decided to increase production to five trucks. The following graph gives the demand curve faced by Femi's HookNLadder. As the graph shows, in order to sell the additional fire truck, Femi must lower the price from $105,000 to $90,000 per truck. Notice that Femi gains revenue from the sale of the additional engine, but at the same time, he loses revenue from the initial four engines because they are all sold at the lower price. Use the purple rectangle (diamond symbols) to shade the area representing the revenue lost from the initial four engines by selling at $90,000 rather than $105,000. Then use the green rectangle (triangle symbols) to shade the area representing the revenue gained from selling an additional engine at $90,000. PRICE (Thousands of dollars per fire engine) Femi 165 150 135 120 105 90 75 60 45 30 15 0 0 1 + 2 Demand 6 3 4 5 QUANTITY (Fire engines) 7 8 9 10 Revenue Lost Revenue Gained increase production from 4 to 5 fire engines because the dominates in this scenario. True or False: If alternatively Femi's HookNLadder were a competitive firm and $105,000 were the market price for an engine, increasing production would not affect the price at which the company is able to sell engines. O True

decided to increase production to five trucks. The following graph gives the demand curve faced by Femi's HookNLadder. As the graph shows, in order to sell the additional fire truck, Femi must lower the price from $105,000 to $90,000 per truck. Notice that Femi gains revenue from the sale of the additional engine, but at the same time, he loses revenue from the initial four engines because they are all sold at the lower price. Use the purple rectangle (diamond symbols) to shade the area representing the revenue lost from the initial four engines by selling at $90,000 rather than $105,000. Then use the green rectangle (triangle symbols) to shade the area representing the revenue gained from selling an additional engine at $90,000. PRICE (Thousands of dollars per fire engine) Femi 165 150 135 120 105 90 75 60 45 30 15 0 0 1 + 2 Demand 6 3 4 5 QUANTITY (Fire engines) 7 8 9 10 Revenue Lost Revenue Gained increase production from 4 to 5 fire engines because the dominates in this scenario. True or False: If alternatively Femi's HookNLadder were a competitive firm and $105,000 were the market price for an engine, increasing production would not affect the price at which the company is able to sell engines. O True

Microeconomics: Private and Public Choice (MindTap Course List)

16th Edition

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Chapter7: Consumer Choice And Elasticity

Section: Chapter Questions

Problem 13CQ: Suppose Erin, the owner-manager of a local hotel projects the following demand for her rooms: a....

Related questions

Question

Femi _______ increase production from 4 to 5 fire engines because the _______ dominates in this scenario.

Blank 1 options:

should

should not

Blank 2 options:

output effect

price effect

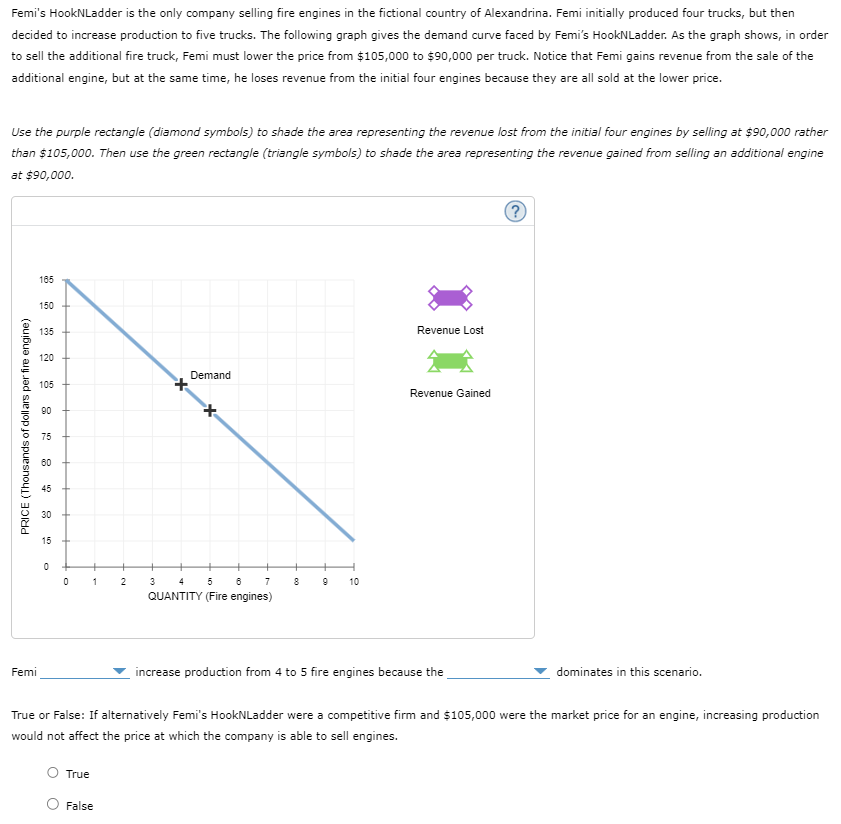

Transcribed Image Text:Femi's HookNLadder is the only company selling fire engines in the fictional country of Alexandrina. Femi initially produced four trucks, but then

decided to increase production to five trucks. The following graph gives the demand curve faced by Femi's HookNLadder. As the graph shows, in order

to sell the additional fire truck, Femi must lower the price from $105,000 to $90,000 per truck. Notice that Femi gains revenue from the sale of the

additional engine, but at the same time, he loses revenue from the initial four engines because they are all sold at the lower price.

Use the purple rectangle (diamond symbols) to shade the area representing the revenue lost from the initial four engines by selling at $90,000 rather

than $105,000. Then use the green rectangle (triangle symbols) to shade the area representing the revenue gained from selling an additional engine

at $90,000.

PRICE (Thousands of dollars per fire engine)

Femi

165

150

135

120

105

90

75

60

45

30

15

0 + + +

0

1 2

True

Demand

False

3 4 5 6 7

QUANTITY (Fire engines)

8

9

10

Revenue Lost

Revenue Gained

increase production from 4 to 5 fire engines because the

(?)

True or False: If alternatively Femi's HookNLadder were a competitive firm and $105,000 were the market price for an engine, increasing production

would not affect the price at which the company is able to sell engines.

dominates in this scenario.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Recommended textbooks for you

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Microeconomics: Private and Public Choice (MindTa…

Economics

ISBN:

9781305506893

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics: Private and Public Choice (MindTap Cou…

Economics

ISBN:

9781305506725

Author:

James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:

Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:

9781337617383

Author:

Roger A. Arnold

Publisher:

Cengage Learning