Current Previous Year Year Income Statement Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Interest Expense Income before Income Tax Expense Income Tax Expense (30%) $110,000 52,000 58,000 36,000 4,000 18,000 5,400 $ 99,000 48,000 51,000 33,000 4,000 14,000 4, 200 Net Income $ 12,600 $ 9,800 Balance Sheet Cash Accounts Receivable, Net Inventory Property and Equipment, Net $ 69,500 17,000 25,000 95,000 $206,500 $ 38,000 12,000 38,000 105,000 Total Assets $193,000 Accounts Payable Income Tax Payable Note Payable (long-term) $ 42,000 1,000 40,000 83,000 90,000 33,500 $206,500 $ 35,000 500 40,000 Total Liabilities Common Stock (par $10) Retained Earnings Total Liabilities and Stockholders' Equity 75,500 90,000 27,500 $193,000

Current Previous Year Year Income Statement Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses Interest Expense Income before Income Tax Expense Income Tax Expense (30%) $110,000 52,000 58,000 36,000 4,000 18,000 5,400 $ 99,000 48,000 51,000 33,000 4,000 14,000 4, 200 Net Income $ 12,600 $ 9,800 Balance Sheet Cash Accounts Receivable, Net Inventory Property and Equipment, Net $ 69,500 17,000 25,000 95,000 $206,500 $ 38,000 12,000 38,000 105,000 Total Assets $193,000 Accounts Payable Income Tax Payable Note Payable (long-term) $ 42,000 1,000 40,000 83,000 90,000 33,500 $206,500 $ 35,000 500 40,000 Total Liabilities Common Stock (par $10) Retained Earnings Total Liabilities and Stockholders' Equity 75,500 90,000 27,500 $193,000

Fundamentals of Financial Management (MindTap Course List)

15th Edition

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Eugene F. Brigham, Joel F. Houston

Chapter4: Analysis Of Financial Statements

Section: Chapter Questions

Problem 24P: Income Statement for Year Ended December 31, 2018 (Millions of Dollars) Net sales 795.0 Cost of...

Related questions

Question

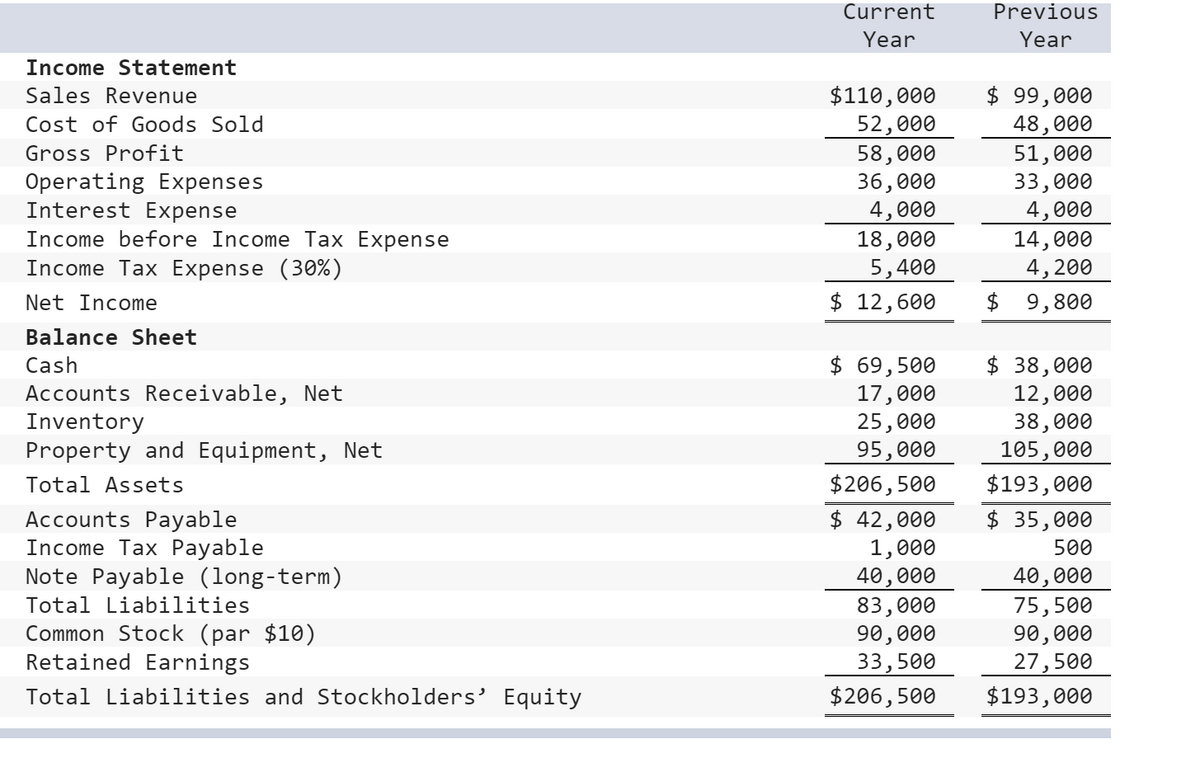

Pinnacle Plus declared and paid a cash dividend of $6,600 in the current year. Its comparative financial statements, prepared at December 31, reported the following summarized information:

I am not sure how to find the right numbers to go in the equation.

Transcribed Image Text:Current

Previous

Year

Year

Income Statement

$110,000

52,000

58,000

36,000

4,000

18,000

5,400

$ 12,600

$ 99,000

48,000

51,000

33,000

4,000

14,000

4, 200

$ 9,800

Sales Revenue

Cost of Goods Sold

Gross Profit

Operating Expenses

Interest Expense

Income before Income Tax Expense

Income Tax Expense (30%)

Net Income

Balance Sheet

$ 69,500

17,000

25,000

95,000

$206,500

$ 38,000

12,000

38,000

105,000

Cash

Accounts Receivable, Net

Inventory

Property and Equipment, Net

Total Assets

$193,000

Accounts Payable

Income Tax Payable

Note Payable (long-term)

$ 42,000

1,000

40,000

83,000

90,000

33,500

$206,500

$ 35,000

500

40,000

75,500

90,000

27,500

Total Liabilities

Common Stock (par $10)

Retained Earnings

Total Liabilities and Stockholders' Equity

$193,000

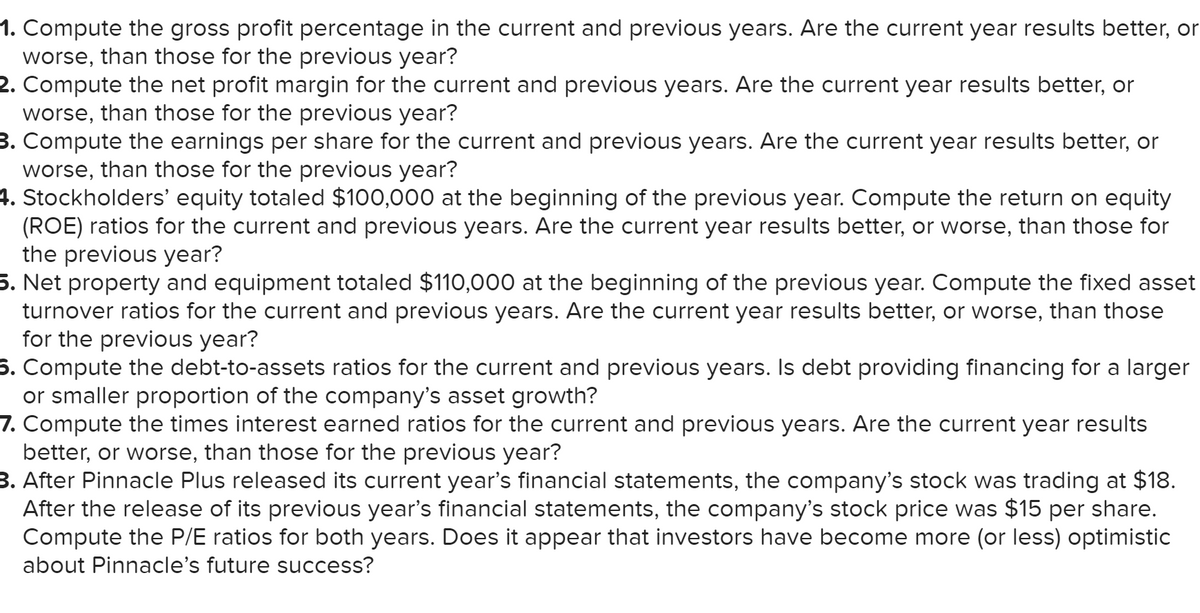

Transcribed Image Text:1. Compute the gross profit percentage in the current and previous years. Are the current year results better, or

worse, than those for the previous year?

2. Compute the net profit margin for the current and previous years. Are the current year results better, or

worse, than those for the previous year?

3. Compute the earnings per share for the current and previous years. Are the current year results better, or

worse, than those for the previous year?

4. Stockholders' equity totaled $100,000 at the beginning of the previous year. Compute the return on equity

(ROE) ratios for the current and previous years. Are the current year results better, or worse, than those for

the previous year?

5. Net property and equipment totaled $110,000 at the beginning of the previous year. Compute the fixed asset

turnover ratios for the current and previous years. Are the current year results better, or worse, than those

for the previous year?

5. Compute the debt-to-assets ratios for the current and previous years. Is debt providing financing for a larger

or smaller proportion of the company's asset growth?

7. Compute the times interest earned ratios for the current and previous years. Are the current year results

better, or worse, than those for the previous year?

3. After Pinnacle Plus released its current year's financial statements, the company's stock was trading at $18.

After the release of its previous year's financial statements, the company's stock price was $15 per share.

Compute the P/E ratios for both years. Does it appear that investors have become more (or less) optimistic

about Pinnacle's future success?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Fundamentals of Financial Management (MindTap Cou…

Finance

ISBN:

9781337395250

Author:

Eugene F. Brigham, Joel F. Houston

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning