The Metlock Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Metlock has decided to locate a new factory in the Panama City area. Metlock will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $ 610.600, useful life 27 years. Building B: Lease for 27 years with annual lease payments of $ 70,870 being made at the beginning of the year. Building C: Purchase for $ 657,200 cash. This building is larger than needed; however, the excess space can be sublet for 27 years at a net annual rental of $ 6,110. Rental payments will be received at the end of each year. The Metlock Inc. has no aversion to being a landlord.

The Metlock Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the Sunbelt. In order to do so, Metlock has decided to locate a new factory in the Panama City area. Metlock will either buy or lease a site depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following three very similar buildings that will meet their needs. Building A: Purchase for a cash price of $ 610.600, useful life 27 years. Building B: Lease for 27 years with annual lease payments of $ 70,870 being made at the beginning of the year. Building C: Purchase for $ 657,200 cash. This building is larger than needed; however, the excess space can be sublet for 27 years at a net annual rental of $ 6,110. Rental payments will be received at the end of each year. The Metlock Inc. has no aversion to being a landlord.

Survey of Accounting (Accounting I)

8th Edition

ISBN:9781305961883

Author:Carl Warren

Publisher:Carl Warren

Chapter12: Differential Analysis And Product Pricing

Section: Chapter Questions

Problem 2CDQ

Related questions

Question

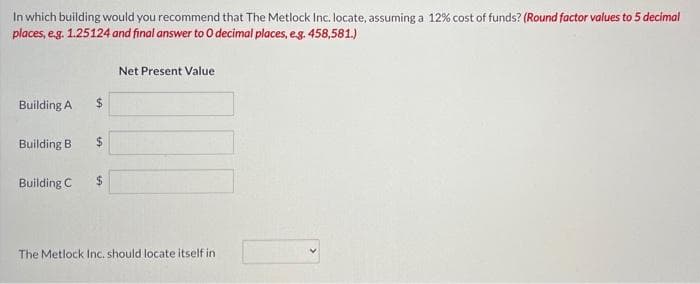

Transcribed Image Text:In which building would you recommend that The Metlock Inc. locate, assuming a 12% cost of funds? (Round factor values to 5 decimal

places, eg. 1.25124 and final answer to O decimal places, eg. 458,581.)

Net Present Value

Building A

$4

Building B

%24

Building C

24

The Metlock Inc. should locate itself in

Transcribed Image Text:The Metlock Inc., a manufacturer of low-sugar, low-sodium, low-cholesterol TV dinners, would like to increase its market share in the

Sunbelt. In order to do so, Metlock has decided to locate a new factory in the Panama City area, Metlock will either buy or lease a site

depending upon which is more advantageous. The site location committee has narrowed down the available sites to the following

three very similar buildings that will meet their needs.

Building A: Purchase for a cash price of $ 610,600, useful life 27 years.

Building B: Lease for 27 years with annual lease payments of $ 70,870 being made at the beginning of the year.

Building C: Purchase for $ 657,200 cash. This building is larger than needed; however, the excess space can be sublet for 27 years at a

net annual rental of $ 6,110. Rental payments will be received at the end of each year. The Metlock Inc. has no aversion to being a

landlord.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 3 steps

Recommended textbooks for you

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Essentials of Business Analytics (MindTap Course …

Statistics

ISBN:

9781305627734

Author:

Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:

Cengage Learning

Intermediate Financial Management (MindTap Course…

Finance

ISBN:

9781337395083

Author:

Eugene F. Brigham, Phillip R. Daves

Publisher:

Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning