Department of computer information systems Financial accounting exam 2 Proper Both General Journal and General Ledger from the Transaction Given 1- Accounting period: are the jobs defined by law for a year starting from.. ending and .of each year, as the basis for calculation, the. -. or profit achieved by the On project . 2- On 1/1 the merchant started his business with a capital of (100,000) deposited in the bank. 3- 1\1 The merchant started his business with a capital of (10,000), which 2000 was cash and the rest was opened for the bank account.

Department of computer information systems Financial accounting exam 2 Proper Both General Journal and General Ledger from the Transaction Given 1- Accounting period: are the jobs defined by law for a year starting from.. ending and .of each year, as the basis for calculation, the. -. or profit achieved by the On project . 2- On 1/1 the merchant started his business with a capital of (100,000) deposited in the bank. 3- 1\1 The merchant started his business with a capital of (10,000), which 2000 was cash and the rest was opened for the bank account.

Cornerstones of Financial Accounting

4th Edition

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Jay Rich, Jeff Jones

Chapter2: The Accounting Information System

Section: Chapter Questions

Problem 30BE: Brief Exercise 2-30 Transaction Analysis Galle Inc. entered into the following transactions during...

Related questions

Topic Video

Question

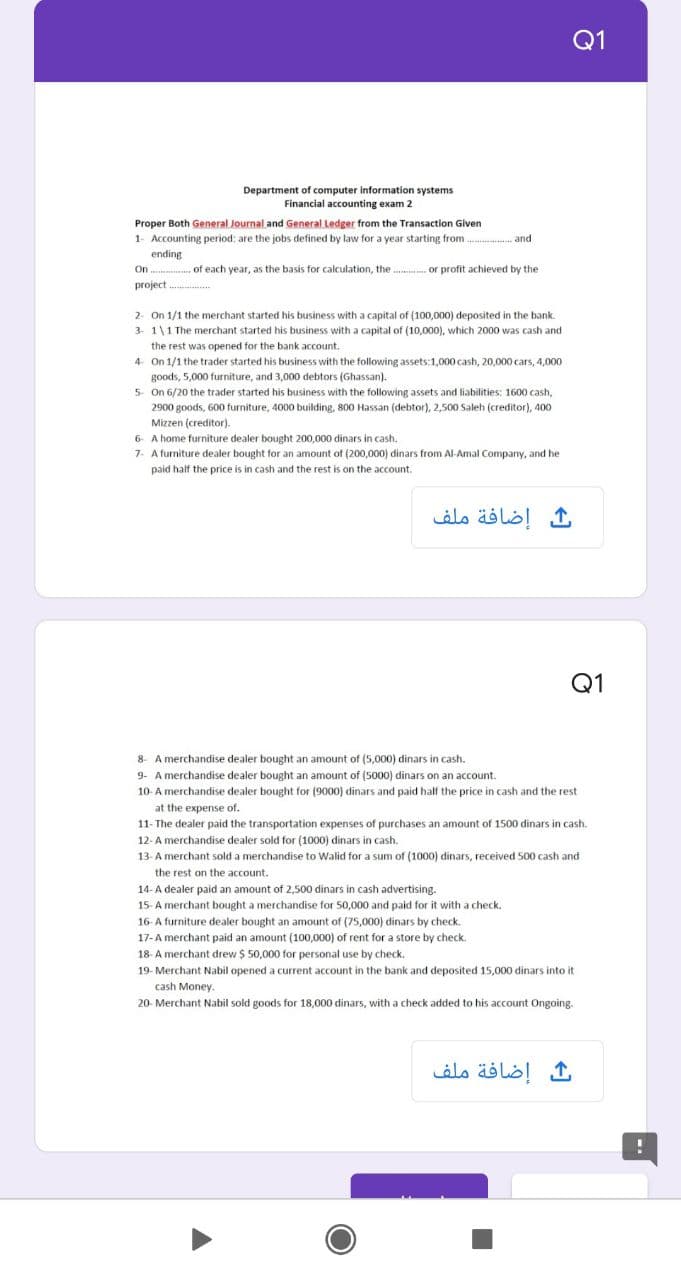

Transcribed Image Text:Q1

Department of computer information systems

Financial accounting exam 2

Proper Both General Journal and General Ledger from the Transaction Given

1- Accounting period: are the jobs defined by law for a year starting from.

and

ending

of each year, as the basis for calculation, the . or profit achieved by the

On

project.

2. On 1/1 the merchant started his business with a capital of (100,000) deposited in the bank.

3- 1\1 The merchant started his business with a capital of (10,000), which 2000 was cash and

the rest was opened for the bank account.

4 On 1/1 the trader started his business with the following assets:1,000 cash, 20,000 cars, 4,000

goods, 5,000 furniture, and 3,000 debtors (Ghassan).

5- On 6/20 the trader started his business with the following assets and liabilities: 1600 cash,

2900 goods, 600 furniture, 4000 building, 800 Hassan (debtor), 2,500 Saleh (creditor), 400

Mizzen (creditor).

6- A home furniture dealer bought 200,000 dinars in cash.

7- A furniture dealer bought for an amount of (200,000) dinars from Al-Amal Company, and he

paid half the price is in cash and the rest is on the account.

إضافة ملف

Q1

8- A merchandise dealer bought an amount of (5,000) dinars in cash.

9- A merchandise dealer bought an amount of (5000) dinars on an account.

10- A merchandise dealer bought for (9000) dinars and paid half the price in cash and the rest

at the expense of.

11- The dealer paid the transportation expenses of purchases an amount of 1500 dinars in cash.

12- A merchandise dealer sold for (1000) dinars in cash.

13- A merchant sold a merchandise to Walid for a sum of (1000) dinars, received 500 cash and

the rest on the account.

14-A dealer paid an amount of 2,500 dinars in cash advertising.

15- A merchant bought a merchandise for 50,000 and paid for it with a check.

16- A furniture dealer bought an amount of (75,000) dinars by check.

17-A merchant paid an amount (100,000) of rent for a store by check.

18- A merchant drew $ 50,000 for personal use by check.

19- Merchant Nabil opened a current account in the bank and deposited 15,000 dinars into it

cash Money.

20- Merchant Nabil sold goods for 18,000 dinars, with a check added to his account Ongoing.

إضافة ملف

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Cornerstones of Financial Accounting

Accounting

ISBN:

9781337690881

Author:

Jay Rich, Jeff Jones

Publisher:

Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,

College Accounting, Chapters 1-27

Accounting

ISBN:

9781337794756

Author:

HEINTZ, James A.

Publisher:

Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:

9781305961883

Author:

Carl Warren

Publisher:

Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:

9781285866307

Author:

Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:

Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:

9781337398169

Author:

Carl Warren, Jeff Jones

Publisher:

Cengage Learning