overhead for the year Total estimated direct labor hours for the company for the year are 97,750 hours. The company is evaluating whether it should use an activity - based costing system in place of its traditional costing system. Additional information about production needed for the activity based costing system follows Zips 58,750 Dees Total Direct labor hours 39,000 97,750 Batches 2,350 300 2,650 Engineering hours 2,050 1,100 3,150 The amount of manufacturing overhead that would be allocated to one unit of Dees using an activity based costing system would be closeest to (Do not round intermediate calculations and round the final answer to the nearest cent.) O A. $92.52 O B. $58.43 O C. $35.21 D. $21.97

Cross Roads Manufacturing currently uses a traditional costing system. The company allocates overhead to its two products, Zips and Dees, using a predetermined manufacturing overhead rate based on direct labor hours. Here is data related to the company's two products: Zips Dees Direct materials per unit Direct labor per unit $148 $120 $54 $49 Direct labor hours per unit 2.5 1 Annual production 23,500 39,000 Information about the company's estimated manufacturing overhead for the year follows: Estimated Activities Activity measures Direct labor hours overhead cost $3,214,250 $199,000 Supervision and maintenance Number of batches Batch costs O A. $92.52 O B. $58.43 O C. $35.21 D. $21.97 Direct labor hours $3,214,250 Supervision and maintenance Batch costs $199,000 Number of batches Number of engineering hours $194,950 Engineering changes $3,608,200 Total estimated manufacturing overhead for the year Total estimated direct labor hours for the company for the year are 97,750 hours. The company is evaluating whether it should use an activity - based costing system in place of its traditional costing system. Additional information about production needed for the activity based costing system follows Zips 58,750 Dees Total Direct labor hours 39,000 97,750 Batches 2,350 300 2,650 Engineering hours 2,050 1,100 3,150 The amount of manufacturing overhead that would be allocated to one unit of Dees using an activity based costing system would be closeest to (Do not round intermediate calculations and round the final answer to the nearest cent.) O A. $92.52 O B. $58.43 O C. $35.21 D. $21.97

Chapter4: Job Order Costing

Section: Chapter Questions

Problem 2PB: Rulers Company is a neon sign company that estimated overhead will be $60,000, consisting of 1,500...

Related questions

Question

The question is in the photos provided

Transcribed Image Text:Cross Roads Manufacturing currently uses a traditional costing system. The company allocates overhead to its two products, Zips and Dees, using a predetermined manufacturing overhead rate based on direct labor hours. Here is data related to the

company's two products:

Zips

Dees

Direct materials per unit

Direct labor per unit

$148

$120

$54

$49

Direct labor hours per unit

2.5

1

Annual production

23,500

39,000

Information about the company's estimated manufacturing overhead for the year follows:

Estimated

Activities

Activity measures

Direct labor hours

overhead cost

$3,214,250

$199,000

Supervision and maintenance

Number of batches

Batch costs

O A. $92.52

O B. $58.43

O C. $35.21

D. $21.97

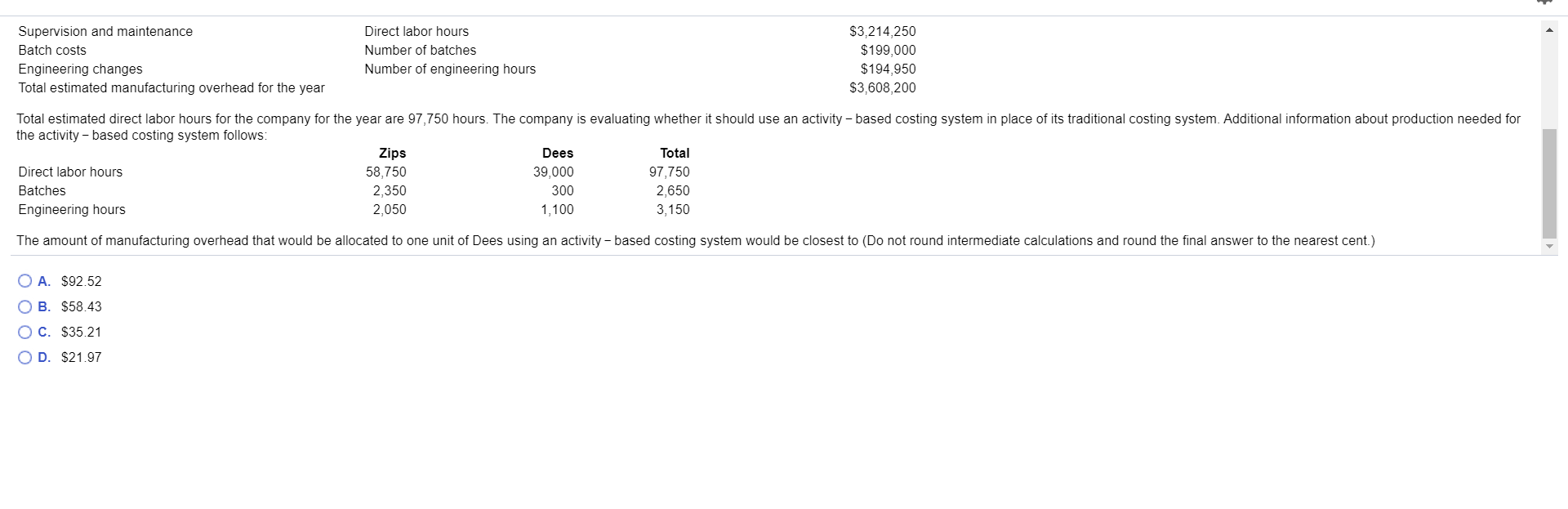

Transcribed Image Text:Direct labor hours

$3,214,250

Supervision and maintenance

Batch costs

$199,000

Number of batches

Number of engineering hours

$194,950

Engineering changes

$3,608,200

Total estimated manufacturing overhead for the year

Total estimated direct labor hours for the company for the year are 97,750 hours. The company is evaluating whether it should use an activity - based costing system in place of its traditional costing system. Additional information about production needed for

the activity based costing system follows

Zips

58,750

Dees

Total

Direct labor hours

39,000

97,750

Batches

2,350

300

2,650

Engineering hours

2,050

1,100

3,150

The amount of manufacturing overhead that would be allocated to one unit of Dees using an activity

based costing system would be closeest to (Do not round intermediate calculations and round the final answer to the nearest cent.)

O A. $92.52

O B. $58.43

O C. $35.21

D. $21.97

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:

9781305087408

Author:

Edward J. Vanderbeck, Maria R. Mitchell

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,