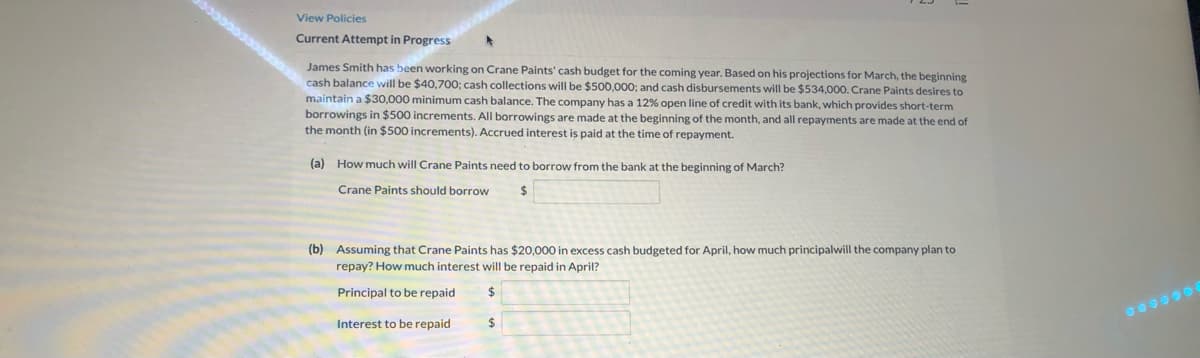

Current Attempt in Progress James Smith has been working on Crane Paints' cash budget for the coming year. Based on his projections for March, the beginning cash balance will be $40,700; cash collections will be $500,000; and cash disbursements will be $534,000. Crane Paints desires to maintain a $30,000 minimum cash balance. The company has a 12% open line of credit with its bank, which provides short-term borrowings in $500 increments. All borrowings are made at the beginning of the month, and all repayments are made at the end of the month (in $500 increments). Accrued interest is paid at the time of repayment. (a) How much will Crane Paints need to borrow from the bank at the beginning of March? Crane Paints should borrow

Current Attempt in Progress James Smith has been working on Crane Paints' cash budget for the coming year. Based on his projections for March, the beginning cash balance will be $40,700; cash collections will be $500,000; and cash disbursements will be $534,000. Crane Paints desires to maintain a $30,000 minimum cash balance. The company has a 12% open line of credit with its bank, which provides short-term borrowings in $500 increments. All borrowings are made at the beginning of the month, and all repayments are made at the end of the month (in $500 increments). Accrued interest is paid at the time of repayment. (a) How much will Crane Paints need to borrow from the bank at the beginning of March? Crane Paints should borrow

Chapter6: Managing Cash Flow

Section: Chapter Questions

Problem 1EP

Related questions

Question

I could use some help with this

Transcribed Image Text:View Policies

Current Attempt in Progress

James Smith has been working on Crane Paints' cash budget for the coming year. Based on his projections for March, the beginning

cash balance will be $40,700; cash collections will be $500,000; and cash disbursements will be $534,000. Crane Paints desires to

maintain a $30,000 minimum cash balance. The company has a 12% open line of credit with its bank, which provides short-term

borrowings in $500 increments. All borrowings are made at the beginning of the month, and all repayments are made at the end of

spaid at the time of repayment.

the month (in $500 increments). Accrued interest

(a) How much will Crane Paints need to borrow from the bank at the beginning of March?

Crane Paints should borrow

(b) Assuming that Crane Paints has $20,000 in excess cash budgeted for April, how much principalwill the company plan to

repay? How much interest will be repaid in April?

Principal to be repaid

Interest to be repaid

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning