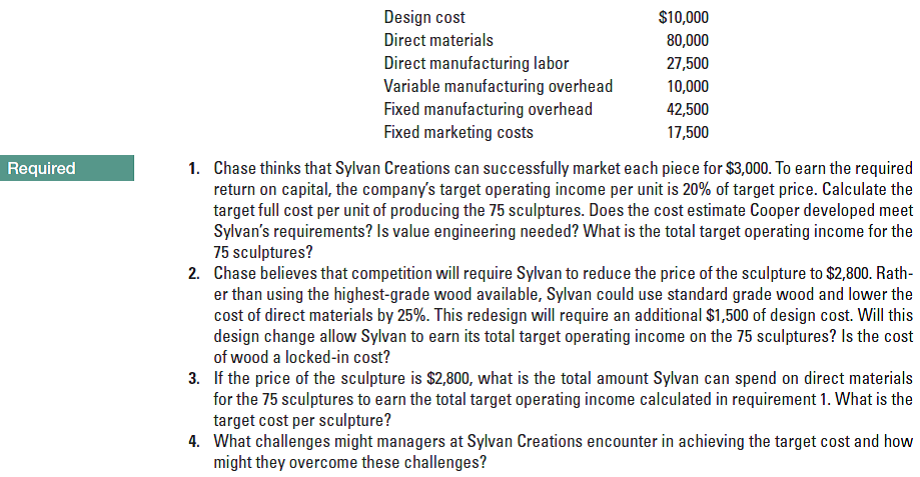

Design cost $10,000 Direct materials 80,000 Direct manufacturing labor Variable manufacturing overhead Fixed manufacturing overhead Fixed marketing costs 27,500 10,000 42,500 17,500 1. Chase thinks that Sylvan Creations can successfully market each piece for $3,000. To earn the required return on capital, the company's target operating income per unit is 20% of target price. Calculate the target full cost per unit of producing the 75 sculptures. Does the cost estimate Cooper developed meet Sylvan's requirements? Is value engineering needed? What is the total target operating income for the 75 sculptures? 2. Chase believes that competition will require Sylvan to reduce the price of the sculpture to $2,800. Rath- er than using the highest-grade wood available, Sylvan could use standard grade wood and lower the cost of direct materials by 25%. This redesign will require an additional $1,500 of design cost. Will this design change allow Sylvan to earn its total target operating income on the 75 sculptures? Is the cost of wood a locked-in cost? Required 3. If the price of the sculpture is $2,800, what is the total amount Sylvan can spend on direct materials for the 75 sculptures to earn the total target operating income calculated in requirement 1. What is the target cost per sculpture? 4. What challenges might managers at Sylvan Creations encounter in achieving the target cost and how might they overcome these challenges?

Design cost $10,000 Direct materials 80,000 Direct manufacturing labor Variable manufacturing overhead Fixed manufacturing overhead Fixed marketing costs 27,500 10,000 42,500 17,500 1. Chase thinks that Sylvan Creations can successfully market each piece for $3,000. To earn the required return on capital, the company's target operating income per unit is 20% of target price. Calculate the target full cost per unit of producing the 75 sculptures. Does the cost estimate Cooper developed meet Sylvan's requirements? Is value engineering needed? What is the total target operating income for the 75 sculptures? 2. Chase believes that competition will require Sylvan to reduce the price of the sculpture to $2,800. Rath- er than using the highest-grade wood available, Sylvan could use standard grade wood and lower the cost of direct materials by 25%. This redesign will require an additional $1,500 of design cost. Will this design change allow Sylvan to earn its total target operating income on the 75 sculptures? Is the cost of wood a locked-in cost? Required 3. If the price of the sculpture is $2,800, what is the total amount Sylvan can spend on direct materials for the 75 sculptures to earn the total target operating income calculated in requirement 1. What is the target cost per sculpture? 4. What challenges might managers at Sylvan Creations encounter in achieving the target cost and how might they overcome these challenges?

Chapter10: Short-term Decision Making

Section: Chapter Questions

Problem 7PB: Remarkable Enterprises requires four units of part A for every unit of Al that it produces....

Related questions

Question

Value engineering, target pricing, and locked-in costs. Sylvan Creations designs, manufactures, and sells modern wood sculptures. Sandra Johnson is an artist for the company. Johnson has spent much of the past month working on the design of an intricate abstract piece. Jim Chase, product development manager, likes the design. However, he wants to make sure that the sculpture can be priced competitively. Ellen Cooper, Sylvan’s cost accountant, presents Chase with the following cost data for the expected production of 75 sculptures:

Transcribed Image Text:Design cost

$10,000

Direct materials

80,000

Direct manufacturing labor

Variable manufacturing overhead

Fixed manufacturing overhead

Fixed marketing costs

27,500

10,000

42,500

17,500

1. Chase thinks that Sylvan Creations can successfully market each piece for $3,000. To earn the required

return on capital, the company's target operating income per unit is 20% of target price. Calculate the

target full cost per unit of producing the 75 sculptures. Does the cost estimate Cooper developed meet

Sylvan's requirements? Is value engineering needed? What is the total target operating income for the

75 sculptures?

2. Chase believes that competition will require Sylvan to reduce the price of the sculpture to $2,800. Rath-

er than using the highest-grade wood available, Sylvan could use standard grade wood and lower the

cost of direct materials by 25%. This redesign will require an additional $1,500 of design cost. Will this

design change allow Sylvan to earn its total target operating income on the 75 sculptures? Is the cost

of wood a locked-in cost?

Required

3. If the price of the sculpture is $2,800, what is the total amount Sylvan can spend on direct materials

for the 75 sculptures to earn the total target operating income calculated in requirement 1. What is the

target cost per sculpture?

4. What challenges might managers at Sylvan Creations encounter in achieving the target cost and how

might they overcome these challenges?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution!

Trending now

This is a popular solution!

Step by step

Solved in 6 steps with 5 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

Cornerstones of Cost Management (Cornerstones Ser…

Accounting

ISBN:

9781305970663

Author:

Don R. Hansen, Maryanne M. Mowen

Publisher:

Cengage Learning

Managerial Accounting

Accounting

ISBN:

9781337912020

Author:

Carl Warren, Ph.d. Cma William B. Tayler

Publisher:

South-Western College Pub

Managerial Accounting: The Cornerstone of Busines…

Accounting

ISBN:

9781337115773

Author:

Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:

Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Financial And Managerial Accounting

Accounting

ISBN:

9781337902663

Author:

WARREN, Carl S.

Publisher:

Cengage Learning,