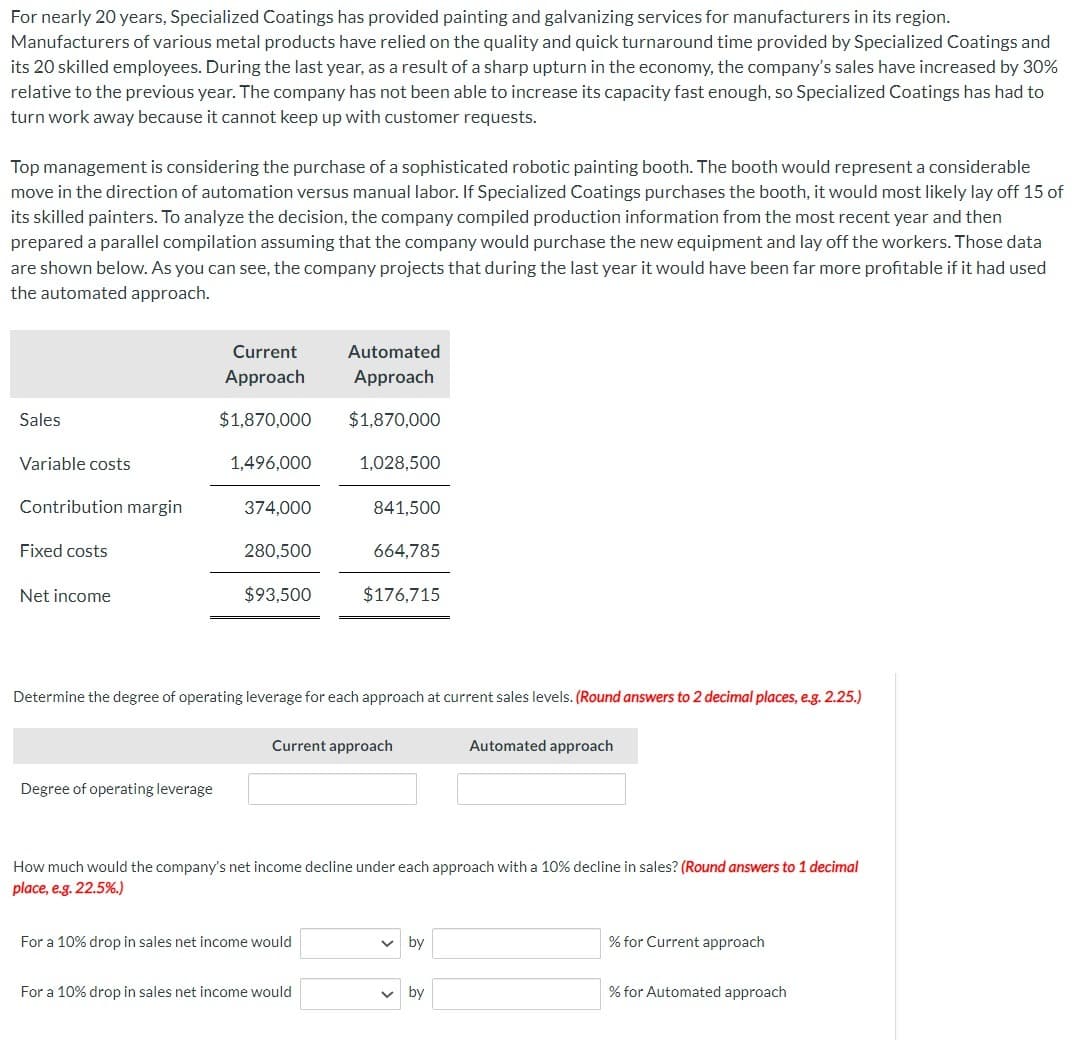

Determine the degree of operating leverage for each approach at current sales levels. (Round answers to 2 decimal places, e.g. 2.25.) Degree of operating leverage Current approach How much would the company's net income decline under each approach with a 10% decline in sales? (Round answers to 1 decimal place, e.g. 22.5%.) For a 10% drop in sales net income would For a 10% drop in sales net income would by Automated approach by % for Current approach % for Automated approach

Q: Given the following information, calculate the net present value: Initial outlay is $50,000;…

A: The NPV of a project refers to the measure of the profitability of the project as it discounts the…

Q: A company issued $500,000 of bonds for $498,351. Interest is paid semiannually. The bond markets and…

A: if bond is issued at lower value and redeemed at premium it is said to be issued at discounthere in…

Q: principal and an agent, granting speci behalf of the principal. This is an example of:

A: Agent and principal are related in such a way that principal is bound by the activities undertaken…

Q: Sidman Products's common stock currently sells for $42 a share. The firm is expected to earn $3.36…

A: We need to use constant growth model to calculate growth rate. P0 = D1/(rs-g) Where D 1 =next…

Q: How does a manager differentiate when to use capital budgeting versus simple return on investment…

A: The objective of the question is to understand the circumstances under which a manager would choose…

Q: In you cash account, you buy 100 shares of XYZ Corporation at a price of $10 per share. Two months…

A: Rate of return is the amount which is earned by the investor on his investment. It includes the…

Q: quired yield to maturity on a comparable-risk bono 10 percent. Compute the bond's yield to maturity.…

A: Yield to maturity is the rate of return realized on bond when bond is held till maturity of bond and…

Q: Carnes Cosmetics Co.'s stock price is $38, and it recently paid a $2.25 dividend. This dividend is…

A: Current Price of Stock = p0 = $38Current Dividend = d0 = $2.25Growth Rate for first Year 3 = g3 =…

Q: Five years ago, you purchased a $1,000 par value corporate bond with an interest rate of 5 percent.…

A: A bond is a kind of debt security issued by the government and private companies to the public for…

Q: I management is considering investing in two alternative Production systems. The systems are…

A: Internal rate of return: Discount rate of a project wherein its net present value equals zero.…

Q: What should be the amount in an RRSP that is earning 7.00% compounded quarterly if it can be…

A: Present Value: The present value is the value of cash flow stream or the fixed lump sum amount at…

Q: There are two firms: Firm U and Firm L. Both firms have $30,000 total assets and $5,000 EBIT…

A: Earnings Per Share (EPS) is a financial metric that measures the portion of a company's profit…

Q: A rich man deposits money at a bank with 11.28% interest compounded annually 5 years ago. After…

A: Total money received can be obtained by multiplying the total monthly payment multiplied by number…

Q: Dakota Mining Company has two competing proposals: a diamond core drill or a hydraulic excavator.…

A: Net present value(NPV) is the difference between present value of all cash inflows and initial…

Q: You bought a stock one year ago for $48.48 per share and sold it today for $56.08 per share. It paid…

A: We invest in stocks with an expectation to earn returns. The returns come from two main forms.…

Q: Beale Manufacturing Company has a beta of 1.9, and Foley Industries has a beta of 0.3. The required…

A: CAPME(ri) = Rf + Bi * (E(Rm) - Rf)E(ri) = Expected returnRf = Risk free rateBi = BetaE(Rm) =…

Q: A stock has had the following year-end prices and dividends: Year 1 Price $64.68 2 3 71.55 77.35…

A: Calculation of arithmetic and geometric mean:Excel working with formula:

Q: 8: Calculate the cross rate between the Costa Rican colón (CRC) and the Canadian dollar (CAD) from…

A: In doing international business sometime, to convert into another currency indirectly third currency…

Q: A professional soccer player has a deferred compensation annuity that pays her $2,400 at the end of…

A: Present value refers to the current value of the future cash flows when discounted for the given…

Q: Suppose a sixy ear bond is purchased for $4800. The face value of the bond when it matures is $7032.…

A: Time = t = 6 YearsPrice of Bond = pv = $4800Face Value = fv = $7032

Q: Computech Corporation is expanding rapidly and currently needs to retain all of its earnings; hence,…

A: According to Gordon's growth model,P = whereP= stock priceD= dividend paidg= growth rater= required…

Q: The financial statements of Friendly Fashions include the following selected data (in millions) is…

A: Ratio analysis aids in decision-making by assisting stakeholders in comprehending a company's…

Q: Vilas Company is considering a capital investment of $202,400 in additional productive facilities.…

A: Payback period is the time required to recover initial investment.NPV means Net present value .It is…

Q: Management of Drake Awesomeness, Inc., is currently evaluating three projects that are independent.…

A: NPV is also known as Net Present Value.. It is a capital budgeting technique which helps in decision…

Q: Reference is made to the 2022 Balance Sheet of Tram-Ropes limited. Tram- Ropes Limited Cash…

A: WACC is weighted cost of equity, weighted cost of debt and weighted cost of preferred stock and is…

Q: Oriole Corp. issues bonds with a face value of $325 million that mature in 14 years. The bonds carry…

A: A bond is a kind of debt security issued by the government and private companies to the public for…

Q: The Human Resources Manager at City Bank indicated that she considered expectancy theory when…

A: The concept where the level of performance can be achieved if enough effort is expended by the…

Q: The next dividend payment by Savitz, Incorporated, will be $2.25 per share. The dividends are…

A: The minimal rate of profit or gain that an investor needs to offset the risk they take on an…

Q: What is the average annual growth rate for Duke Energy's recent dividends? Year 2022 2021 2020 2019…

A: A company pays dividends from its profits to its stock holders. The dividend amount is determined by…

Q: Financial analysts have estimated the returns on shares of the Goldday Corporation and the overall…

A: Correlation coefficient between Goldday and the Market can be found by using the following formula…

Q: What proportion of each stock’s risk was market risk, and what proportion was specific risk? What is…

A: "As the question posted contains multiple sub parts. According to the guidelines first three sub…

Q: Calculate per-unit costs and compare to last year. Are the reduced unit costs for Product A due to…

A: per unit production & marketing cost for A:last year - 50/100 = 0.5 & 2.5/100coming year -…

Q: Suppose that Gyp Sum Industries currently has the balance sheet shown below, and that sales for the…

A: The AFN refers to the funding that is required by the company for its operations to reach the…

Q: Problem 1: Nachman Industries just paid a dividend of D = $1.32. Analysts expect the company's…

A: Current Dividend = d0 = $1.32Growth Rate for Year 1 = g1 = 30%Growth Rate for Year 2 = g2 =…

Q: You are evaluating a project for The Farstroke golf club, guaranteed to correct that nasty slice.…

A: Operating Cash flow is the amount which is earned by the investor from the project. It is the net…

Q: Bonita Sports ells volleyball kits that it purchases from a sports equipment distributor. The…

A: Variable in the question: Static BudgetDescription DataUnit (kits)2500Sales…

Q: Given the following information, what is the corporation's federal tax obligation? Use the federal…

A: Tax on $7,000:Tax = $7,000 * 15%Tax = $1,050Tax on $67,000:Tax = $50,000 * 15% + ($67,000 - $50,000)…

Q: Marian Plunket owns her own business and is considering an investment. If she undertakes the…

A: NPV is the difference between present value of cash inflows and the present value of cash outflows.…

Q: A rich man deposits money at a bank with 17.17% interest compounded annually 7 years ago. After…

A: Present value is the equivalent value based on the time value of money today required based on…

Q: FIFO and LIFO costs under perpetual inventory system The following units of an item were available…

A: A perpetual inventory system is a method of tracking and recording inventory transactions in…

Q: Suppose there are two independent economic factors, M₁ and M₂. The risk-free rate is 6%, and all…

A: Expected return is frequently used alongside risk metrics like beta or standard deviation. When…

Q: For the next two questions, assume the interest rate is 6% compounded annually. Use the online…

A: Present value refers to the current value of the future cash flow. Present value can be determined…

Q: he Adeeva's gross monthly income is $3600. They have 18 remaining payments of $370 on a new car.…

A: Mortgage loans are secured loans and loans are given based on the monthly income and other…

Q: Following is information on an investment in a manufacturing machine. The machine has zero salvage…

A: NPV is also known as Net Present Value.. It is a capital budgeting technique which helps in decision…

Q: . Given the following information for Lightning Power Co., find the WACC. Assume the company’s tax…

A: The weighted average cost of capital is the rate that a company is expected to pay on average to all…

Q: A 3/1 ARM is made for $170,000 at 7 percent with a 30-year maturity. Required: a. Assuming that…

A: A mortgage loan having an ARM facility can change or alter the interest rate on the mortgage at…

Q: John is looking for a new car. He has a down payment of $1,750.00 and wants to pay $300.00 per month…

A: A loan refers to a contract where money is borrowed by one party on the promise of future repayment…

Q: A family want to have a $213,000.00 higher education fund for their children at the end of 19 years.…

A: An annuity refers to a payment series that is provided in exchange for a lump sum payment. It is…

Q: Toronto Donuts Bakery collects 50% of its monthly sales immediately and the rest a month later. Its…

A:

Q: You are given the following information concerning three portfolios, the market portfolio, and the…

A: Information ratio:The information ratio of a portfolio is a measure of the risk-adjusted return of…

Dengar

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 2 images

- In 20x5, Major Company initiated a full-scale, quality improvement program. At the end of the year, Jack Aldredge, the president, noted with some satisfaction that the defects per unit of product had dropped significantly compared to the prior year. He was also pleased that relationships with suppliers had improved and defective materials had declined. The new quality training program was also well accepted by employees. Of most interest to the president, however, was the impact of the quality improvements on profitability. To help assess the dollar impact of the quality improvements, the actual sales and the actual quality costs for 20x4 and 20x5 are as follows by quality category: All prevention costs are fixed (by discretion). Assume all other quality costs are unit-level variable. Required: 1. Compute the relative distribution of quality costs for each year and prepare a pie chart. Do you believe that the company is moving in the right direction in terms of the balance among the quality cost categories? Explain. 2. Prepare a one-year trend performance report for 20x5 (compare the actual costs of 20x5 with those of 20x4, adjusted for differences in sales volume). How much have profits increased because of the quality improvements made by Major Company? 3. Estimate the additional improvement in profits if Major Company ultimately reduces its quality costs to 2.5 percent of sales revenues (assume sales of 10 million).Suppose that Kicker had the following sales and cost experience (in thousands of dollars) for May of the current year and for May of the prior year: In May of the prior year, Kicker started an intensive quality program designed to enable it to build original equipment manufacture (OEM) speaker systems for a major automobile company. The program was housed in research and development. In the beginning of the current year, Kickers accounting department exercised tighter control over sales commissions, ensuring that no dubious (e.g., double) payments were made. The increased sales in the current year required additional warehouse space that Kicker rented in town. (Round ratios to four decimal places. Round sales dollars computations to the nearest dollar.) Required: 1. Calculate the contribution margin ratio for May of both years. 2. Calculate the break-even point in sales dollars for both years. 3. Calculate the margin of safety in sales dollars for both years. 4. CONCEPTUAL CONNECTION Analyze the differences shown by your calculations in Requirements 1, 2, and 3.Paladin Company manufactures plain paper fax machines in a small factory in Minnesota Sales have increased by 50% in each of the past 3 years, as Paladin has expanded its market from the United States to Canada and Mexico. As a result, the Minnesota factory is at capacity. Beryl Adams, president of Paladin, has examined the situation and developed the following alternatives: 1. Add a permanent second shift at the plant. However, the semiskilled workers who assemble the fax machines are in short supply, and the wage rate of 15 per hour would probably have to be increased across the board to 18 per hour in order to attract sufficient workers from out of town. The total wage increase (including fringe benefits) would amount to 125,000. The heavier use of plant facilities would lead to increased plant maintenance and small tool cost. 2. Open a new plant and locate it in Mexico. Wages (including fringe benefits) would average 3.50 per hour. Investment in plant and equipment would amount to 300,000. 3. Open a new plant and locate it in a foreign trade zone, possibly in Dallas. Wages would be somewhat lower than in Minnesota, but higher than in Mexico. The advantages of postponing tariff payments on imported parts could amount to 50,000 per year. Required: Advise Beryl of the advantages and disadvantages of each of her alternatives.

- Lindell Manufacturing embarked on an ambitious quality program that is centered on continual improvement. This improvement is operationalized by declining quality costs from year to year. Lindell rewards plant managers, production supervisors, and workers with bonuses ranging from 1,000 to 10,000 if their factory meets its annual quality cost goals. Len Smith, manager of Lindells Boise plant, felt obligated to do everything he could to provide this increase to his employees. Accordingly, he has decided to take the following actions during the last quarter of the year to meet the plants budgeted quality cost targets: a. Decrease inspections of the process and final product by 50% and transfer inspectors temporarily to quality training programs. Len believes this move will increase the inspectors awareness of the importance of quality; also, decreasing inspection will produce significantly less downtime and less rework. By increasing the output and decreasing the costs of internal failure, the plant can meet the budgeted reductions for internal failure costs. Also, by showing an increase in the costs of quality training, the budgeted level for prevention costs can be met. b. Delay replacing and repairing defective products until the beginning of the following year. While this may increase customer dissatisfaction somewhat, Len believes that most customers expect some inconvenience. Besides, the policy of promptly dealing with customers who are dissatisfied could be reinstated in 3 months. In the meantime, the action would significantly reduce the costs of external failure, allowing the plant to meet its budgeted target. c. Cancel scheduled worker visits to customers plants. This program, which has been very well received by customers, enables Lindell workers to see just how the machinery they make is used by the customer and also gives them first-hand information on any remaining problems with the machinery. Workers who went on previous customer site visits came back enthusiastic and committed to Lindells quality program. Lindells quality program staff believes that these visits will reduce defects during the following year. Required: 1. Evaluate Lens ethical behavior. In this evaluation, consider his concern for his employees. Was he justified in taking the actions described? If not, what should he have done? 2. Assume that the company views Lens behavior as undesirable. What can the company do to discourage it? 3. Assume that Len is a CMA and a member of the IMA. Refer to the ethical code for management accountants in Chapter 1. Were any of these ethical standards violated?Bienestar, Inc., has two plants that manufacture a line of wheelchairs. One is located in Kansas City, and the other in Tulsa. Each plant is set up as a profit center. During the past year, both plants sold their tilt wheelchair model for 1,620. Sales volume averages 20,000 units per year in each plant. Recently, the Kansas City plant reduced the price of the tilt model to 1,440. Discussion with the Kansas City manager revealed that the price reduction was possible because the plant had reduced its manufacturing and selling costs by reducing what was called non-value-added costs. The Kansas City manufacturing and selling costs for the tilt model were 1,260 per unit. The Kansas City manager offered to loan the Tulsa plant his cost accounting manager to help it achieve similar results. The Tulsa plant manager readily agreed, knowing that his plant must keep pacenot only with the Kansas City plant but also with competitors. A local competitor had also reduced its price on a similar model, and Tulsas marketing manager had indicated that the price must be matched or sales would drop dramatically. In fact, the marketing manager suggested that if the price were dropped to 1,404 by the end of the year, the plant could expand its share of the market by 20 percent. The plant manager agreed but insisted that the current profit per unit must be maintained. He also wants to know if the plant can at least match the 1,260 per-unit cost of the Kansas City plant and if the plant can achieve the cost reduction using the approach of the Kansas City plant. The plant controller and the Kansas City cost accounting manager have assembled the following data for the most recent year. The actual cost of inputs, their value-added (ideal) quantity levels, and the actual quantity levels are provided (for production of 20,000 units). Assume there is no difference between actual prices of activity units and standard prices. Required: 1. Calculate the target cost for expanding the Tulsa plants market share by 20 percent, assuming that the per-unit profitability is maintained as requested by the plant manager. 2. Calculate the non-value-added cost per unit. Assuming that non-value-added costs can be reduced to zero, can the Tulsa plant match the Kansas City per-unit cost? Can the target cost for expanding market share be achieved? What actions would you take if you were the plant manager? 3. Describe the role that benchmarking played in the effort of the Tulsa plant to protect and improve its competitive position.Malone Industries has been in business for five years and has been very successful. In the past year, it expanded operations by buying Hot Metal Manufacturing for a price greater than the value of the net assets purchased. In the past year, the customer base has expanded much more than expected, and the companys owners want to increase the goodwill account. Your CPA firm has been hired to help Malone prepare year-end financial statements, and your boss has asked you to talk to Malones managers about goodwill and whether an adjustment can be made to the goodwill account. How do you respond to the owners and managers?

- Wright Plastic Products is a small company that specialized in the production of plastic dinner plates until several years ago. Although profits for the company had been good, they have been declining in recent years because of increased competition. Many competitors offer a full range of plastic products, and management felt that this created a competitive disadvantage. The output of the companys plants was exclusively devoted to plastic dinner plates. Three years ago, management made a decision to add additional product lines. They determined that existing idle capacity in each plant could easily be adapted to produce other plastic products. Each plant would produce one additional product line. For example, the Atlanta plant would add a line of plastic cups. Moreover, the variable cost of producing a package of cups (one dozen) was virtually identical to that of a package of plastic plates. (Variable costs referred to here are those that change in total as the units produced change. The costs include direct materials, direct labor, and unit-based variable overhead such as power and other machine costs.) Since the fixed expenses would not change, the new product was forecast to increase profits significantly (for the Atlanta plant). Two years after the addition of the new product line, the profits of the Atlanta plant (as well as other plants) had not improvedin fact, they had dropped. Upon investigation, the president of the company discovered that profits had not increased as expected because the so-called fixed cost pool had increased dramatically. The president interviewed the manager of each support department at the Atlanta plant. Typical responses from four of those managers are given next. Materials handling: The additional batches caused by the cups increased the demand for materials handling. We had to add one forklift and hire additional materials handling labor. Inspection: Inspecting cups is more complicated than plastic plates. We only inspect a sample drawn from every batch, but you need to understand that the number of batches has increased with this new product line. We had to hire more inspection labor. Purchasing: The new line increased the number of purchase orders. We had to use more resources to handle this increased volume. Accounting: There were more transactions to process than before. We had to increase our staff. Required: 1. Explain why the results of adding the new product line were not accurately projected. 2. Could this problem have been avoided with an activity-based cost management system? If so, would you recommend that the company adopt this type of system? Explain and discuss the differences between an activity-based cost management system and a traditional cost management system.At the beginning of the last quarter of 20x1, Youngston, Inc., a consumer products firm, hired Maria Carrillo to take over one of its divisions. The division manufactured small home appliances and was struggling to survive in a very competitive market. Maria immediately requested a projected income statement for 20x1. In response, the controller provided the following statement: After some investigation, Maria soon realized that the products being produced had a serious problem with quality. She once again requested a special study by the controllers office to supply a report on the level of quality costs. By the middle of November, Maria received the following report from the controller: Maria was surprised at the level of quality costs. They represented 30 percent of sales, which was certainly excessive. She knew that the division had to produce high-quality products to survive. The number of defective units produced needed to be reduced dramatically. Thus, Maria decided to pursue a quality-driven turnaround strategy. Revenue growth and cost reduction could both be achieved if quality could be improved. By growing revenues and decreasing costs, profitability could be increased. After meeting with the managers of production, marketing, purchasing, and human resources, Maria made the following decisions, effective immediately (end of November 20x1): a. More will be invested in employee training. Workers will be trained to detect quality problems and empowered to make improvements. Workers will be allowed a bonus of 10 percent of any cost savings produced by their suggested improvements. b. Two design engineers will be hired immediately, with expectations of hiring one or two more within a year. These engineers will be in charge of redesigning processes and products with the objective of improving quality. They will also be given the responsibility of working with selected suppliers to help improve the quality of their products and processes. Design engineers were considered a strategic necessity. c. Implement a new process: evaluation and selection of suppliers. This new process has the objective of selecting a group of suppliers that are willing and capable of providing nondefective components. d. Effective immediately, the division will begin inspecting purchased components. According to production, many of the quality problems are caused by defective components purchased from outside suppliers. Incoming inspection is viewed as a transitional activity. Once the division has developed a group of suppliers capable of delivering nondefective components, this activity will be eliminated. e. Within three years, the goal is to produce products with a defect rate less than 0.10 percent. By reducing the defect rate to this level, marketing is confident that market share will increase by at least 50 percent (as a consequence of increased customer satisfaction). Products with better quality will help establish an improved product image and reputation, allowing the division to capture new customers and increase market share. f. Accounting will be given the charge to install a quality information reporting system. Daily reports on operational quality data (e.g., percentage of defective units), weekly updates of trend graphs (posted throughout the division), and quarterly cost reports are the types of information required. g. To help direct the improvements in quality activities, kaizen costing is to be implemented. For example, for the year 20x1, a kaizen standard of 6 percent of the selling price per unit was set for rework costs, a 25 percent reduction from the current actual cost. To ensure that the quality improvements were directed and translated into concrete financial outcomes, Maria also began to implement a Balanced Scorecard for the division. By the end of 20x2, progress was being made. Sales had increased to 26,000,000, and the kaizen improvements were meeting or beating expectations. For example, rework costs had dropped to 1,500,000. At the end of 20x3, two years after the turnaround quality strategy was implemented, Maria received the following quality cost report: Maria also received an income statement for 20x3: Maria was pleased with the outcomes. Revenues had grown, and costs had been reduced by at least as much as she had projected for the two-year period. Growth next year should be even greater as she was beginning to observe a favorable effect from the higher-quality products. Also, further quality cost reductions should materialize as incoming inspections were showing much higher-quality purchased components. Required: 1. Identify the strategic objectives, classified by the Balanced Scorecard perspective. Next, suggest measures for each objective. 2. Using the results from Requirement 1, describe Marias strategy using a series of if-then statements. Next, prepare a strategy map. 3. Explain how you would evaluate the success of the quality-driven turnaround strategy. What additional information would you like to have for this evaluation? 4. Explain why Maria felt that the Balanced Scorecard would increase the likelihood that the turnaround strategy would actually produce good financial outcomes. 5. Advise Maria on how to encourage her employees to align their actions and behavior with the turnaround strategy.Luna Company is a printing company and a subsidiary of a large publishing company. Luna is in its fourth year of a 5-year, quality improvement program. The program began in 20X1 as a result of a report by a consulting firm that revealed that quality costs were about 20% of sales. Concerned about the level of quality costs, Lunas top management began a 5-year plan in 20X1 with the objective of lowering quality costs to 10% of sales by the end of 20X5. Sales and quality costs for each year are as follows: Quality costs by category are expressed as a percentage of sales as follows: The detail of the 20X5 budget for quality costs is also provided. Actual quality costs for 20X4 and 20X5 are as follows: Required: 1. Prepare an interim quality cost performance report for 20X5 that compares actual quality costs with budgeted quality costs. Comment on the firms ability to achieve its quality goals for the year. 2. Prepare a single-period quality performance report for 20X5 that compares the actual quality costs of 20X4 with the actual costs of 20X5. How much did profits change because of improved quality? 3. Prepare a graph that shows the trend in total quality costs as a percentage of sales since the inception of the quality improvement program. 4. Prepare a graph that shows the trend for all four quality cost categories for 20X1 through 20X5. How does this graph help management know that the reduction in total quality costs is attributable to quality improvements? 5. Assume that the company is preparing a second 5-year plan to reduce quality costs to 2.5% of sales. Prepare a long-range quality cost performance report that compares the costs for 20X5 with those planned for the end of the second 5-year period. Assume sales of 45 million at the end of 5 years. The final planned relative distribution of quality costs is as follows: proofreading, 50%; other inspection, 13%; quality training, 30%; and quality reporting, 7%. Assume that all prevention costs are fixed and all other costs are variable (with respect to sales).

- Javier Company has sales of 8 million and quality costs of 1,600,000. The company is embarking on a major quality improvement program. During the next three years, Javier intends to attack failure costs by increasing its appraisal and prevention costs. The right prevention activities will be selected, and appraisal costs will be reduced according to the results achieved. For the coming year, management is considering six specific activities: quality training, process control, product inspection, supplier evaluation, prototype testing, and redesign of two major products. To encourage managers to focus on reducing non-value-added quality costs and select the right activities, a bonus pool is established relating to reduction of quality costs. The bonus pool is equal to 10 percent of the total reduction in quality costs. Current quality costs and the costs of these six activities are given in the following table. Each activity is added sequentially so that its effect on the cost categories can be assessed. For example, after quality training is added, the control costs increase to 320,000, and the failure costs drop to 1,040,000. Even though the activities are presented sequentially, they are totally independent of each other. Thus, only beneficial activities need be selected. Required: 1. Identify the control activities that should be implemented, and calculate the total quality costs associated with this selection. Assume that an activity is selected only if it increases the bonus pool. 2. Given the activities selected in Requirement 1, calculate the following: a. The reduction in total quality costs b. The percentage distribution for control and failure costs c. The amount for this years bonus pool 3. Suppose that a quality engineer complained about the gainsharing incentive system. Basically, he argued that the bonus should be based only on reductions of failure and appraisal costs. In this way, investment in prevention activities would be encouraged, and eventually, failure and appraisal costs would be eliminated. After eliminating the non-value-added costs, focus could then be placed on the level of prevention costs. If this approach were adopted, what activities would be selected? Do you agree or disagree with this approach? Explain.Artisan Metalworks has a bottleneck in their production that occurs within the engraving department. Jamal Moore, the COO, is considering hiring an extra worker, whose salary will be $55,000 per year, to solve the problem. With this extra worker, the company could produce and sell 3,000 more units per year. Currently, the selling price per unit is $25 and the cost per unit is $7.85. Using the information provided, calculate the annual financial impact of hiring the extra worker.Recently, Ulrich Company received a report from an external consulting group on its quality costs. The consultants reported that the companys quality costs total about 21 percent of its sales revenues. Somewhat shocked by the magnitude of the costs, Rob Rustin, president of Ulrich Company, decided to launch a major quality improvement program. For the coming year, management decided to reduce quality costs to 17 percent of sales revenues. Although the amount of reduction was ambitious, most company officials believed that the goal could be realized. To improve the monitoring of the quality improvement program, Rob directed Pamela Golding, the controller, to prepare monthly performance reports comparing budgeted and actual quality costs. Budgeted costs and sales for the first two months of the year are as follows: The following actual sales and actual quality costs were reported for January: Required: 1. Reorganize the monthly budgets so that quality costs are grouped in one of four categories: appraisal, prevention, internal failure, or external failure. (Essentially, prepare a budgeted cost of quality report.) Also, identify each cost as variable (V) or fixed (F). (Assume that no costs are mixed.) 2. Prepare a performance report for January that compares actual costs with budgeted costs. Comment on the companys progress in improving quality and reducing its quality costs.