Concept explainers

Cornerstone Exercise 2-22 Transaction Analysis

The Mendholm Company entered into the following transactions:

- Performed services on account, 521,500.

- Collected $9,500 from client related to services performed in Item a.

- Find $500 dividend to stockholders.

- Paid salaries of $4,000 for the current month.

(Continued)

Required:

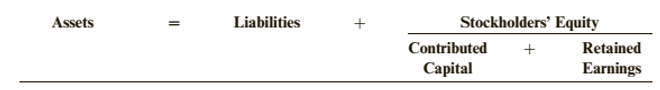

Show the effect of each transaction using the following model:

Concept Introduction:

Transaction Analysis- Every transaction is first analyzed by accountant with the help of accounting equation to see transactions that affects the business event. This is known as transaction analysis which states that each transaction is analyzed to determine the effect of each transaction in two parts or dual effect on each element of an accounting equation so that the equation is in balance. The accounting equation is shown as:

Requirement 1:

To show the effect on Mendholm Company when it performed services on account for $21500.

Answer to Problem 22CE

In this situation, when Mendholm Company performed services on account for $21500, it will increase assets and increases shareholder’s equity by $21500.

Explanation of Solution

When Mendholm Company performed services for which payment will be made later, this is known as ‘sale on account’. This creates an asset called accounts receivable which will be increased by $21500because payment is due from client. Also, revenue is recorded when service is performed and not when cash is received. Thus, retained earnings will also increase by $21500. This effect in accounting equation will be shown as:

Concept Introduction:

Transaction Analysis- Every transaction is first analyzed by accountant with the help of accounting equation to see transactions that affects the business event. This is known as transaction analysis which states that each transaction is analyzed to determine the effect of each transaction in two parts or dual effect on each element of an accounting equation so that the equation is in balance. The accounting equation is shown as:

Requirement 2:

To show the effect on Mendholm Companywhen cash of $9500 is collected from client for services performed on account.

Answer to Problem 22CE

When cash of $9500 is collected from client for services performed on account, it will increase assets for cash received and reduce assets at the same for decrease in accounts receivable created earlier.

Explanation of Solution

In this case, cash is collected from a client for services performed earlier on account which means that asset in the form of cash received has increased for Mendholm Company by $9500. Also, accounts receivable was increased at the time when the services were performed. So, now at the time pf payment, this will be reduced by $9500. Thus, the effect of this transaction on accounting equation will be shown as:

Concept Introduction:

Transaction Analysis- Every transaction is first analyzed by accountant with the help of accounting equation to see transactions that affects the business event. This is known as transaction analysis which states that each transaction is analyzed to determine the effect of each transaction in two parts or dual effect on each element of an accounting equation so that the equation is in balance. The accounting equation is shown as:

Requirement 3:

Toshow the effect on Mendholm Company whendividend of $500 is paid to stock holders.

Answer to Problem 22CE

In this case, if dividend is paid to stock holders, it will decrease assets(cash) and retained earnings from stockholder’s equity by $500.

Explanation of Solution

Dividends when declared are distributed from retained earnings as a contribution in stockholder’s equity fund. Thus, when Mendholm Company is paying dividend it will reduce the retained earnings by $500. Also, since it is cash dividend to stockholders, therefore, it will reduce assets in the form of cash by $500. This will be reflected in accounting equation as:

Concept Introduction:

Transaction Analysis- Every transaction is first analyzed by accountant with the help of accounting equation to see transactions that affects the business event. This is known as transaction analysis which states that each transaction is analyzed to determine the effect of each transaction in two parts or dual effect on each element of an accounting equation so that the equation is in balance. The accounting equation is shown as:

Requirement 4:

To show the effect on Mendholm Company whensalaries of $4000 is paid for current month.

Answer to Problem 22CE

In this case, salaries paid for current month will reduce assets by $4000 and decrease retained earnings by 4000.

Explanation of Solution

Since expense is a cost of asset consumed as a part of operating activity, so salaries are treated as an expense which when paid will reduce the retained earnings. Thus, retained earnings will be reduced by $4000. Also, since salaries are paid in cash, it will reduce assets by $4000. According to expense recognition principle, expenses are recorded in the same period when it helped to generate revenue. Since this transaction is related to Mendholm Company’s operations, therefore, it is classified as an operating activity. This will be shown in accounting equation as:

Want to see more full solutions like this?

Chapter 2 Solutions

Cornerstones of Financial Accounting

- Brief Exercise 2-30 Transaction Analysis Galle Inc. entered into the following transactions during January. Borrowed $50,000 from First Street Bank by signing a new payable. Purchased $25,000 of equipment for cash. (Continued) Paid $500 to landlord for rent for January. Performed services for customers on account, $10,000. Collected $31000 from customers for services performed in Transaction d. Paid salaries of $2,500 for the current month. Required: Show the effect of each transaction using the following model.arrow_forwardExercise 2-43 Transaction Analysis Goal Systems, a business consulting firm, engaged in the following transactions: Issued common stock for $75,000 cash. Borrowed $35,000 from a bank. Purchased equipment for $12,000 cash. Prepaid rent on office space for 6 months in the amount of $7.800. Performed consulting services in exchange for $6,300 cash. Perfumed consulting services on credit in the amount of $18,750. Incurred and paid wage expense of $9,500. Collected $10,200 of the receivable arising from Transaction f. Purchased supplies for $1,800 on credit. Used $1,200 of the supplies purchased in Transaction i. Paid for all of the supplies purchased in Transaction i. Required: For each transaction described above. indicate the effects on assets, liabilities, and stockholders equity using the format below.arrow_forwardBrief Exercise 2-32 Journalize Transactions Galle Inc. entered into the following transactions during January. January, 1: Borrowed $50,000 from First Street Bank by signing a note payable. January, 4: Purchased $25,000 of equipment for cash. January, 6: Paid $500 to landlord for rent for January. January, 15: Performed services for customers on account. $10,000. January, 25: Collected $3,000 from customers for services performed in Transaction d. January, 30: Paid salaries of $2,500 for the current month. Required: Prepare journal entries for the transactions.arrow_forward

- Exercise 2-39 Transaction Analysis OBJECTIVE e The following events occurred for Parker Company. Performed consulting services for a client in exchange for $3,200 cash. Performed consulting services for a client on amount. $1,700. Paid $30,000 cash for land. Purchased office supplies on accounts $900. Paid a $2,500 cash dividend to stockholders. Paid $550 on account for supplies purchased in Transaction d. Paid $800 cash for the current months rent. Collected $1,500 from client in Transaction b. Stockholders invested $20,000 cash in the business. Required: 1. Analyze the effect of each transaction on the accounting equation. For example, if salaries of $500 were paid. the answer would be Decrease in stockholders equity (expense) $500 and decrease in assets (cash) $500. 2. CONCEPTUAL CONNECTION For Event 6, what accounting principle did you use to determine the amount to be recorded for supplies?arrow_forwardBrief Exercise 1-24 The Accounting Equation Financial information for three independent cases is as follows: The liabilities of Dent Company are $82,000, and its stockholders' equity is $120,000. What is the amount of Dents total assets? The total assets of Wayne Inc. are $55,000, and its stockholders' equity is $22,500. What is the amount of Waynes total liabilities? Gordon Companys total assets increased by $60,000 during the year, and its liabilities decreased by $35,000. Did Gordons stockholders' equity increase or decrease? By how much? Required: Determine the missing amount for each case.arrow_forwardTransactions; financial statements 2. Net income: 10,850 On April 1, 20Y8, Maria Adams established Custom Realty. Maria completed the following transactions during the month of April: a. Opened a business bank account with a deposit of 24,000 in exchange for common stock. b. Paid rent on office and equipment for the month, 3,600. c. Paid automobile expenses for month, 1,350, and miscellaneous expenses, 600. d. Purchased supplies on account, 1,200. e. Earned sales commissions, receiving cash, 19,800. f. Paid creditor on account, 750. g. Paid office salaries, 2,500. h. Paid dividends, 3,500. i. Determined that the cost of supplies on hand was 300; therefore, the cost of supplies used was 900. Instructions 1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings: 2. Prepare an income statement for April, a statement of stockholders equity for April, and a balance sheet as of April 30.arrow_forward

- Brief Exercise 3-28 Accrual- and Cash-Basis Accounting The following are several transactions for Halpin Advertising Company. Purchased $1,000 of supplies. 0Sold $5,000 of advertising services, on account, to customers. Used $250 of supplies. Collected $3,000 from customers in payment of their accounts. Purchased equipment for $10,000 cash. Recorded $500 depreciation on the equipment for the current period. Required: Identify the effect, if any, that each of the above transactions would have on net income under cash-basis accounting and accrual-basis accounting.arrow_forwardExercise 2-40 Transaction Analysis Amanda Webb opened a home health care business under the name Home Care Inc. During its first month of operations. the business had the following transactions: Issued common stock to Ms. Webb and other stockholders in exchange for $30,000 cash. Paid $18,500 cash for a parcel of land on which the business will eventually build an office building. Purchased supplies for $2350 on credit. Used the supplies purchased in Transaction c. Paid rent for the month on office space and equipment. $800 cash. Performed services for clients in exchange for $3,910 cash. Paid salaries for the month. $1,100. Paid $650 cash for advertising in the current month. Paid $1,900 on account for supplies purchased in Transaction c. Performed services for clients on credit in the amount of 51,050. Paid a $600 dividend to stockholders Required: Prepare an analysis of the effects of these transactions on the accounting equation of the business. Use the format below.arrow_forwardProblem 2-56A Analyzing Transactions Luis Madero, after working for several years with a large public accounting firm decided to open his own accounting service. The business is operated as a corporation under the name Madero Accounting Services. The following captions and amounts summarize Maderos balance sheet at July 31, 2019. The following events occurred during August 2019. Issued common stock to Ms. Garriz in exchange for $15,000 cash. Paid $850 for first months rent on office space. Purchased supplies of $2,250 on credit. Borrowed $8,000 from the bank. Paid $1,080 on account for supplies purchased earlier on credit. Paid secretarys salary for August of $2,150. Performed amounting services for clients who paid cash upon completion of the service in the total amount of $4,700. Used $3,180 of the supplies on hand. Perfumed accounting services for clients on credit in the total amount of $1,920. Purchased $500 in supplies for cash. Collected $1,290 cash from clients for whom services were performed on credit. Paid $1,000 dividend to stockholders. Required: Record the effects of the transactions listed above on the accounting equation. Use the format given in the problem, starting with the totals at July 31, 20l9. Prepare the trial balance at August 31, 2019.arrow_forward

- Exercise 2-41 Transaction Analysis and Business Activities The accountant for Compton Inc. has collected the following information: Compton purchased a tract of land from Jacobsen Real Estate for $875,000 cash. Compton issued 2,000 shares of its common stock to George Micros in exchange for $125,000 cash. Compton purchased a John Deere tractor for $86,000 on credit. Michael Romano paid Compton $10,400 cash for services performed. The services had been performed by Compton several month ago for a [ma] price of $12,000 of which Rotunno had previously paid $1,600. Compton paid its monthly payroll by issuing checks totaling $36,250. Compton declared and paid its annual dividend of $5,000 cash Required: 1. Prepare an analysis of the effects of these transactions on the accounting equation of the business. Use the format below. 2. Indicate whether the transaction is a financing, investing, or operating activity.arrow_forwardTransactions; financial statements On August 1, 2018, Brooke Kline established Western Realty. Brooke completed the following transactions during the month of August: A. Opened a business bank account with a deposit of 35,000 in exchange for common stock. B. Purchased supplies on account, 2,750. C. Paid creditor on account, 1,800. D. Earned sales commissions, receiving cash, 52,800. E. Paid rent on office and equipment for the month, 4,500. F. Paid dividends, 3,000. G. Paid automobile expenses for month, 1,100, and miscellaneous expenses, 1,200. H. Paid office salaries, 5,250. I. Determined that the cost of supplies on hand was 1,750; therefore, the cost of supplies used was 1,000. Instructions 1. Indicate the effect of each transaction and the balances after each transaction, using the following tabular headings:arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,