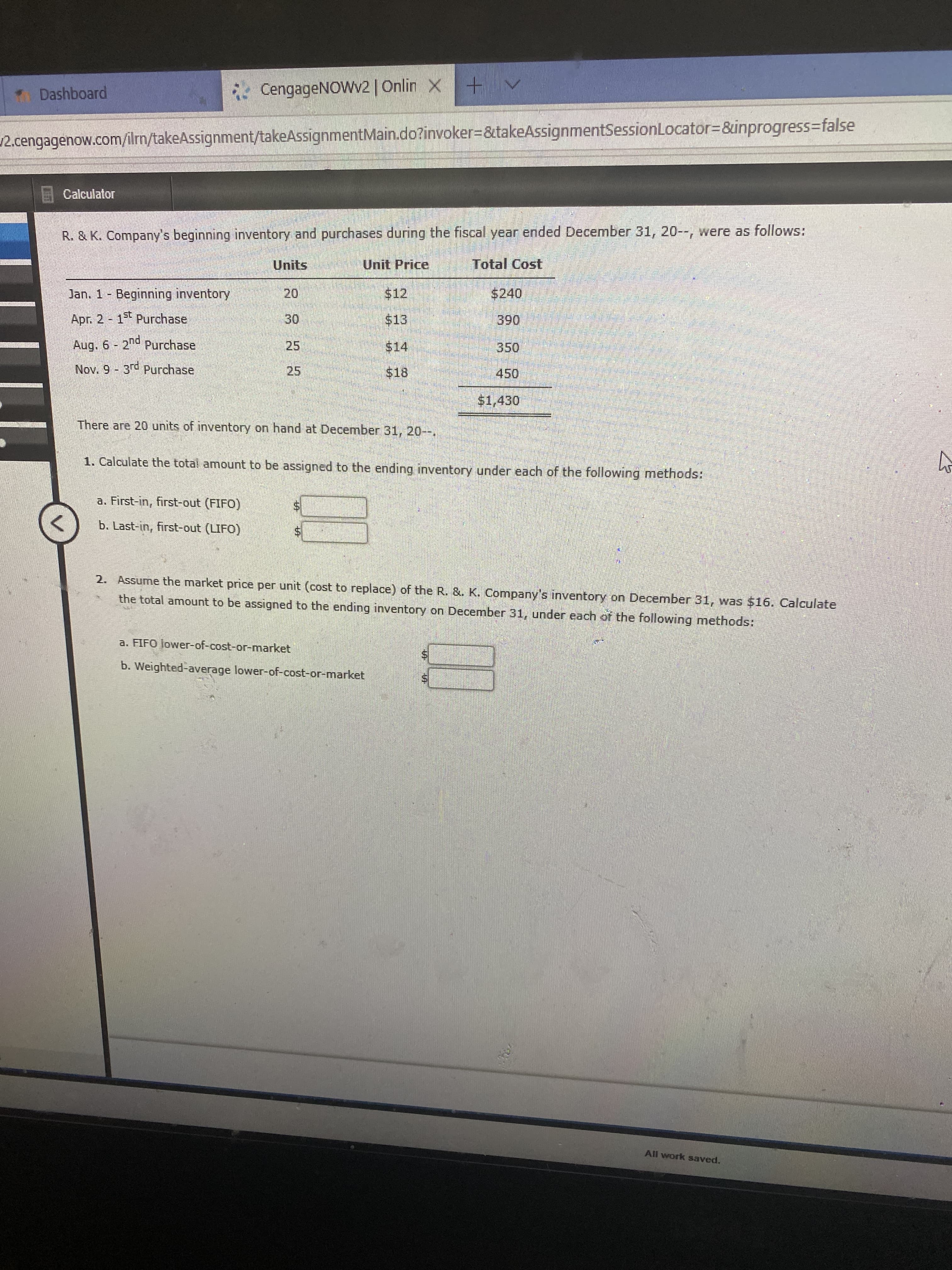

Dashboard CengageNOWv2 | Onlin X+ 2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker%3D&takeAssignmentSessionLocator=D&inprogress3false Calculator R. & K. Company's beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows: Units Unit Price Total Cost Jan. 1 Beginning inventory 20 $12 $240 Apr. 2 1st Purchase 30 $13 390 Aug. 6 2nd pPurchase 25 $14 350 Nov. 9 3rd pPurchase 25 $18 450 $1,430 There are 20 units of inventory on hand at December 31, 20--. 1. Calculate the tota! amount to be assigned to the ending inventory under each of the following methods: a. First-in, first-out (FIFO) b. Last-in, first-out (LIFO) 2. Assume the market price per unit (cost to replace) of the R. &. K. Company's inventory on December 31, was $16. Calculate the total amount to be assigned to the ending inventory on December 31, under each of the following methods: a. FIFO lower-of-cost-or-market b. Weighted-average lower-of-cost-or-market All work saved. 134 %24 %24 Dashboard CengageNOWv2 | Onlin X 2.cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Calculator The following information is taken from the books of All in the Family Center for the first quarter of its fiscal year ending on April 30, 20--: Cost Retail Inventory, start of period (January 1, 20--) $37,000 $66,000 Net purchases during the period 174,000 330,000 Net sales for the period 310,500 Required: 1. Estimate the ending inventory as of April 30, 20--, using the retail inventory method. Round your intermediate calculations and final answer to the nearest whole dollar. Estimate the ending inventory 2. Estimate the cost of goods sold for the time period, January 1, through April 30, using the retail inventory method. Round your intermediate calculations and final answer to t Estimated cost of goods sold

Dashboard CengageNOWv2 | Onlin X+ 2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker%3D&takeAssignmentSessionLocator=D&inprogress3false Calculator R. & K. Company's beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows: Units Unit Price Total Cost Jan. 1 Beginning inventory 20 $12 $240 Apr. 2 1st Purchase 30 $13 390 Aug. 6 2nd pPurchase 25 $14 350 Nov. 9 3rd pPurchase 25 $18 450 $1,430 There are 20 units of inventory on hand at December 31, 20--. 1. Calculate the tota! amount to be assigned to the ending inventory under each of the following methods: a. First-in, first-out (FIFO) b. Last-in, first-out (LIFO) 2. Assume the market price per unit (cost to replace) of the R. &. K. Company's inventory on December 31, was $16. Calculate the total amount to be assigned to the ending inventory on December 31, under each of the following methods: a. FIFO lower-of-cost-or-market b. Weighted-average lower-of-cost-or-market All work saved. 134 %24 %24 Dashboard CengageNOWv2 | Onlin X 2.cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false Calculator The following information is taken from the books of All in the Family Center for the first quarter of its fiscal year ending on April 30, 20--: Cost Retail Inventory, start of period (January 1, 20--) $37,000 $66,000 Net purchases during the period 174,000 330,000 Net sales for the period 310,500 Required: 1. Estimate the ending inventory as of April 30, 20--, using the retail inventory method. Round your intermediate calculations and final answer to the nearest whole dollar. Estimate the ending inventory 2. Estimate the cost of goods sold for the time period, January 1, through April 30, using the retail inventory method. Round your intermediate calculations and final answer to t Estimated cost of goods sold

Chapter3: Setting Up A New Company

Section: Chapter Questions

Problem 3.4C

Related questions

Question

100%

Transcribed Image Text:Dashboard

CengageNOWv2 | Onlin X+

2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker%3D&takeAssignmentSessionLocator=D&inprogress3false

Calculator

R. & K. Company's beginning inventory and purchases during the fiscal year ended December 31, 20--, were as follows:

Units

Unit Price

Total Cost

Jan. 1 Beginning inventory

20

$12

$240

Apr. 2 1st Purchase

30

$13

390

Aug. 6 2nd pPurchase

25

$14

350

Nov. 9 3rd pPurchase

25

$18

450

$1,430

There are 20 units of inventory on hand at December 31, 20--.

1. Calculate the tota! amount to be assigned to the ending inventory under each of the following methods:

a. First-in, first-out (FIFO)

b. Last-in, first-out (LIFO)

2. Assume the market price per unit (cost to replace) of the R. &. K. Company's inventory on December 31, was $16. Calculate

the total amount to be assigned to the ending inventory on December 31, under each of the following methods:

a. FIFO lower-of-cost-or-market

b. Weighted-average lower-of-cost-or-market

All work saved.

134

%24

%24

Transcribed Image Text:Dashboard

CengageNOWv2 | Onlin X

2.cengagenow.com/ilm/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false

Calculator

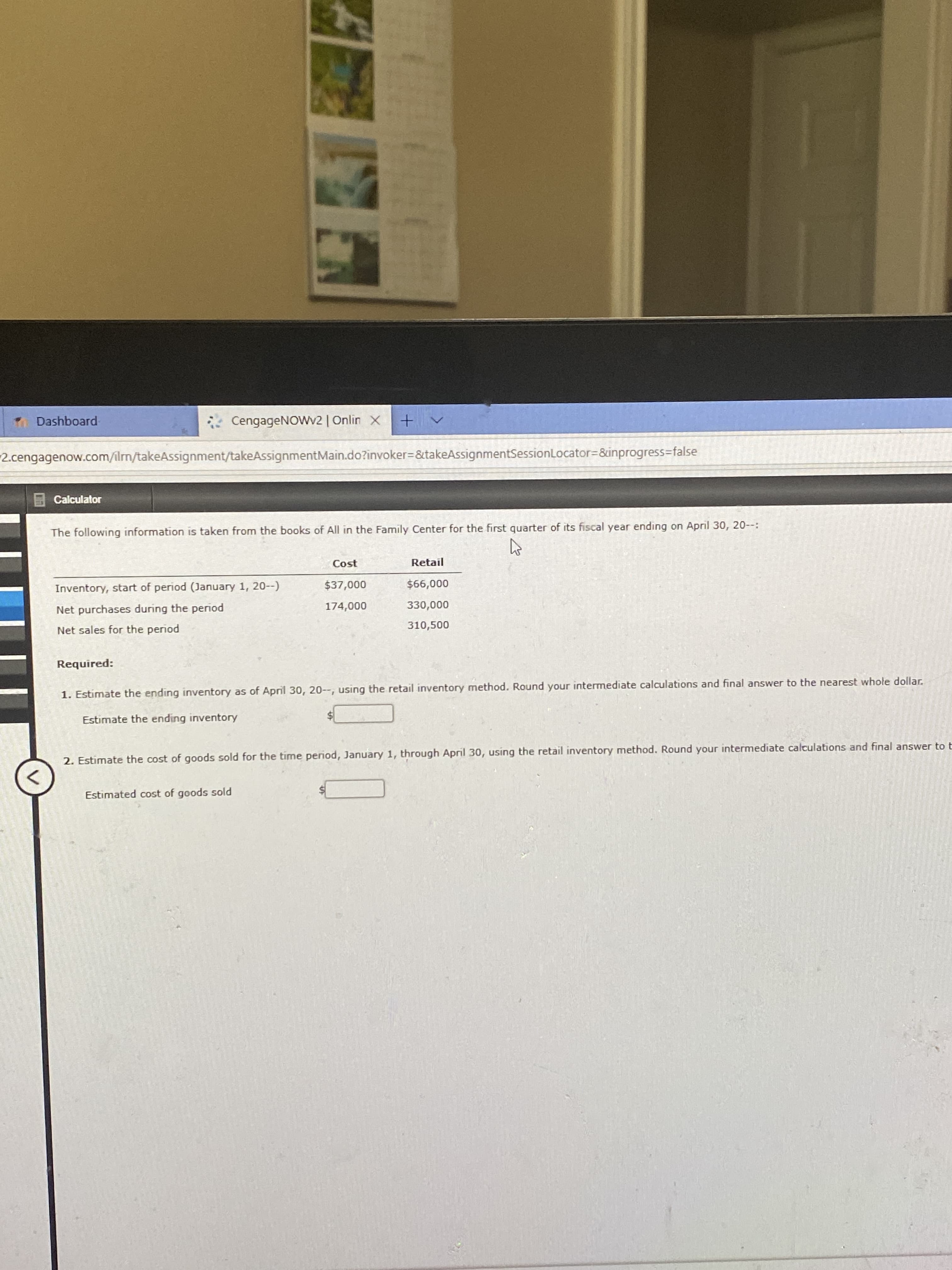

The following information is taken from the books of All in the Family Center for the first quarter of its fiscal year ending on April 30, 20--:

Cost

Retail

Inventory, start of period (January 1, 20--)

$37,000

$66,000

Net purchases during the period

174,000

330,000

Net sales for the period

310,500

Required:

1. Estimate the ending inventory as of April 30, 20--, using the retail inventory method. Round your intermediate calculations and final answer to the nearest whole dollar.

Estimate the ending inventory

2. Estimate the cost of goods sold for the time period, January 1, through April 30, using the retail inventory method. Round your intermediate calculations and final answer to t

Estimated cost of goods sold

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning