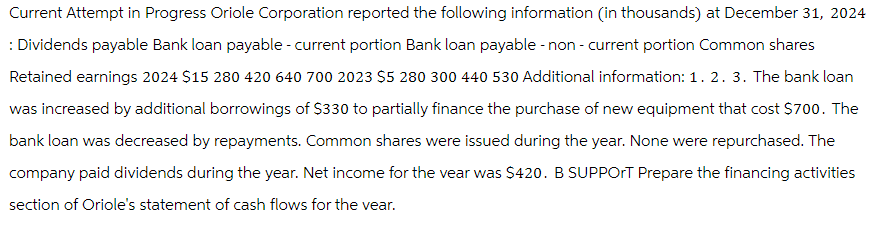

Current Attempt in Progress Oriole Corporation reported the following information (in thousands) at December 31, 2024 : Dividends payable Bank loan payable - current portion Bank loan payable - non-current portion Common shares Retained earnings 2024 $15 280 420 640 700 2023 $5 280 300 440 530 Additional information: 1. 2. 3. The bank loan was increased by additional borrowings of $330 to partially finance the purchase of new equipment that cost $700. The bank loan was decreased by repayments. Common shares were issued during the year. None were repurchased. The company paid dividends during the year. Net income for the year was $420. B SUPPORT Prepare the financing activities section of Oriole's statement of cash flows for the year.

Current Attempt in Progress Oriole Corporation reported the following information (in thousands) at December 31, 2024 : Dividends payable Bank loan payable - current portion Bank loan payable - non-current portion Common shares Retained earnings 2024 $15 280 420 640 700 2023 $5 280 300 440 530 Additional information: 1. 2. 3. The bank loan was increased by additional borrowings of $330 to partially finance the purchase of new equipment that cost $700. The bank loan was decreased by repayments. Common shares were issued during the year. None were repurchased. The company paid dividends during the year. Net income for the year was $420. B SUPPORT Prepare the financing activities section of Oriole's statement of cash flows for the year.

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter14: Statement Of Cash Flows

Section: Chapter Questions

Problem 38E: Tidwell Company experienced the following during 20X1: a. Sold preferred stock for 480,000. b....

Related questions

Question

Transcribed Image Text:Current Attempt in Progress Oriole Corporation reported the following information (in thousands) at December 31, 2024

: Dividends payable Bank loan payable - current portion Bank loan payable - non-current portion Common shares

Retained earnings 2024 $15 280 420 640 700 2023 $5 280 300 440 530 Additional information: 1. 2. 3. The bank loan

was increased by additional borrowings of $330 to partially finance the purchase of new equipment that cost $700. The

bank loan was decreased by repayments. Common shares were issued during the year. None were repurchased. The

company paid dividends during the year. Net income for the year was $420. B SUPPORT Prepare the financing activities

section of Oriole's statement of cash flows for the year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 2 steps

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning

Fundamentals Of Financial Management, Concise Edi…

Finance

ISBN:

9781337902571

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub