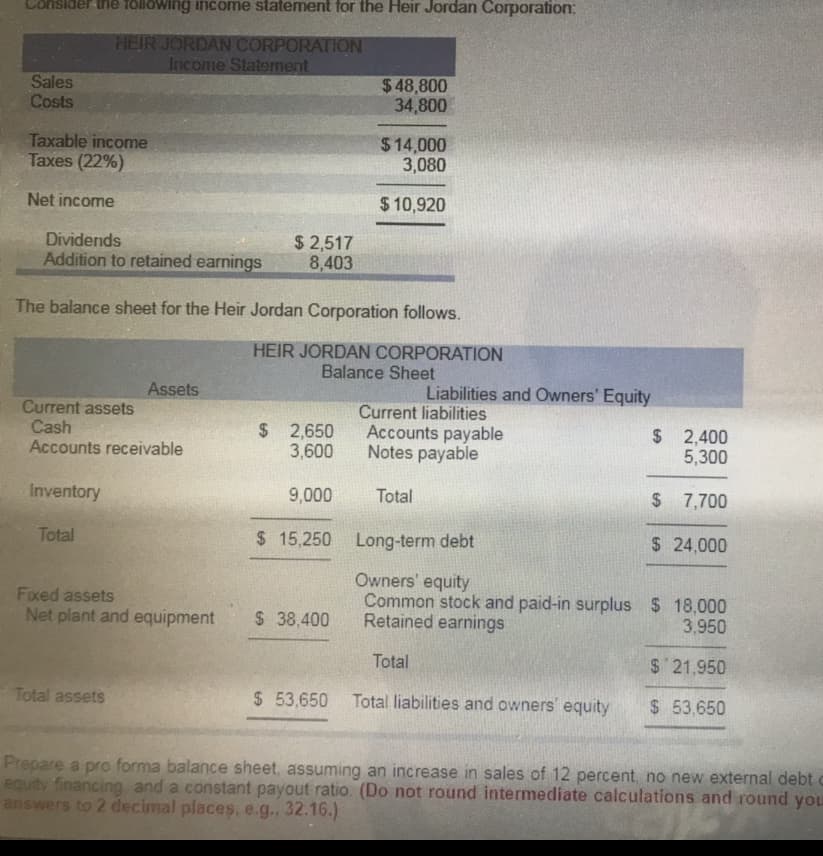

CShsiger-ne tolowing income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATION Income Staternent Sales $48,800 34,800 Costs Taxable income Taxes (22%) Net income $14,000 3,080 $10,920 Dividends Addition to retained earnings 8,403 $ 2,517 The balance sheet for the Heir Jordan Corporation follows HEIR JORDAN CORPORATION Balance Sheet Assets Liabilities and Owners' Equity Current assets Cash Accounts receivable Current liabilities 2,650 Accounts payable $ 2,400 3,600 Notes payable 5,300 $ 7,700 24,000 Common stock and paid-in surplus 18,000 Inventory 9,000 Total Total s 15,250 Long-term debt Owners' equity Fixed assets Net plant and equipment 38,400 Retained earnings 3,950 $ 21,950 53,650 Total liabilities and owners' equity 53,50 Total Total assets Prepare a pro forma balance sheet assuming an increase in sales of 12 percent, no new external debt and a constant payout ratio (Do not round intermediate calculations and round you answers to 2 decimal places, e.g., 32.16.)

CShsiger-ne tolowing income statement for the Heir Jordan Corporation: HEIR JORDAN CORPORATION Income Staternent Sales $48,800 34,800 Costs Taxable income Taxes (22%) Net income $14,000 3,080 $10,920 Dividends Addition to retained earnings 8,403 $ 2,517 The balance sheet for the Heir Jordan Corporation follows HEIR JORDAN CORPORATION Balance Sheet Assets Liabilities and Owners' Equity Current assets Cash Accounts receivable Current liabilities 2,650 Accounts payable $ 2,400 3,600 Notes payable 5,300 $ 7,700 24,000 Common stock and paid-in surplus 18,000 Inventory 9,000 Total Total s 15,250 Long-term debt Owners' equity Fixed assets Net plant and equipment 38,400 Retained earnings 3,950 $ 21,950 53,650 Total liabilities and owners' equity 53,50 Total Total assets Prepare a pro forma balance sheet assuming an increase in sales of 12 percent, no new external debt and a constant payout ratio (Do not round intermediate calculations and round you answers to 2 decimal places, e.g., 32.16.)

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 22BEA: The income statement, statement of retained earnings, and balance sheet for Somerville Company are...

Related questions

Question

100%

Transcribed Image Text:CShsiger-ne

tolowing income statement for the Heir Jordan Corporation:

HEIR JORDAN CORPORATION

Income Staternent

Sales

$48,800

34,800

Costs

Taxable income

Taxes (22%)

Net income

$14,000

3,080

$10,920

Dividends

Addition to retained earnings 8,403

$ 2,517

The balance sheet for the Heir Jordan Corporation follows

HEIR JORDAN CORPORATION

Balance Sheet

Assets

Liabilities and Owners' Equity

Current assets

Cash

Accounts receivable

Current liabilities

2,650 Accounts payable

$ 2,400

3,600 Notes payable

5,300

$ 7,700

24,000

Common stock and paid-in surplus 18,000

Inventory

9,000 Total

Total

s 15,250 Long-term debt

Owners' equity

Fixed assets

Net plant and equipment

38,400

Retained earnings

3,950

$ 21,950

53,650 Total liabilities and owners' equity 53,50

Total

Total assets

Prepare a pro forma balance sheet assuming an increase in sales of 12 percent, no new external debt

and a constant payout ratio (Do not round intermediate calculations and round you

answers to 2 decimal places, e.g., 32.16.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning