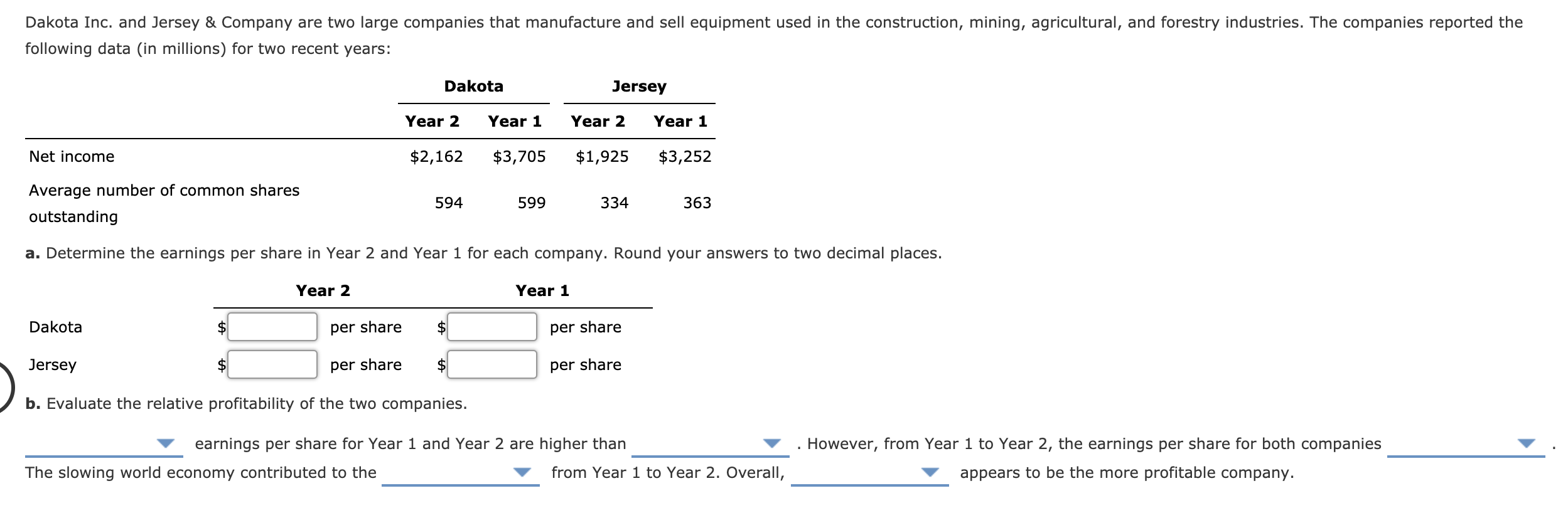

Dakota Inc. and Jersey & Company are two large companies that manufacture and sell equipment used in the construction, mining, agricultural, and forestry industries. The companies reported the following data (in millions) for two recent years: Dakota Jersey Year 2 Year 1 Year 2 Year 1 Net income $2,162 $3,705 $1,925 $3,252 Average number of common shares 594 599 334 363 outstanding a. Determine the earnings per share in Year 2 and Year 1 for each company. Round your answers to two decimal places. Year 2 Year 1 Dakota $ per share 2$ per share Jersey $ per share per share b. Evaluate the relative profitability of the two companies. earnings per share for Year 1 and Year 2 are higher than However, from Year 1 to Year 2, the earnings per share for both companies The slowing world economy contributed to the from Year 1 to Year 2. Overall, appears to be the more profitable company.

Dakota Inc. and Jersey & Company are two large companies that manufacture and sell equipment used in the construction, mining, agricultural, and forestry industries. The companies reported the following data (in millions) for two recent years: Dakota Jersey Year 2 Year 1 Year 2 Year 1 Net income $2,162 $3,705 $1,925 $3,252 Average number of common shares 594 599 334 363 outstanding a. Determine the earnings per share in Year 2 and Year 1 for each company. Round your answers to two decimal places. Year 2 Year 1 Dakota $ per share 2$ per share Jersey $ per share per share b. Evaluate the relative profitability of the two companies. earnings per share for Year 1 and Year 2 are higher than However, from Year 1 to Year 2, the earnings per share for both companies The slowing world economy contributed to the from Year 1 to Year 2. Overall, appears to be the more profitable company.

Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Chapter4: Profitability Analysis

Section: Chapter Questions

Problem 11QE: Phillips-Van Heusen, an apparel manufacturer, reported net income (amounts in thousands) for Year 4...

Related questions

Question

Practice Pack

Hello, I need help solving this. I don't know what to do.

Transcribed Image Text:Dakota Inc. and Jersey & Company are two large companies that manufacture and sell equipment used in the construction, mining, agricultural, and forestry industries. The companies reported the

following data (in millions) for two recent years:

Dakota

Jersey

Year 2

Year 1

Year 2

Year 1

Net income

$2,162

$3,705

$1,925

$3,252

Average number of common shares

594

599

334

363

outstanding

a. Determine the earnings per share in Year 2 and Year 1 for each company. Round your answers to two decimal places.

Year 2

Year 1

Dakota

$

per share

2$

per share

Jersey

$

per share

per share

b. Evaluate the relative profitability of the two companies.

earnings per share for Year 1 and Year 2 are higher than

However, from Year 1 to Year 2, the earnings per share for both companies

The slowing world economy contributed to the

from Year 1 to Year 2. Overall,

appears to be the more profitable company.

Expert Solution

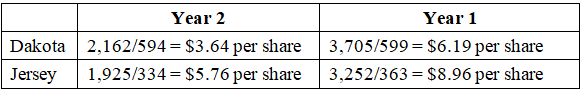

Step 1

- Calculate earnings per share:

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps with 2 images

Better your learning with

Practice Pack

Better your learning with

Practice Pack

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning