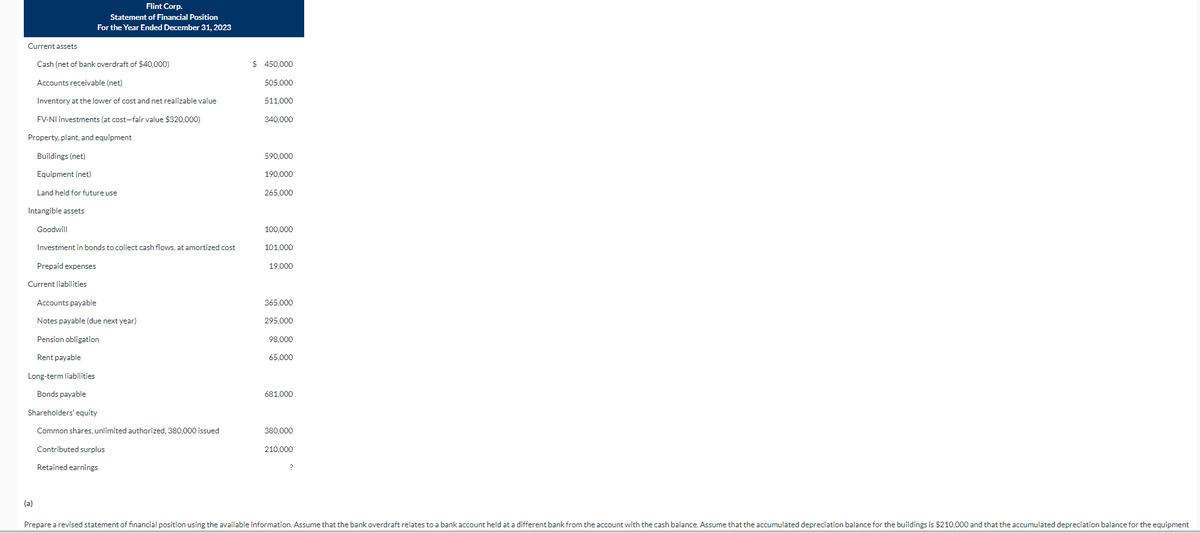

Current assets Flint Corp. Statement of Financial Position For the Year Ended December 31, 2023 Cash (net of bank overdraft of $40,000) $ 450,000 Accounts receivable (net) 505,000 Inventory at the lower of cost and net realizable value 511,000 FV-NI investments (at cost-fair value $320,000) 340,000 Property, plant, and equipment Buildings (net) Equipment (net) Land held for future use Intangible assets Goodwill Investment in bonds to collect cash flows, at amortized cost Prepaid expenses Current liabilities Accounts payable Notes payable (due next year) Pension obligation Rent payable Long-term liabilities 590,000 190,000 265,000 100,000 101,000 19,000 365,000 295,000 98,000 65,000 Bonds payable 681,000 Shareholders' equity Common shares, unlimited authorized,380,000 issued 380,000 Contributed surplus Retained earnings 210,000 ? (a) Prepare a revised statement of financial position using the available information. Assume that the bank overdraft relates to a bank account held at a different bank from the account with the cash balance. Assume that the accumulated depreciation balance for the buildings is $210,000 and that the accumulated depreciation balance for the equipment

Flint Corp.

Unlock instant AI solutions

Tap the button

to generate a solution