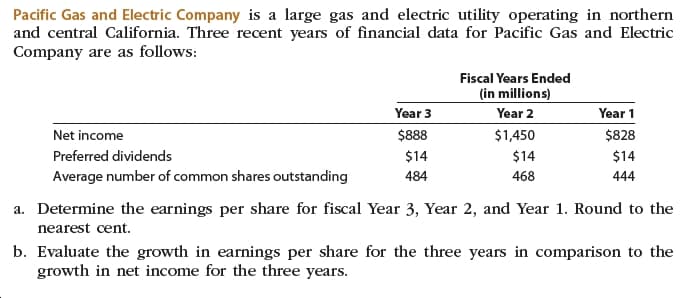

Pacific Gas and Electric Company is a large gas and electric utility operating in northern and central California. Three recent years of financial data for Pacific Gas and Electric Company are as follows: Fiscal Years Ended (in millions) Year 3 Year 2 Year 1 $888 $1,450 $828 Net income Preferred dividends $14 $14 $14 Average number of common shares outstanding 444 484 468 a. Determine the earnings per share for fiscal Year 3, Year 2, and Year 1. Round to the nearest cent. b. Evaluate the growth in earnings per share for the three years in comparison to the growth in net income for the three years.

Pacific Gas and Electric Company is a large gas and electric utility operating in northern and central California. Three recent years of financial data for Pacific Gas and Electric Company are as follows: Fiscal Years Ended (in millions) Year 3 Year 2 Year 1 $888 $1,450 $828 Net income Preferred dividends $14 $14 $14 Average number of common shares outstanding 444 484 468 a. Determine the earnings per share for fiscal Year 3, Year 2, and Year 1. Round to the nearest cent. b. Evaluate the growth in earnings per share for the three years in comparison to the growth in net income for the three years.

Corporate Financial Accounting

14th Edition

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Carl Warren, James M. Reeve, Jonathan Duchac

Chapter12: Corporations: Organization, Stock Transactions, And Dividends

Section: Chapter Questions

Problem 12.2ADM

Related questions

Question

Practice Pack

Transcribed Image Text:Pacific Gas and Electric Company is a large gas and electric utility operating in northern

and central California. Three recent years of financial data for Pacific Gas and Electric

Company are as follows:

Fiscal Years Ended

(in millions)

Year 3

Year 2

Year 1

$888

$1,450

$828

Net income

Preferred dividends

$14

$14

$14

Average number of common shares outstanding

444

484

468

a. Determine the earnings per share for fiscal Year 3, Year 2, and Year 1. Round to the

nearest cent.

b. Evaluate the growth in earnings per share for the three years in comparison to the

growth in net income for the three years.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Includes step-by-step video

Trending now

This is a popular solution!

Learn your way

Includes step-by-step video

Step by step

Solved in 3 steps with 3 images

Recommended textbooks for you

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781305088436

Author:

Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Financial Reporting, Financial Statement Analysis…

Finance

ISBN:

9781285190907

Author:

James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:

Cengage Learning