Sales Cost of goods sold Gross profit Operating expenses Operating income Interest expense $168,000 90,000 78,000 32,000 $151,000 78,000 73,000 30,000 43,000 46,000 2,000 44,000 11,000 $33,000 3,000 40,000 Income before taxes 10,000 $30,000 Income taxes Net income

Sales Cost of goods sold Gross profit Operating expenses Operating income Interest expense $168,000 90,000 78,000 32,000 $151,000 78,000 73,000 30,000 43,000 46,000 2,000 44,000 11,000 $33,000 3,000 40,000 Income before taxes 10,000 $30,000 Income taxes Net income

Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Chapter15: Financial Statement Analysis

Section: Chapter Questions

Problem 40E: Cuneo Companys income statements for the last 3 years are as follows: Refer to the information for...

Related questions

Question

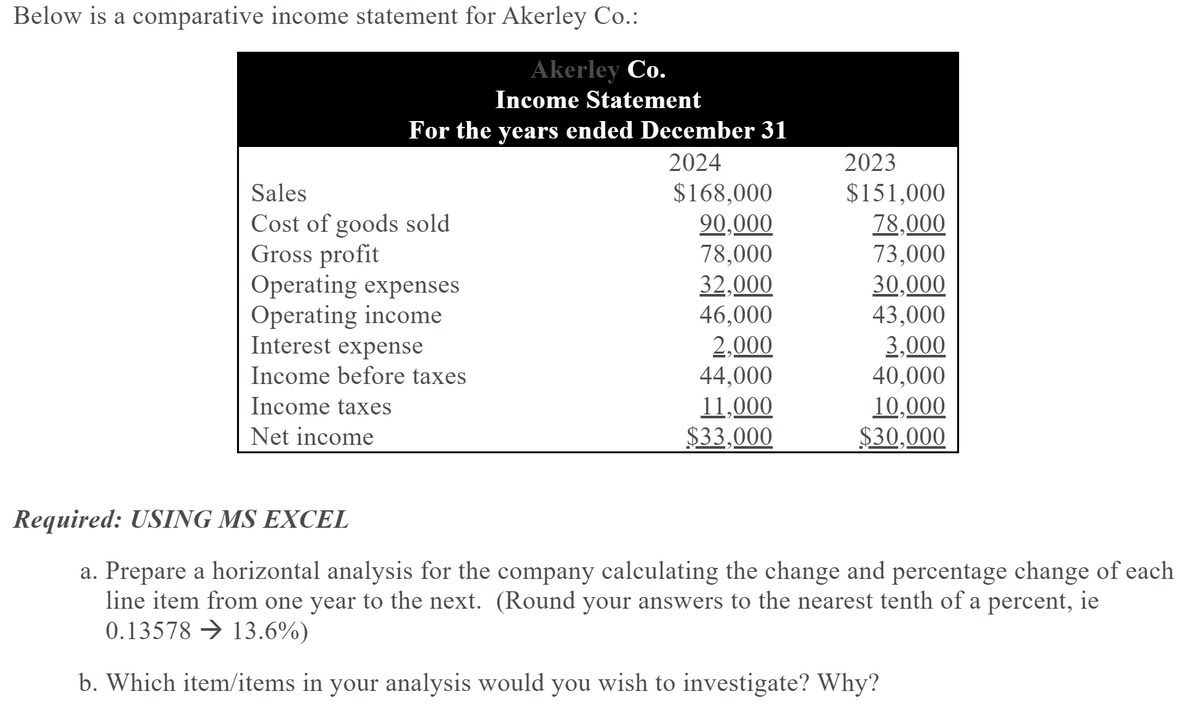

Transcribed Image Text:Below is a comparative income statement for Akerley Co.:

Akerley Co.

Income Statement

For the years ended December 31

2024

2023

$168,000

90,000

78,000

32,000

46,000

2,000

44,000

$151,000

78,000

73,000

Sales

Cost of goods sold

Gross profit

Operating expenses

Opcrating income

Interest expense

30,000

43,000

3,000

40,000

10,000

$30,000

Income before taxes

11,000

$33,000

Income taxes

Net income

Required: USING MS EXCEL

a. Prepare a horizontal analysis for the company calculating the change and percentage change of each

line item from one year to the next. (Round your answers to the nearest tenth of a percent, ie

0.13578 → 13.6%)

b. Which item/items in your analysis would you wish to investigate? Why?

Expert Solution

Step 1 Introduction

Horizontal analysis is an analysis carried out horizontally between the line of times which is calculated as the change in item occurred compared to last year.

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting: The Impact on Decision Make…

Accounting

ISBN:

9781305654174

Author:

Gary A. Porter, Curtis L. Norton

Publisher:

Cengage Learning