estions 1 bartleby CengageNOWv21Onlin X +v > https://v2.cengagenow.com/ilm/takeAssignment/takeAssignment Main.do?invoker-assignments&takeAssignmentSessionLocator-assignment-take&inprogres * 2. Chapter 7 Homework eBook Calculator Print Item Alternative Inventory Methods 1. PR.07.02 Habicht Company was formed in 2018 to produce a single product. The production and sales for the next 4 years were as follows: 2. PR.07.01.ALGO Production Sales 3. EX.07.15 Total Units in Ending Sales Units Units Costs Revenue Inventory 4. EX.07.13.ALGO 2018 $200,000 100,000 $400,000 80,000 20,000 2019 120,000 234,000 110,000 5. EX.07.11 550,000 30,000 2020 247,000 150,000 130,000 10,000 750,000 6. PR.07.07 2021 130,000 240,500 120,000 20,000 600,000 Required: 1. Determine the gross profit for each year under each of the following periodic inventory methods: 2018 2019 2020 2021 a. FIFO (Round unit costs to 2 decimal places, if required.) b. LIFO (Round unit costs to 2 decimal places, if required.) c. Weighted Average (Round unit costs to 3 decimal places and your final answers to the Previous Next Check My Work 8 more Check My Work uses remaining. Progress: 3/6 items 2:58 PM B A 4)) O Type here to search 29 10/27/2019 hp 64

estions 1 bartleby CengageNOWv21Onlin X +v > https://v2.cengagenow.com/ilm/takeAssignment/takeAssignment Main.do?invoker-assignments&takeAssignmentSessionLocator-assignment-take&inprogres * 2. Chapter 7 Homework eBook Calculator Print Item Alternative Inventory Methods 1. PR.07.02 Habicht Company was formed in 2018 to produce a single product. The production and sales for the next 4 years were as follows: 2. PR.07.01.ALGO Production Sales 3. EX.07.15 Total Units in Ending Sales Units Units Costs Revenue Inventory 4. EX.07.13.ALGO 2018 $200,000 100,000 $400,000 80,000 20,000 2019 120,000 234,000 110,000 5. EX.07.11 550,000 30,000 2020 247,000 150,000 130,000 10,000 750,000 6. PR.07.07 2021 130,000 240,500 120,000 20,000 600,000 Required: 1. Determine the gross profit for each year under each of the following periodic inventory methods: 2018 2019 2020 2021 a. FIFO (Round unit costs to 2 decimal places, if required.) b. LIFO (Round unit costs to 2 decimal places, if required.) c. Weighted Average (Round unit costs to 3 decimal places and your final answers to the Previous Next Check My Work 8 more Check My Work uses remaining. Progress: 3/6 items 2:58 PM B A 4)) O Type here to search 29 10/27/2019 hp 64

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter6: Cost Of Goods Sold And Inventory

Section: Chapter Questions

Problem 41BE: ( Appendix 6B) Inventory Costing Methods: Periodic Inventory Systems. Refer to the information for...

Related questions

Question

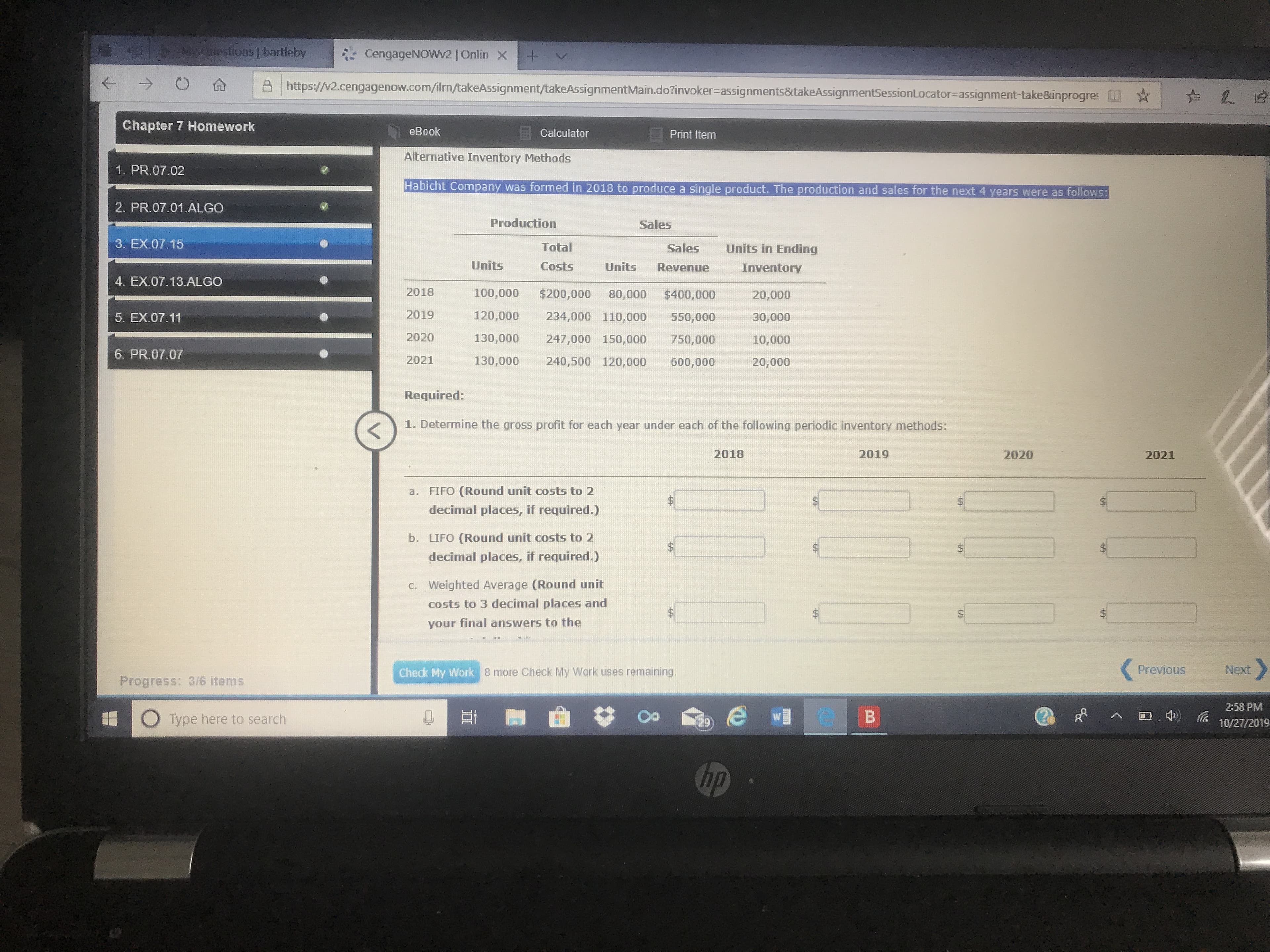

Habicht company was formed in 2018 to produce a single product. The production and sales for the next 4 years were as follows:

Transcribed Image Text:estions 1 bartleby

CengageNOWv21Onlin X

+v

>

https://v2.cengagenow.com/ilm/takeAssignment/takeAssignment Main.do?invoker-assignments&takeAssignmentSessionLocator-assignment-take&inprogres

* 2.

Chapter 7 Homework

eBook

Calculator

Print Item

Alternative Inventory Methods

1. PR.07.02

Habicht Company was formed in 2018 to produce a single product. The production and sales for the next 4 years were as follows:

2. PR.07.01.ALGO

Production

Sales

3. EX.07.15

Total

Units in Ending

Sales

Units

Units

Costs

Revenue

Inventory

4. EX.07.13.ALGO

2018

$200,000

100,000

$400,000

80,000

20,000

2019

120,000

234,000 110,000

5. EX.07.11

550,000

30,000

2020

247,000 150,000

130,000

10,000

750,000

6. PR.07.07

2021

130,000

240,500 120,000

20,000

600,000

Required:

1. Determine the gross profit for each year under each of the following periodic inventory methods:

2018

2019

2020

2021

a. FIFO (Round unit costs to 2

decimal places, if required.)

b. LIFO (Round unit costs to 2

decimal places, if required.)

c. Weighted Average (Round unit

costs to 3 decimal places and

your final answers to the

Previous

Next

Check My Work

8 more Check My Work uses remaining.

Progress: 3/6 items

2:58 PM

B

A 4))

O Type here to search

29

10/27/2019

hp

64

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 5 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781305653535

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Accounting Information Systems

Finance

ISBN:

9781337552127

Author:

Ulric J. Gelinas, Richard B. Dull, Patrick Wheeler, Mary Callahan Hill

Publisher:

Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:

9781111581565

Author:

Gaylord N. Smith

Publisher:

Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:

9781337788281

Author:

James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:

Cengage Learning