Debit $18,000 9,700 2,000 23,000 No. 101 Cash 126 Supplies 128 Prepaid insurance 167 Equipment 168 Accumulated depreciation-Equipment 301 A. Cruz, Capital 302 A. Cruz, Withdrawals 404 Services revenue 612 Depreciation expense-Equipment 622 Salaries expense 637 Insurance expense 640 Rent expense Account Title Credit $ 6,500 44,439 6,000 35,500 2,000 20,697 1,491 2,379 1,172 $86,439 $86,439 652 Supplies expense Totals 1. Prepare the December 31, closing entries for Cruz Company. Assume the account number for Income Summary is 901. 2. Prepare the December 31, post-closing trial balance for Cruz Company. Note: A. Cruz, Capital was $44,439 on Decemb prior year.

Debit $18,000 9,700 2,000 23,000 No. 101 Cash 126 Supplies 128 Prepaid insurance 167 Equipment 168 Accumulated depreciation-Equipment 301 A. Cruz, Capital 302 A. Cruz, Withdrawals 404 Services revenue 612 Depreciation expense-Equipment 622 Salaries expense 637 Insurance expense 640 Rent expense Account Title Credit $ 6,500 44,439 6,000 35,500 2,000 20,697 1,491 2,379 1,172 $86,439 $86,439 652 Supplies expense Totals 1. Prepare the December 31, closing entries for Cruz Company. Assume the account number for Income Summary is 901. 2. Prepare the December 31, post-closing trial balance for Cruz Company. Note: A. Cruz, Capital was $44,439 on Decemb prior year.

College Accounting (Book Only): A Career Approach

13th Edition

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:Scott, Cathy J.

Chapter12: Financial Statements, Closing Entries, And Reversing Entries

Section: Chapter Questions

Problem 4PB: The following accounts appear in the ledger of Sheldon Company on January 31, the end of this fiscal...

Related questions

Question

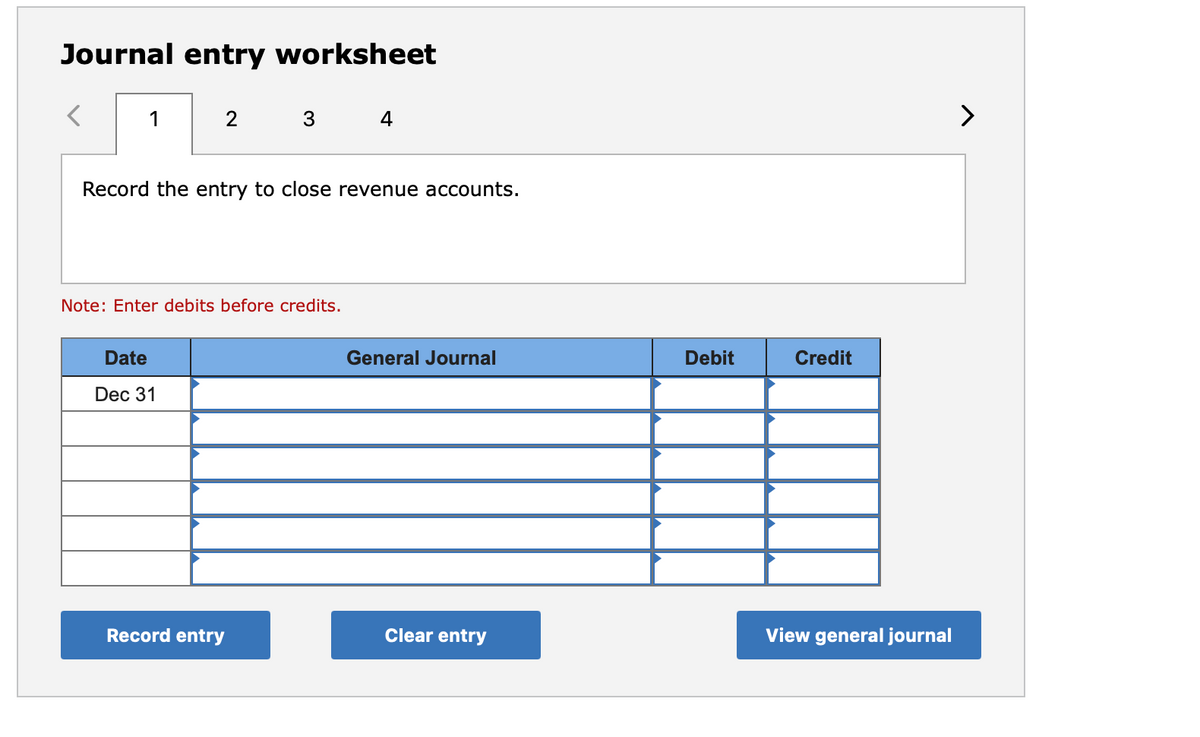

Transcribed Image Text:Journal entry worksheet

1

3

4

>

Record the entry to close revenue accounts.

Note: Enter debits before credits.

Date

General Journal

Debit

Credit

Dec 31

Record entry

Clear entry

View general journal

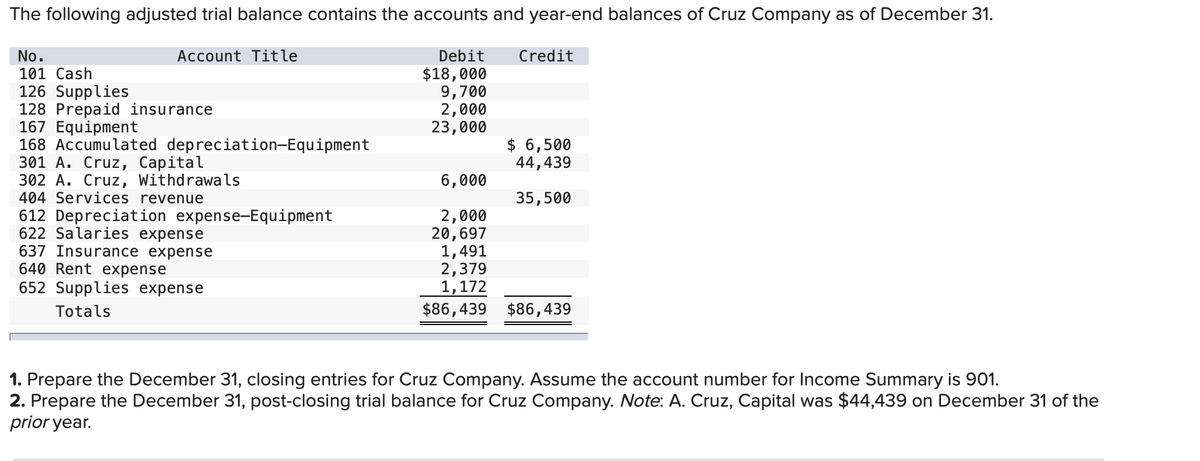

Transcribed Image Text:The following adjusted trial balance contains the accounts and year-end balances of Cruz Company as of December 31.

No.

Account Title

Debit

Credit

$18,000

9,700

2,000

23,000

101 Cash

126 Supplies

128 Prepaid insurance

167 Equipment

168 Accumulated depreciation-Equipment

301 A. Cruz, Capital

302 A. Cruz, Withdrawals

404 Services revenue

$ 6,500

44,439

6,000

35,500

612 Depreciation expense-Equipment

622 Salaries expense

637 Insurance expense

640 Rent expense

652 Supplies expense

2,000

20,697

1,491

2,379

1,172

$86,439 $86,439

Totals

1. Prepare the December 31, closing entries for Cruz Company. Assume the account number for Income Summary is 901.

2. Prepare the December 31, post-closing trial balance for Cruz Company. Note: A. Cruz, Capital was $44,439 on December 31 of the

prior year.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Recommended textbooks for you

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:

9781337280570

Author:

Scott, Cathy J.

Publisher:

South-Western College Pub

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial Accounting

Accounting

ISBN:

9781337272124

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:

9781947172685

Author:

OpenStax

Publisher:

OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,