d. Explain why there is or is not a difference in the net income amounts in the two income statements. e. Explain why Empey Manufacturing might want to prepare both an absorption- costing income statement and a variable-costing income statement.

d. Explain why there is or is not a difference in the net income amounts in the two income statements. e. Explain why Empey Manufacturing might want to prepare both an absorption- costing income statement and a variable-costing income statement.

Managerial Accounting

15th Edition

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:Carl Warren, Ph.d. Cma William B. Tayler

Chapter11: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 22E: Total cost method of product pricing Based on the data presented in Exercise 17, assume that Smart...

Related questions

Question

please explain in steps thanks

Transcribed Image Text:d. Explain why there is or is not a difference in the net income amounts in the two

income statements.

e. Explain why Empey Manufacturing might want to prepare both an absorption-

costing income statement and a variable-costing income statement.

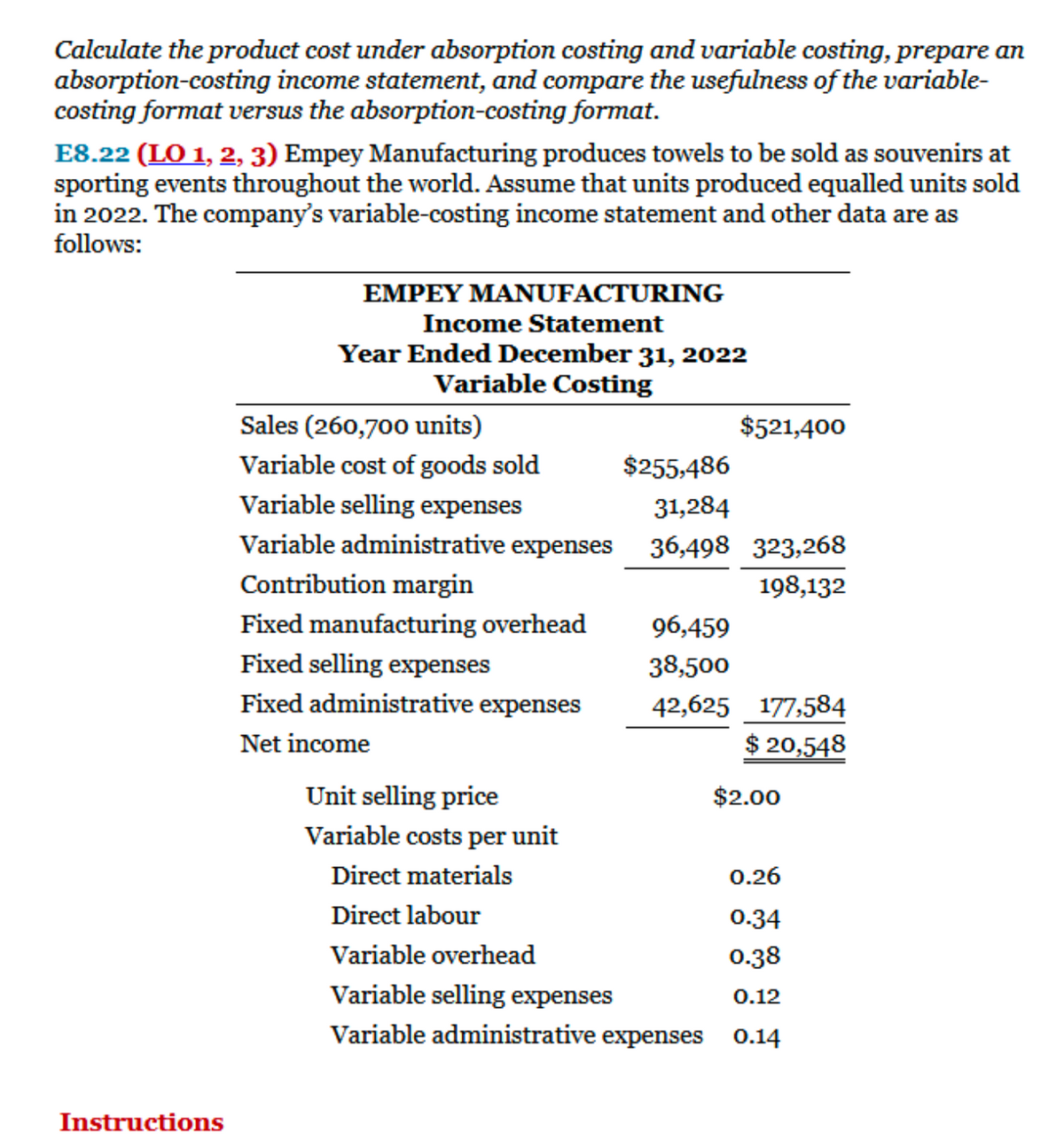

Transcribed Image Text:Calculate the product cost under absorption costing and variable costing, prepare an

absorption-costing income statement, and compare the usefulness of the variable-

costing format versus the absorption-costing format.

E8.22 (LO 1, 2, 3) Empey Manufacturing produces towels to be sold as souvenirs at

sporting events throughout the world. Assume that units produced equalled units sold

in 2022. The company's variable-costing income statement and other data are as

follows:

EMPEY MANUFACTURING

Income Statement

Year Ended December 31, 2022

Variable Costing

Sales (260,700 units)

$521,400

Variable cost of goods sold

$255,486

Variable selling expenses

31,284

Variable administrative expenses

36,498 323,268

Contribution margin

198,132

Fixed manufacturing overhead

96,459

Fixed selling expenses

38,500

Fixed administrative expenses

42,625

177,584

Net income

$ 20,548

Unit selling price

Variable costs per unit

Direct materials

Direct labour

Variable overhead

Variable selling expenses

Variable administrative expenses

Instructions

$2.00

0.26

0.34

0.38

0.12

0.14

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning