Determ followir

Q: he beginning of current year, Cash Company reported the following shareholders' e re capital, P5 par...

A: Solution Concept When share dividend is issued the retained earnings is debited When cash dividend i...

Q: EM owns 30% of MOCK's share capital. During the year to 31 December 2011, MOCK sold inventories at t...

A: As per the provision of IAS 28 Investment in associates, unrealised profit from the transaction betw...

Q: subcontracted by the client, specifically in what corresponds to criteria of security, availability,...

A: A SOC for Service Organizations reports are designed to help service organizations that provide ser...

Q: Samra Ltd has 2 000 000 ordinary shares on issue at the beginning of the year, 1 July 2014. These sh...

A: 1. Weighted-average number of shares calculated in accordance with AASB 133 Period Shares Wei...

Q: Adriana Graphic Design receives $2,000 from a client billed in a previous month for services provide...

A: Cash received from client = $2000

Q: Bellinger Industries is considering two projects for inclusion in its capital budget, and you have b...

A: The MIRR is a financial indicator of the acceptability of a project. It is utilized in capital budge...

Q: If assets are $112.000 and liabilities are $38.500. then equity equals: Multiple Cholce $38,500. O $...

A: Assets = $112000 Liabilities = $38500

Q: petitor. If correct, this may have disclosure implications. Management advises you that although the...

A: (a) The auditors prepare a management representation letter, which is signed by the business's senio...

Q: item below that would cause the trial balance to not balance? ple Cholce ) A $1,260 collection of an...

A: Trial Balance is a summarizing statement in which balances of all ledger accounts are summarized. In...

Q: The cashier of a company bought one calculator for office used. The invoice was given to the account...

A: Accounting principle are the rules for recording/presenting financial transaction which needs to be ...

Q: An entity shall offset a deferred tax asset and deferred tax liability A. When income taxes are lev...

A: As per IAS 12 - Income Taxes, An entity shall offset a deferred tax asset and deferred tax liability...

Q: Calculate Applesoft's Gross Profit Margin for the year ended December 31. Round to the

A: Gross Profit Gross profit is the profit a business makes after subtracting all the costs that are di...

Q: Tom works for Hot Chicken Ltd. He receives an annual salary of $80 000. He is also entitled to four ...

A: Cost of Annual Leave: It is appropriate for every employee to be compensated for the time they have ...

Q: . Johnnie Lazy has a Php47,000 capital balance in a partnership. He personally sells his interest to...

A: solution fact of the case Johnnie Lazy has a capital balance of 47000 in a partnership He personall...

Q: On March 31, 2021, Gardner Corporation received authorization to issue $50,000 of 9 percent, 30-year...

A: Note:- Since you have posted a question with multiple sub-parts, we will solve the first three sub-p...

Q: A/P R/E $253 Cash RM WIP FG МОН PP&E Beg $39 $89 $14 $19 $120 $28 a. b. с. d. е. f. g. h. i. j. k. E...

A: Calculation of actual overhead Salary and wages (70% x 50) 35 Depreciation on PP&E (90% ...

Q: Merchant Abdul Rahman imported 1,000 baby strollers from abroad, at a value of 200,000 shekels, in a...

A: Price Price of 1000 strollers 200000 Shipping cost 10000 Custom duties (10% x 200000) + (5 ...

Q: Which of the following does not appear in a statement of retained earnings? a. Net loss b. Prior pe...

A: The statement of retained earnings is a financial statement that reflects changes in retained earnin...

Q: Locky Privetra is considering investing in Sea Lounge Ltd (SLL), a large cruise ship company. Locky ...

A: Here related with the fact of Audit opinion and assurance which are provided by the auditors to fina...

Q: The following table shows income statement and balance sheet data for five U.S. industries in 2017. ...

A: Solution Cash cycle Expresses how manu days it takes a company to convert cash in to inventory and t...

Q: The following data are available for the Valentine Corporation for a recent month: Product A Product...

A: Answer) Calculation of Weighted Average Contribution Margin Ratio Product A Product B Pr...

Q: Which of the following statements is not true concerning interim financial reporting and inventories...

A: Companies that use the LIFO method may encounter a liquidation of base period inventories at an inte...

Q: The following information is available for Cubic Company before closing the accounts. After all clos...

A: All revenues are closed by crediting the income summary account and expenses are closed by debiting ...

Q: Establishes the tax differences between individuals and corporations in the United States.

A: Disclaimer: “Since you have asked multiple question, we will solve the first question for you. If yo...

Q: MOWGLI Company provided the following information for the year ended December 31, 2021. Contribution...

A: 1. Income Statement - This statement shows the income earned and loss incurred by the organization i...

Q: igh Country, Inc., produces and sells many recreational products. The company has just opened a new ...

A: 1a: Computation of Unit Product Cost - Absorption Costing Particulars Per unit Unit Product C...

Q: VAL HELSING Company provided the following information on December 31, 2021: Accounts payable (net o...

A: Current liabilities: Liabilities that have to be paid within one year or one operating cycle, whiche...

Q: On November 1, Jasper Company loaned another company $270,000 at a 8.0% interest rate. The note rece...

A: Interest revenue reported in first year = Amount of loan x rate of interest x No. of months / 12

Q: 20. Record the entry for write-off $ By the end of the year (December 31st); total accounts written ...

A: Solution:- Given, MB inc., allowances for uncollectible accounts has a beginning balance of $6,500. ...

Q: On 1 July 2020, B Ltd acquired all the assets and liabilities of P Ltd. In exchange for these assets...

A: Business Combination: In a business combination, the acquirer gets ownership of another company via ...

Q: Chuzzle Company used the direct method to prepare the statement of cash flows. The entity had the fo...

A: A statement of cash flow gives information about the flow of cash in the business. This statem...

Q: During Heaton Company’s first two years of operations, it reported absorption costing net operating ...

A: The income statement can be prepared using various methods as variable costing and absorption costin...

Q: On Separate 1, Erika Company Purchased land $47,500 cash. Prepare the journal entry for this transac...

A: Increase in assets should be debited. Decrease in assets should be credited. Given, land purchased f...

Q: Worksheet elimination 1 will include only the subsidiary’s stock (par value and additional paid-in c...

A: Worksheet in consolidation is tool which is used in the preparation of consolidation of financial st...

Q: Q1. The balance in the unearned rent account for Jones Co. as of December 31 is $1,200. If Jones Co....

A: Unearned rent is the amount of revenue received in advance. It is in the nature of liability. The am...

Q: Rose Company has a relevant range of production between 10,000 and 25,000 units. The following cost ...

A: Disclaimer: “Since you have posted a question with multiple sub-parts, we will solve first three sub...

Q: If equity is $310,000 and liabilities are $193,000, then assets equal: Multiple Cholce $117,000. $19...

A: Equity = $310000 Liabilities = $193000

Q: Intra group Transactions Kent Ltd owns all the share capital of Lodh Ltd. That is, Lodh Ltd is a w...

A: The question is related to Consolidated Financial Statements. Kent is a parent company of Lodh Ltd. ...

Q: Angel owned a property costing Php. 2,000,000.00. She exchanged her property with the lot of Princes...

A: Lets understand the basics. When asset is transfer for non monetary consideration then exchange shou...

Q: HELL'S KITCHEN Company has the following accounts information for the year ended December 31, 2021. ...

A: Total assets includes both Current assets and Non current assets. Current assets: Current assets are...

Q: Chuzzle Company used the direct method to prepare the statement of cash flows. The entity had the fo...

A: Net cash provided by investing activities will include Cash receipts from dividends on long-term inv...

Q: At the beginning of current year, Cash Company reported the following shareholders' equity: Share ca...

A: Retained earnings are that part of a total profit of a company that is retained after paying all cos...

Q: Journalize the selected transactions. Assume 360 days per year. Description choices are: Accounts P...

A: The journal entries are prepared to record day to day transactions of the business on regular basis....

Q: Healesville Sanctuary is a family-owned and operated wildlife park located in Melbourne. Healesville...

A: Here asked different scenario in which the decision which are taken from Auditors for these differen...

Q: Intra group Transactions Kent Ltd owns all the share capital of Lodh Ltd. That is, Lodh Ltd is a w...

A: Solution Share capital is the money a company raises by issuing common stock or preferred stock.

Q: The following information is available for the year-ended December 31, 2022 for Sport Court Resurfac...

A: Sport Court Resurfacing (SCR) Corporation For the Year Ended Dec 31, 2022 Journal Entry Date A...

Q: The following information is for ChiSox corporation DM 100 DL 80 Insurance - Factory 24 Insurance - ...

A: Conversion cost is the sum of all direct labor and manufacturing overheads. In the problem above, ...

Q: A project has annual cash flows of $3,000 for the next 10 years and then $5,500 each year for the fo...

A: IRR is the rate on which present value of cash inflows and present values of cash outflows are equal...

Q: In a business combination, the acquiree is the business that: Select one: a. Finances the business c...

A: Acquiree An acquiree is a target company that is subject to an acquisition attempt by an acquirer. A...

Q: I want to have 6000000 when I retire on April 18, 2055. I plan on making annual equal payments start...

A: Future Value: Using an expected rate of growth, future value (FV) is defined as the worth of a prese...

Step by step

Solved in 4 steps

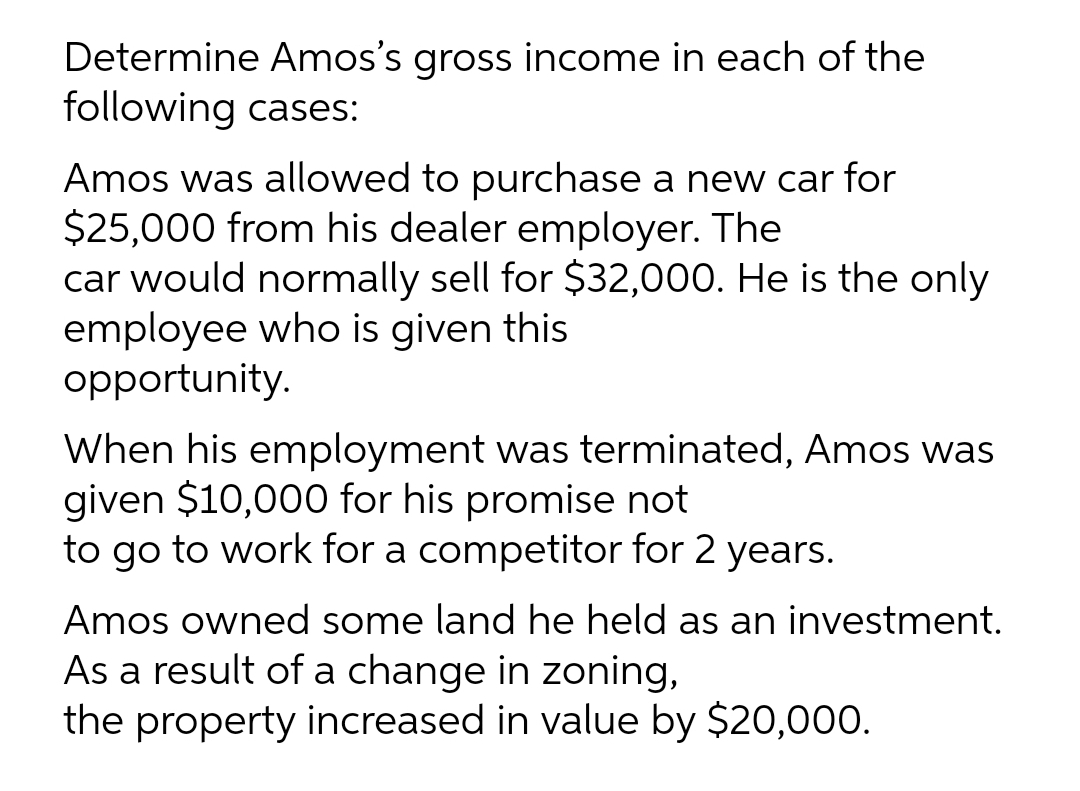

- Determine whether the taxpayer has income that is subject to taxation in each of the following situations: a. Capital Motor Company is going out of business. As a result, June is able to purchase a car for 12,000; its original sticker price was 25,000. b. Chuck is the sole owner of Ransom, Inc., a corporation. He purchases a machine from Ransom for 10,000. Ransom had paid 50,000 for the machine, which was worth 30,000 at the time of the sale to Chuck. c. Gerry is an elementary school teacher. She receives the Teacher of the Month Award for February. As part of the award, she gets to drive a new car supplied by a local dealer for a month. The rental value of the car is 400 per month. d. Payne has worked for Stewart Company for the last 25 years. On the 25th anniversary of his employment with Stewart, he receives a set of golf clubs worth 1,200 as a reward for his years of loyal service to the company. e. Anna enters a sweepstakes contest that was advertised on the back of a cereal box, and wins 30,000. The prize will be paid out in 30 annual installments of 1,000. She receives her first check this year. f. Terry buys an antique vase at an estate auction for 780. Upon returning home, she accidentally drops the vase and finds that a 100 bill had been taped inside it.Terry traveled to a neighboring state to investigate the purchase of two hardware stores. His expenses included travel, legal, accounting, and miscellaneous expenses. The total was 52,000. He incurred the expenses in June and July 2019. Under the following circumstances, what can Terry deduct in 2019? a. Terry was in the hardware store business and did not acquire the two hardware stores. b. Terry was in the hardware store business and acquired the two hardware stores and began operating them on October 1, 2019. c. Terry did not acquire the two hardware stores and was not in the hardware store business. d. Terry acquired the two hardware stores but was not in the hardware store business when he acquired them. Operations began on October 1, 2019.Which of the following will result in the recognition of gross income? Gail's employer allows her to set aside $ 4,000 from her wages to cover the cost of daycare for Gail's four-year-old daughter. Gail's daycare costs are $ 4,300 for the year. Hannah purchases a new sofa from her employer, Sofas-R-Us, for $ 1,200. The cost of the sofa to the furniture store is $ 1,100 and the sofa normally sells for $ 1,700. Jayden's employer purchases her commuting pass for the subway at a cost of $ 225 per month. Havana is a lawyer. The law firm she works for pays for her subscription to Lawyer's Weekly, a trade magazine for attorneys. None of the above will result in recognition of gross income.